The Australian stock market has seen a slight downturn, with the ASX200 slipping by 0.17% due to pressures from consumer discretionary stocks and banking shares, despite strength in utilities and materials sectors. In this context, investors are increasingly looking at diverse opportunities beyond traditional large-cap stocks. Penny stocks, though an older term, still represent smaller or emerging companies that can offer potential value when backed by strong financials and growth prospects. This article will spotlight three such penny stocks on the ASX that may provide both stability and potential upside for investors seeking to explore smaller companies with promising futures.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.455 | A$282.17M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.20 | A$340.76M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.78 | A$98.46M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.03 | A$64.14M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$103.1M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.06 | A$335.4M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$200.04 million.

Operations: The company generates NZ$76.35 million from its operations in developing, manufacturing, and selling products for soft tissue repair.

Market Cap: A$200.04M

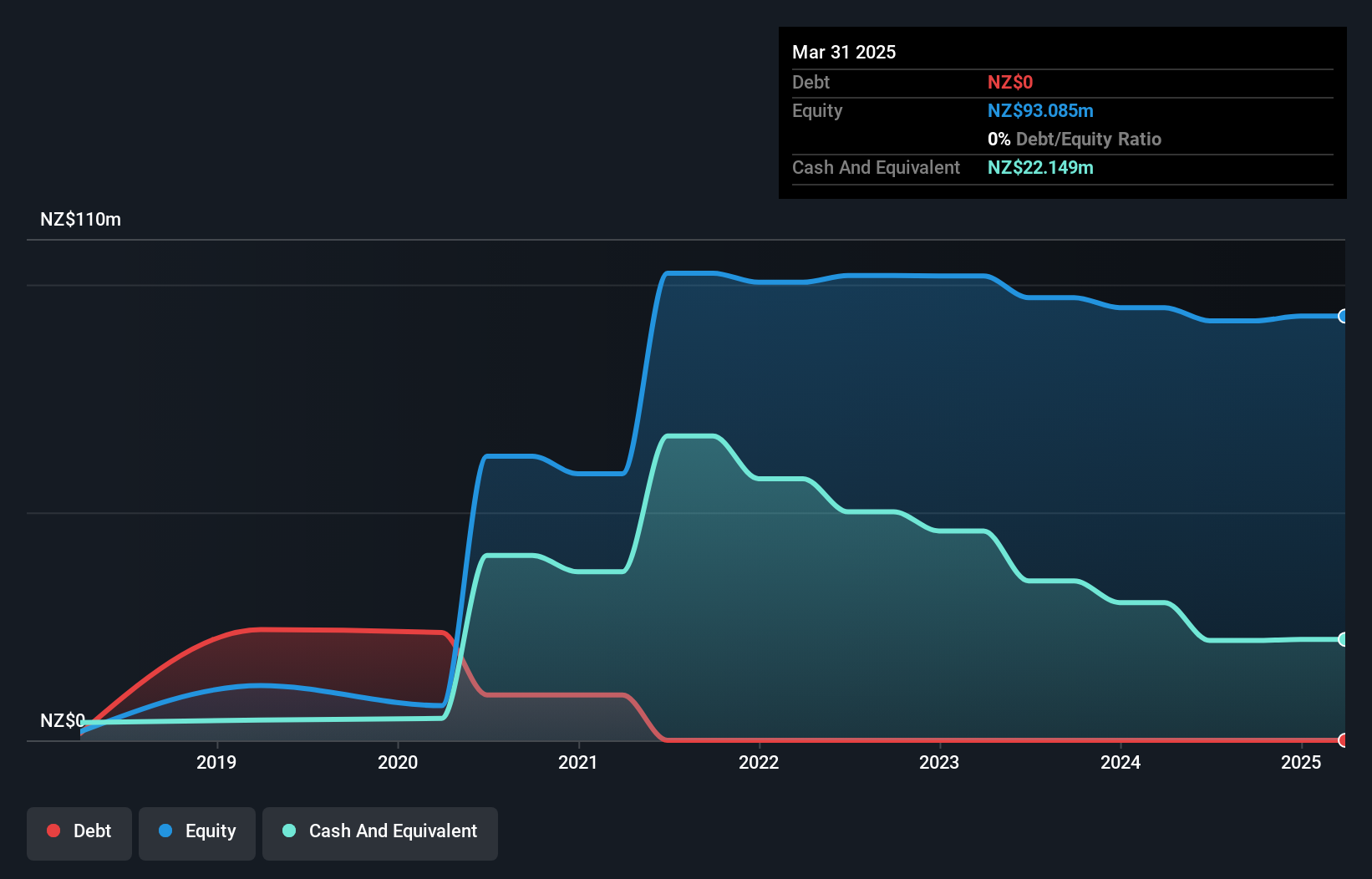

Aroa Biosurgery, with a market cap of A$200.04 million, has shown promise in the penny stock arena through its innovative extracellular matrix technology for wound and soft tissue repair. Despite being unprofitable, it reduced its net loss from NZ$6.31 million to NZ$3.29 million year-over-year for the half-year ending September 2024, indicating progress towards profitability. The company is debt-free and trades significantly below estimated fair value, suggesting potential upside if forecasts hold true. With an experienced management team and board, Aroa's stable weekly volatility and sufficient cash runway further support its investment appeal amidst inherent risks in the biotech sector.

- Take a closer look at Aroa Biosurgery's potential here in our financial health report.

- Gain insights into Aroa Biosurgery's outlook and expected performance with our report on the company's earnings estimates.

Australian Strategic Materials (ASX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Strategic Materials Ltd is an integrated producer of critical metals for advanced and clean technologies in Australia, with a market cap of A$85.22 million.

Operations: The company generates revenue from two main segments: Korea, contributing A$1.57 million, and the Dubbo Project, which accounts for A$1.53 million.

Market Cap: A$85.22M

Australian Strategic Materials, with a market cap of A$85.22 million, operates as an integrated producer of critical metals but remains pre-revenue. Recent board changes include the appointment of Dominic Heaton, bringing significant mining expertise to support growth objectives. While unprofitable and experiencing increasing losses over five years, ASM's financial stability is bolstered by more cash than debt and sufficient short-term assets to cover liabilities. The company has reduced its debt-to-equity ratio significantly over the past five years and maintains a stable cash runway for over a year despite declining free cash flow trends.

- Navigate through the intricacies of Australian Strategic Materials with our comprehensive balance sheet health report here.

- Learn about Australian Strategic Materials' historical performance here.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

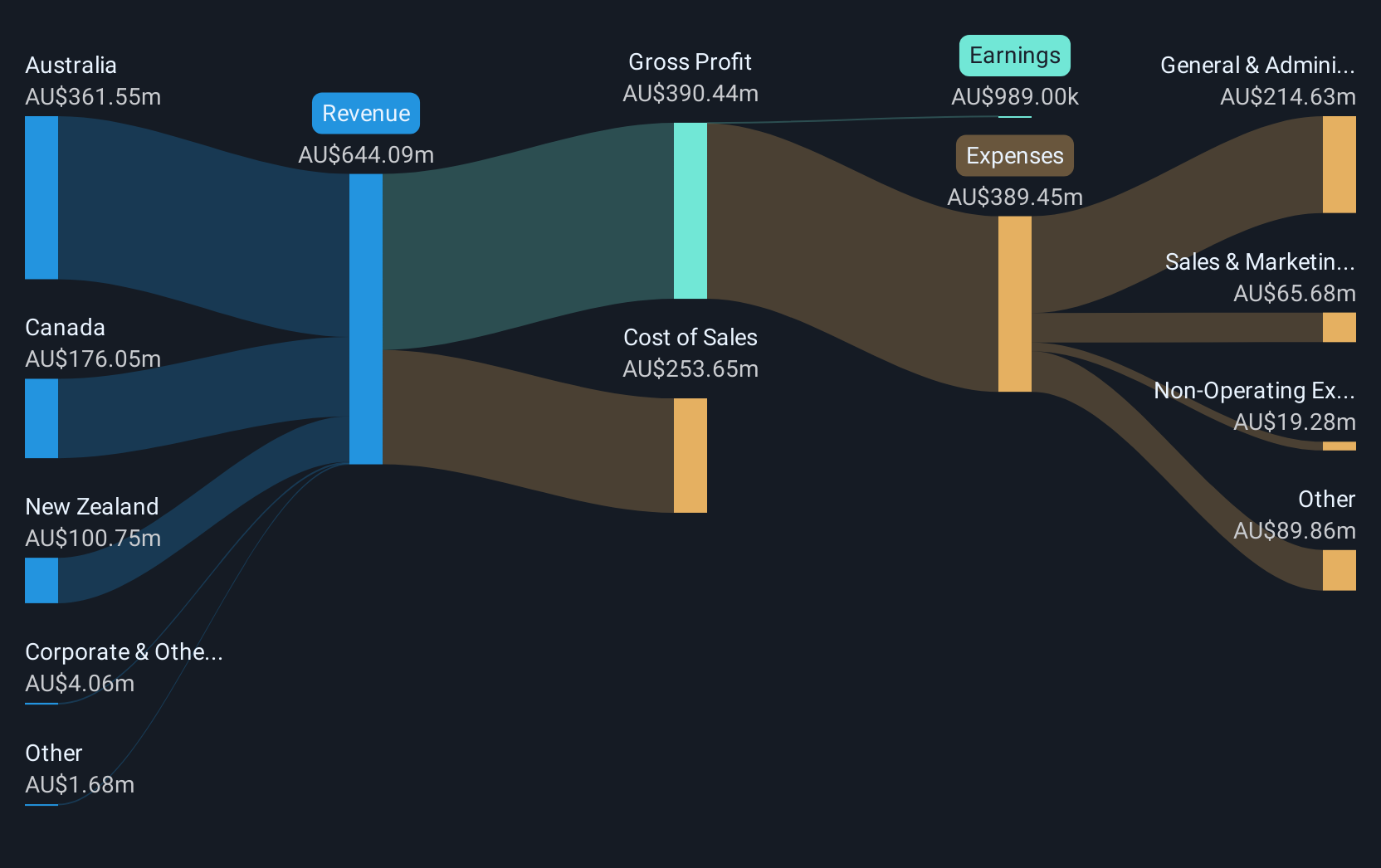

Overview: Michael Hill International Limited owns and operates jewelry stores, offering related services in Australia, New Zealand, and Canada, with a market cap of A$182.76 million.

Operations: The company's revenue for its jewelry operations in Australia, New Zealand, and Canada totals A$646.60 million.

Market Cap: A$182.76M

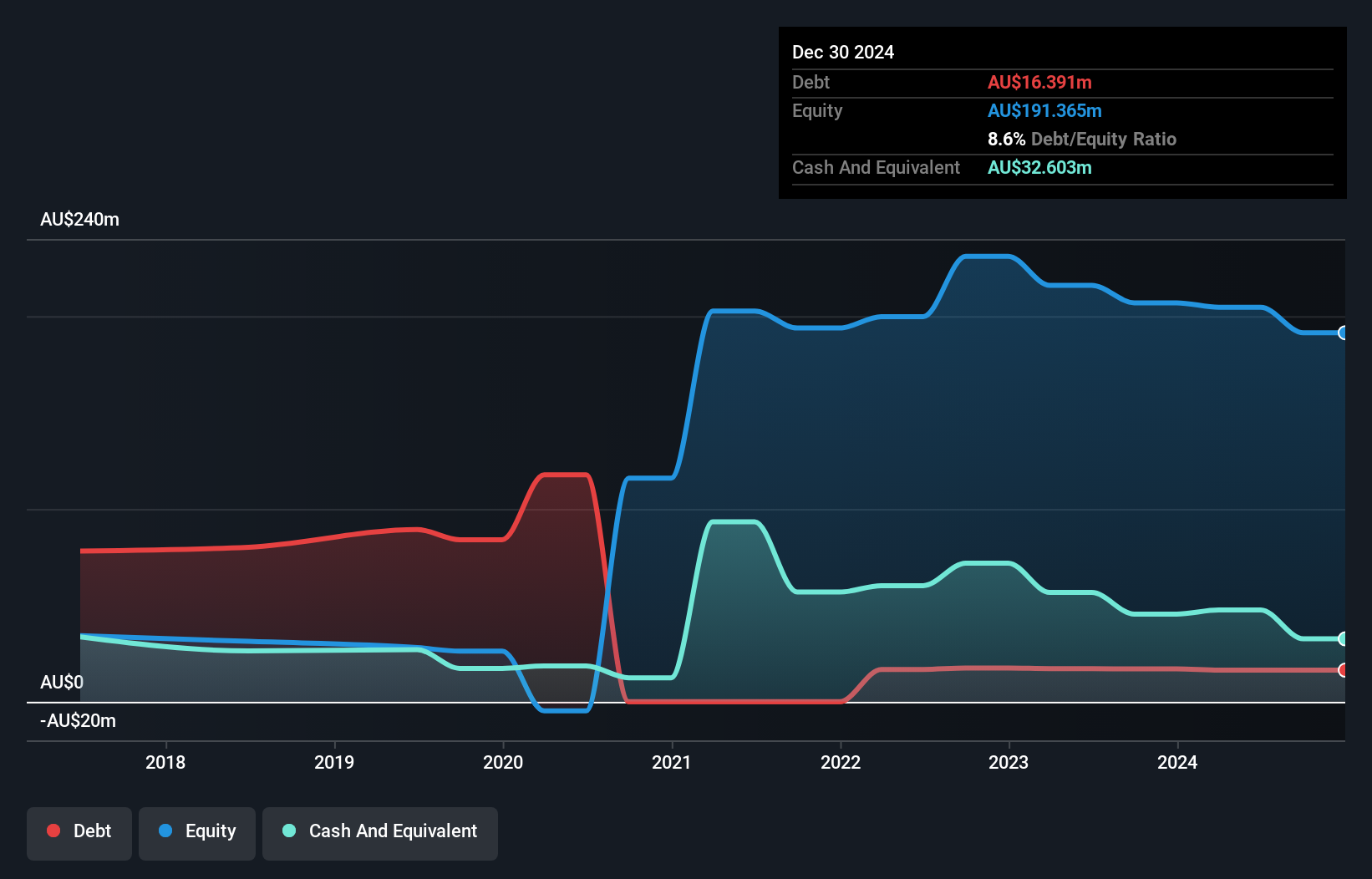

Michael Hill International, with a market cap of A$182.76 million, operates jewelry stores across Australia, New Zealand, and Canada. Despite being unprofitable with a negative return on equity of -0.29%, the company trades at good value compared to peers and industry benchmarks. Its short-term assets exceed both short-term (A$145 million) and long-term liabilities (A$233.3 million), indicating solid liquidity management. The company's net debt to equity ratio is satisfactory at 23.2%. Analysts predict earnings growth of 40.56% annually, though recent guidance suggests a potential decline in EBIT for the first half of fiscal year 2025 compared to the previous year.

- Dive into the specifics of Michael Hill International here with our thorough balance sheet health report.

- Evaluate Michael Hill International's prospects by accessing our earnings growth report.

Summing It All Up

- Explore the 1,035 names from our ASX Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARX

Aroa Biosurgery

Develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix (ECM) technology in the United States and internationally.

Very undervalued with high growth potential.

Market Insights

Community Narratives