ASX Stocks Possibly Trading Below Their Intrinsic Value By Up To 46.6%

Reviewed by Simply Wall St

The Australian market showed resilience, edging up slightly despite pressures from significant players like Aristocrat Leisure and Macquarie Group. In such a fluctuating environment, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on discrepancies between market price and fundamental worth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.95 | A$1.78 | 46.6% |

| Lynas Rare Earths (ASX:LYC) | A$7.47 | A$13.32 | 43.9% |

| Austal (ASX:ASB) | A$5.17 | A$9.28 | 44.3% |

| Charter Hall Group (ASX:CHC) | A$17.89 | A$34.25 | 47.8% |

| SciDev (ASX:SDV) | A$0.365 | A$0.68 | 46.4% |

| Polymetals Resources (ASX:POL) | A$0.815 | A$1.51 | 46.1% |

| Genesis Minerals (ASX:GMD) | A$3.80 | A$6.70 | 43.3% |

| Sandfire Resources (ASX:SFR) | A$10.81 | A$20.79 | 48% |

| PointsBet Holdings (ASX:PBH) | A$1.095 | A$2.08 | 47.4% |

| Superloop (ASX:SLC) | A$2.48 | A$4.52 | 45.1% |

Let's uncover some gems from our specialized screener.

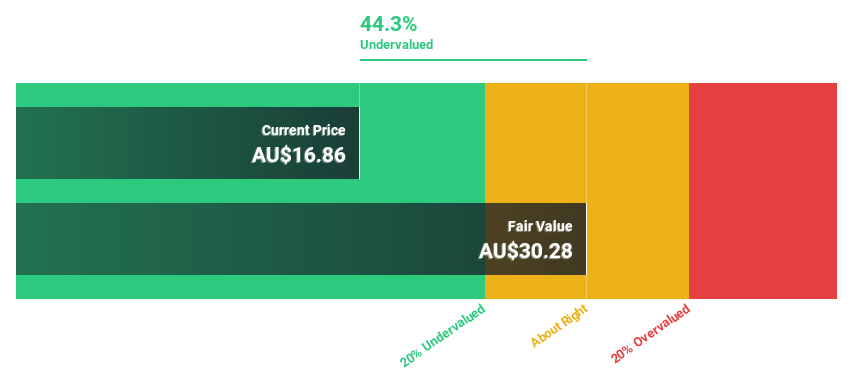

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.61 billion, is involved in sourcing and retailing household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: The company's revenue is primarily derived from the retailing of furniture, amounting to A$492.63 million.

Estimated Discount To Fair Value: 32.6%

Nick Scali is trading at A$18.82, significantly below its estimated fair value of A$27.91, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow at 12.3% per year, outpacing the Australian market's growth rate of 11.7%. While revenue growth is slower than desired at 8.5%, it still surpasses the market average of 5.5%. Recent executive changes include a new CFO appointment to support strategic financial initiatives.

- Our growth report here indicates Nick Scali may be poised for an improving outlook.

- Click here to discover the nuances of Nick Scali with our detailed financial health report.

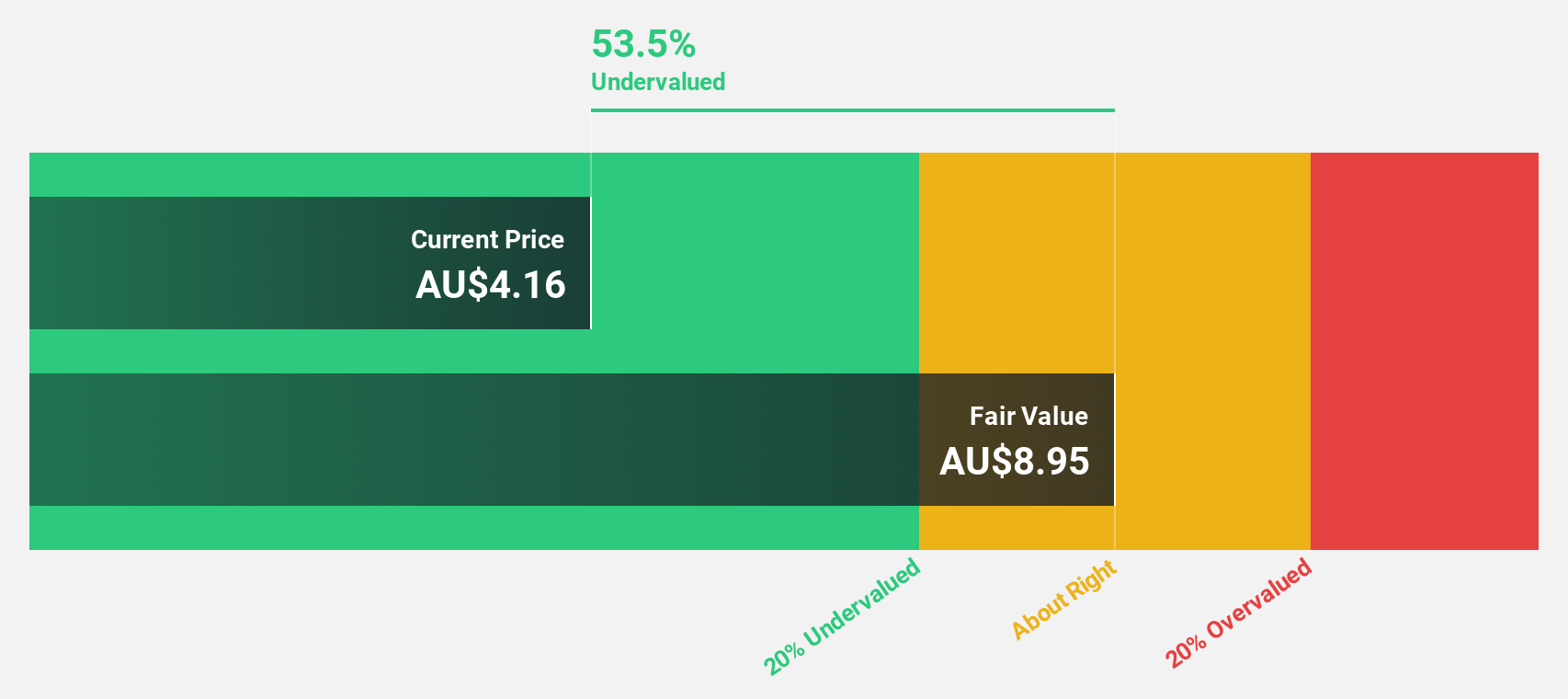

Select Harvests (ASX:SHV)

Overview: Select Harvests Limited is an Australian company involved in the cultivation, processing, packaging, and sale of almonds and their by-products with a market capitalization of A$707.70 million.

Operations: The company's revenue primarily comes from its almond segment, which generated A$337.29 million.

Estimated Discount To Fair Value: 11.2%

Select Harvests is trading at A$4.98, slightly below its estimated fair value of A$5.61, suggesting it might be undervalued based on cash flows. The company's earnings are expected to grow significantly at 35.6% annually, surpassing the Australian market's growth rate of 11.7%. Despite recent shareholder dilution and large one-off items affecting results, Select Harvests became profitable this year with revenue forecasted to outpace the market's average growth rate.

- Our expertly prepared growth report on Select Harvests implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Select Harvests here with our thorough financial health report.

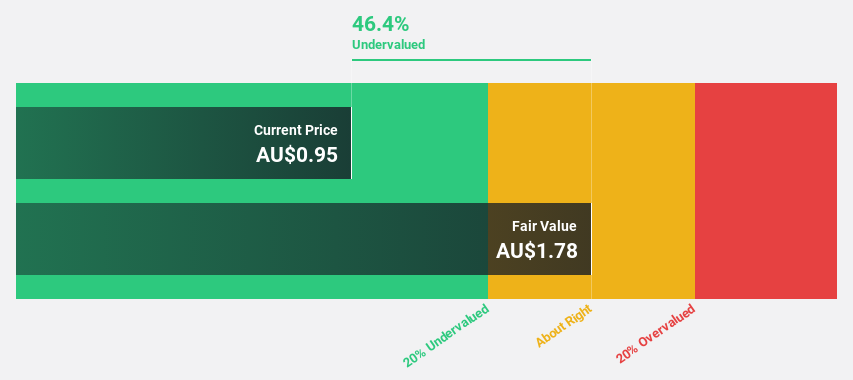

Smart Parking (ASX:SPZ)

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market cap of A$386.77 million.

Operations: The company's revenue segments include A$5.30 million from the Technology Division, A$3.69 million from Parking Management in Germany, A$0.07 million from Australia, A$5.87 million from New Zealand, and A$47.58 million from the United Kingdom.

Estimated Discount To Fair Value: 46.6%

Smart Parking is trading at A$0.95, below its estimated fair value of A$1.78, indicating potential undervaluation based on cash flows. Despite recent shareholder dilution, earnings are projected to grow significantly at 34.1% annually, outpacing the Australian market's growth rate of 11.7%. Recent index inclusions and a completed equity offering raising A$45 million may enhance visibility and financial flexibility as revenue is forecasted to grow rapidly compared to the broader market.

- In light of our recent growth report, it seems possible that Smart Parking's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Smart Parking stock in this financial health report.

Next Steps

- Dive into all 39 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Select Harvests, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHV

Select Harvests

Engages in the growing, processing, packaging, and selling of almonds and its by-products in Australia.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives