- Australia

- /

- Specialty Stores

- /

- ASX:MTO

Dividend Investors: Don't Be Too Quick To Buy MotorCycle Holdings Limited (ASX:MTO) For Its Upcoming Dividend

MotorCycle Holdings Limited (ASX:MTO) stock is about to trade ex-dividend in 4 days. You can purchase shares before the 17th of March in order to receive the dividend, which the company will pay on the 7th of April.

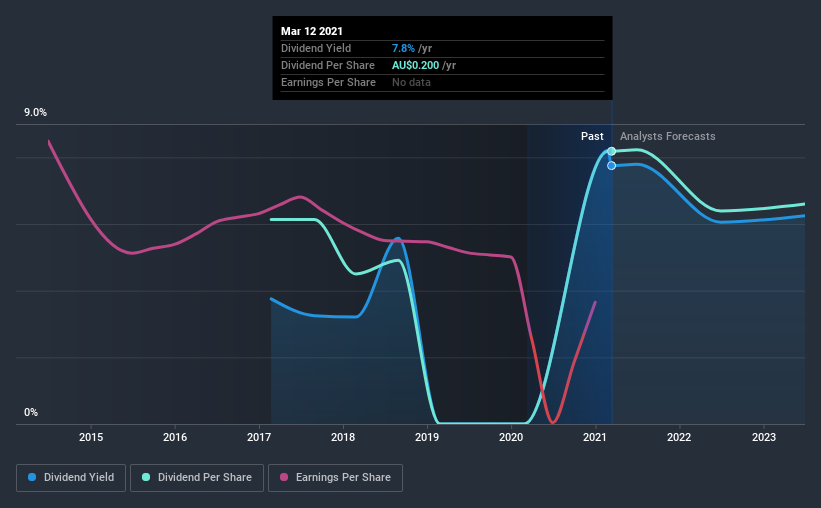

MotorCycle Holdings's upcoming dividend is AU$0.10 a share, following on from the last 12 months, when the company distributed a total of AU$0.20 per share to shareholders. Looking at the last 12 months of distributions, MotorCycle Holdings has a trailing yield of approximately 7.8% on its current stock price of A$2.58. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether MotorCycle Holdings has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for MotorCycle Holdings

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. MotorCycle Holdings distributed an unsustainably high 189% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by MotorCycle Holdings's 17% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. MotorCycle Holdings has delivered an average of 7.5% per year annual increase in its dividend, based on the past four years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. MotorCycle Holdings is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

From a dividend perspective, should investors buy or avoid MotorCycle Holdings? Not only are earnings per share shrinking, but MotorCycle Holdings is paying out a disconcertingly high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

With that in mind though, if the poor dividend characteristics of MotorCycle Holdings don't faze you, it's worth being mindful of the risks involved with this business. Be aware that MotorCycle Holdings is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade MotorCycle Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade MotorCycle Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MTO

MotorCycle Holdings

Owns and operates motorcycle dealerships in Australia.

Very undervalued with flawless balance sheet.