The Australian market is showing signs of resilience, with the ASX200 up 0.33% at 8,542 points in intra-day trade, nearing record highs. Amidst these vibrant market conditions, identifying stocks with potential for growth is crucial. Penny stocks, though sometimes seen as a throwback to earlier times, remain relevant by offering opportunities in smaller or newer companies that combine affordability with growth potential. Let's take a closer look at several penny stocks that stand out for their financial strength and promise amidst the current economic landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.34 | A$110.39M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.66 | A$125.87M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$444.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.395 | A$838.65M | ✅ 3 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$228.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.69 | A$175.09M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.75 | A$140.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 475 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alpha HPA (ASX:A4N)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alpha HPA Limited is a specialty metals and technology company with a market capitalization of A$972.14 million.

Operations: The company generates revenue primarily from its HPA First Project, amounting to A$0.07 million.

Market Cap: A$972.14M

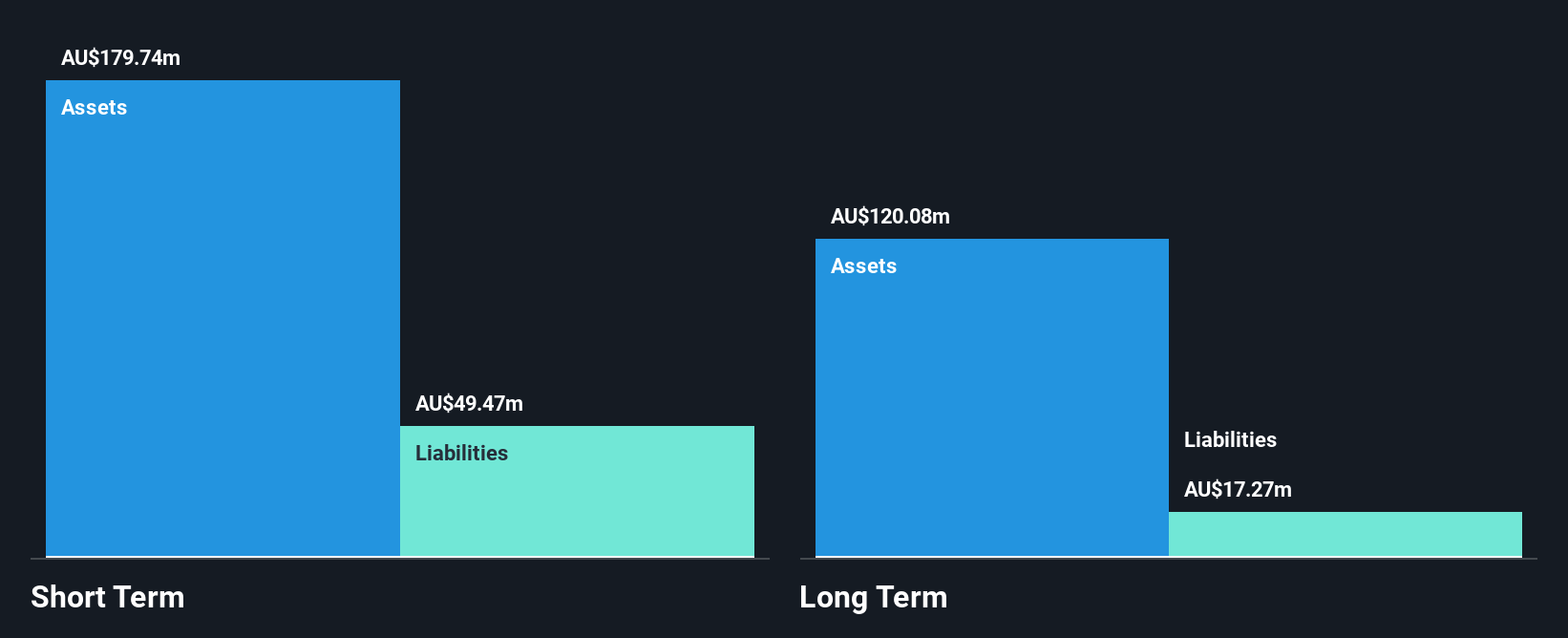

Alpha HPA Limited, with a market capitalization of A$972.14 million, remains pre-revenue, generating only A$0.07 million from its HPA First Project. Despite being unprofitable and experiencing increased losses over the past five years, the company has more cash than debt and sufficient short-term assets to cover liabilities. The management team is relatively new with an average tenure of 0.3 years, while the board is experienced at 5.2 years on average. Although revenue growth is forecasted at a high rate annually, profitability isn't expected within the next three years given current trends and financials.

- Dive into the specifics of Alpha HPA here with our thorough balance sheet health report.

- Gain insights into Alpha HPA's future direction by reviewing our growth report.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited operates motorcycle dealerships across Australia and has a market capitalization of A$207.40 million.

Operations: The company generates revenue from two main segments: Motorcycle Retailing, which accounts for A$446.85 million, and Motorcycle and Accessories Wholesaling, contributing A$180.54 million.

Market Cap: A$207.4M

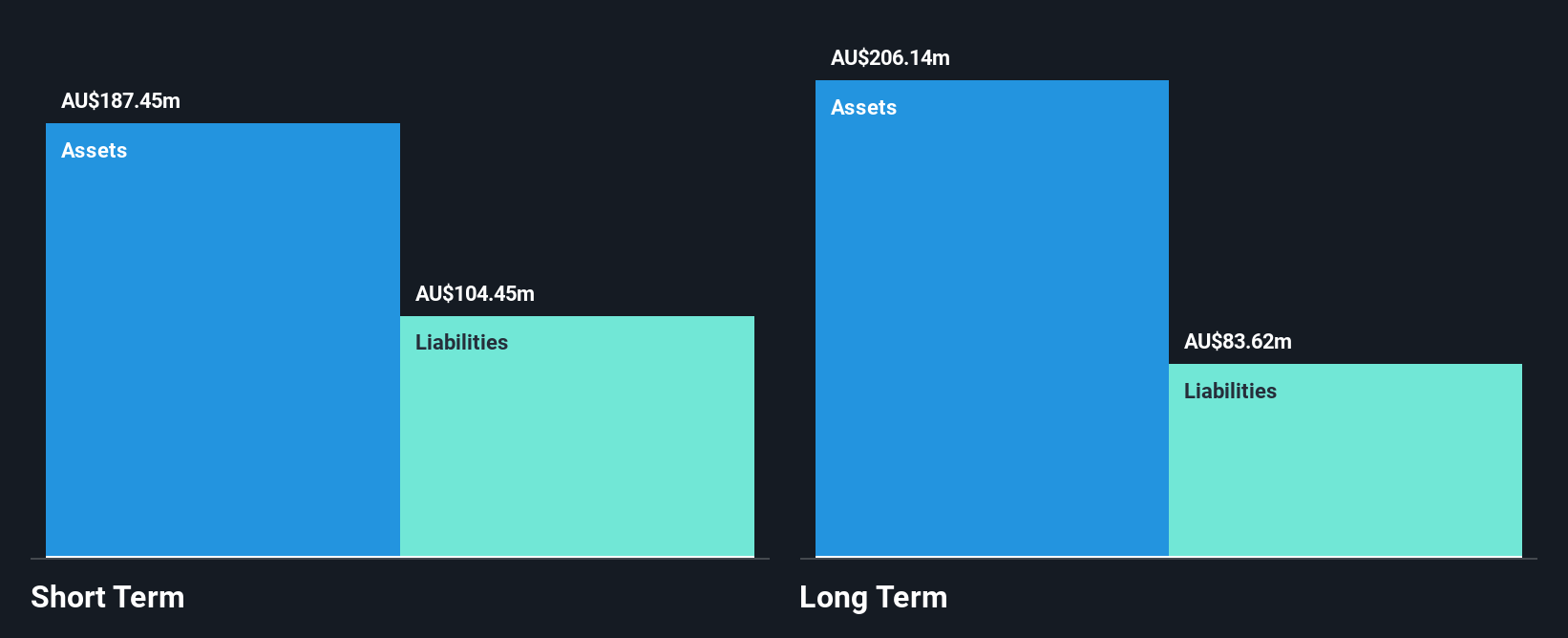

MotorCycle Holdings Limited, with a market cap of A$207.40 million, has shown mixed performance in the penny stock category. The company benefits from strong revenue streams in motorcycle retailing and wholesaling, totaling A$627.39 million. Debt management is robust as operating cash flow covers debt well and interest payments are adequately covered by EBIT. However, earnings growth was negative last year at -11.2%, though long-term liabilities are well-covered by short-term assets of A$187.4 million. Recent board changes include the appointment of Ms. Nikki Thomas as an Independent Non-Executive Director to strengthen governance and strategic oversight.

- Take a closer look at MotorCycle Holdings' potential here in our financial health report.

- Gain insights into MotorCycle Holdings' outlook and expected performance with our report on the company's earnings estimates.

Nuix (ASX:NXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$724.31 million.

Operations: The company's revenue is primarily generated from its Software & Programming segment, amounting to A$227.37 million.

Market Cap: A$724.31M

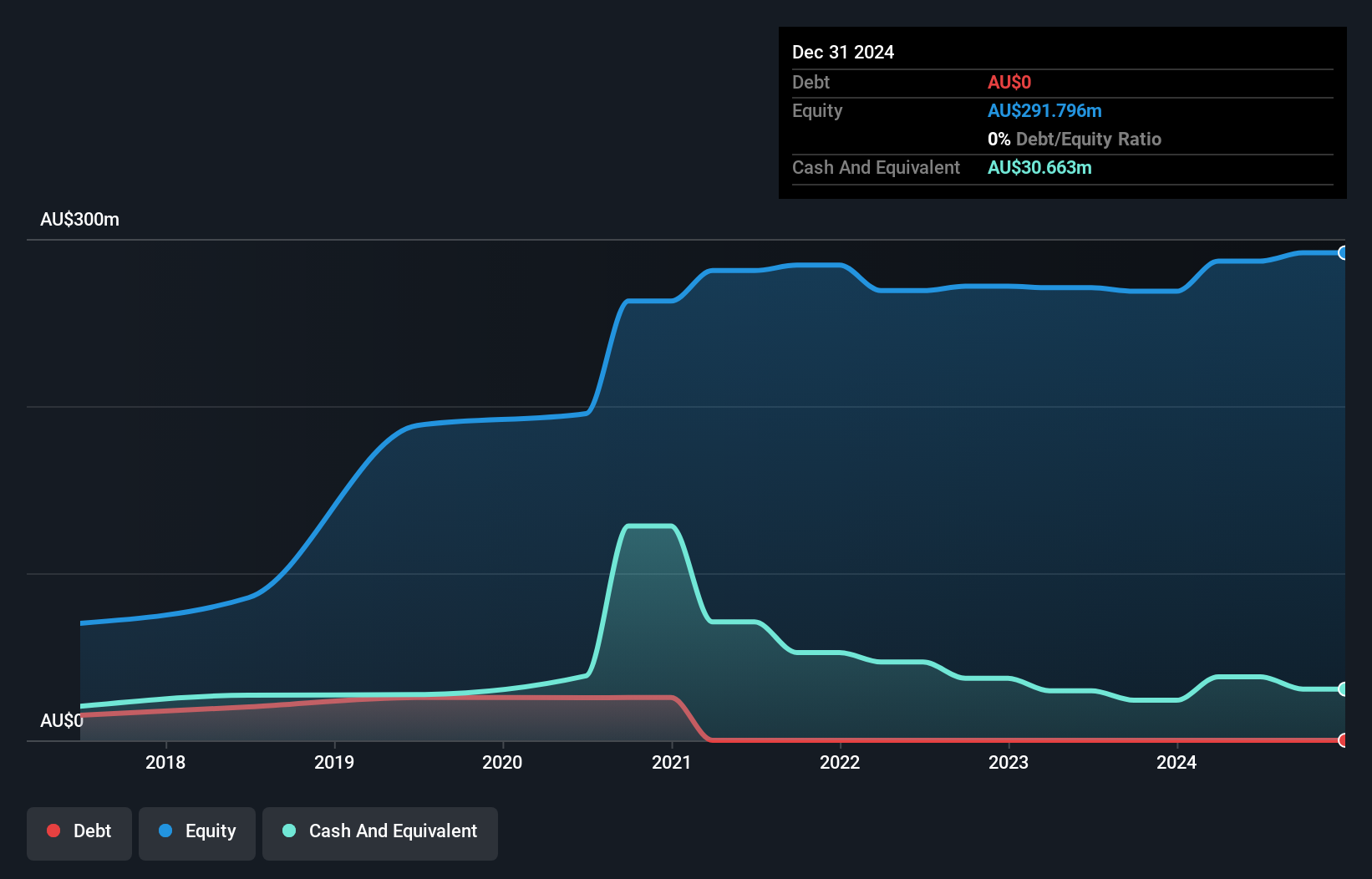

Nuix Limited, with a market cap of A$724.31 million, trades at 29.5% below its estimated fair value, indicating potential value for investors. The company is debt-free and has seen a reduction in liabilities over time, with short-term assets (A$119.4M) comfortably covering both short-term (A$83.1M) and long-term liabilities (A$19.8M). Despite being unprofitable and experiencing increased losses over the past five years, Nuix maintains a sufficient cash runway exceeding three years due to positive free cash flow growth. Management and board members are experienced, providing stability amid financial challenges as earnings are forecasted to grow significantly annually by 51.8%.

- Jump into the full analysis health report here for a deeper understanding of Nuix.

- Review our growth performance report to gain insights into Nuix's future.

Turning Ideas Into Actions

- Investigate our full lineup of 475 ASX Penny Stocks right here.

- Want To Explore Some Alternatives? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:A4N

Excellent balance sheet with limited growth.

Market Insights

Community Narratives