- Australia

- /

- Hospitality

- /

- ASX:GYG

ASX Stock Picks With Estimated Discounts Of Up To 39.1%

Reviewed by Simply Wall St

The Australian market has experienced a mixed week, with positive developments failing to offset concerns about prolonged high interest rates and sector-specific challenges. In this environment, identifying undervalued stocks becomes crucial, as they may offer potential opportunities for investors looking to navigate the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webjet Group (ASX:WJL) | A$0.72 | A$1.39 | 48.2% |

| Telix Pharmaceuticals (ASX:TLX) | A$14.98 | A$25.60 | 41.5% |

| Symal Group (ASX:SYL) | A$2.47 | A$4.58 | 46% |

| Superloop (ASX:SLC) | A$2.92 | A$5.30 | 44.9% |

| Regal Partners (ASX:RPL) | A$2.82 | A$4.88 | 42.2% |

| NRW Holdings (ASX:NWH) | A$5.06 | A$8.97 | 43.6% |

| Immutep (ASX:IMM) | A$0.26 | A$0.49 | 46.6% |

| Cynata Therapeutics (ASX:CYP) | A$0.25 | A$0.43 | 42.4% |

| CleanSpace Holdings (ASX:CSX) | A$0.715 | A$1.35 | 46.9% |

| Betmakers Technology Group (ASX:BET) | A$0.18 | A$0.35 | 48.4% |

Let's explore several standout options from the results in the screener.

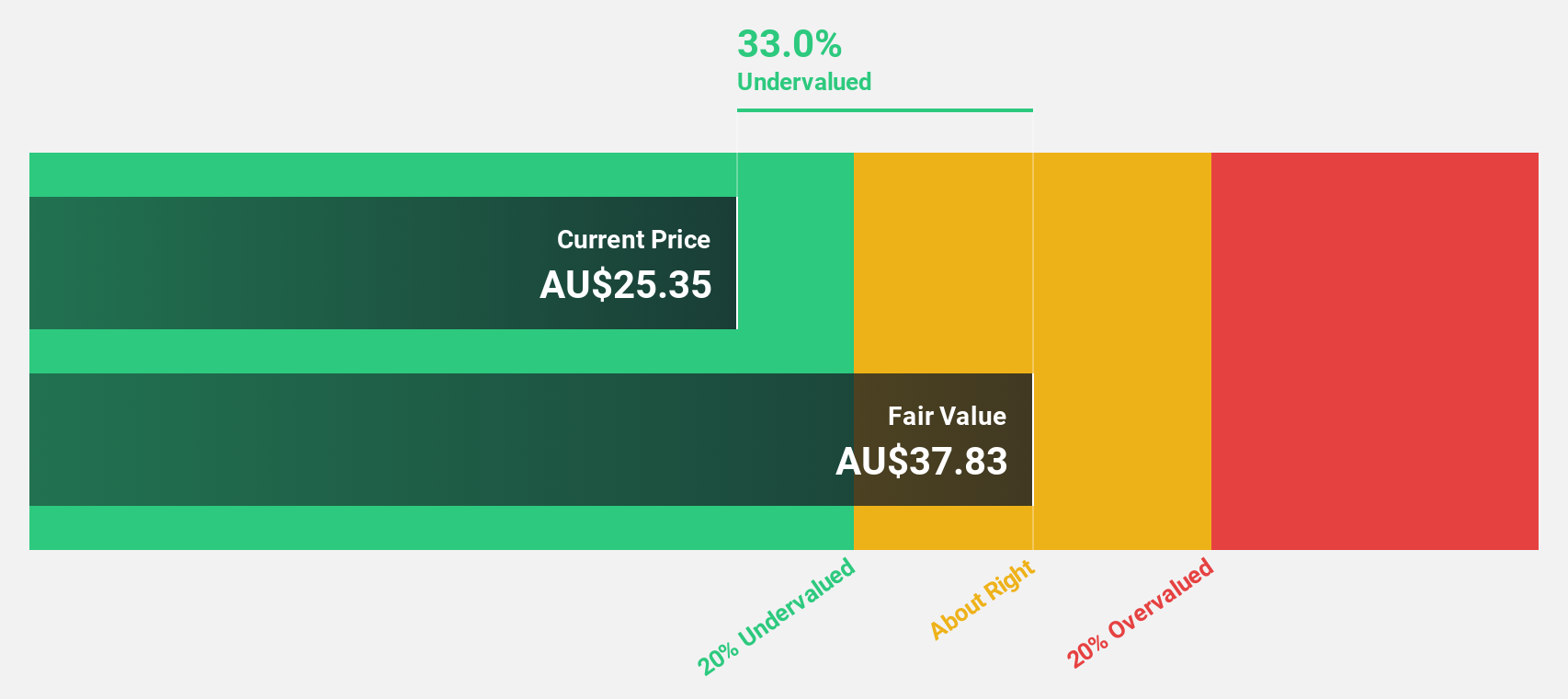

Guzman y Gomez (ASX:GYG)

Overview: Guzman y Gomez Limited operates quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.47 billion.

Operations: The company generates revenue of A$465.04 million from its quick service restaurant operations across Australia, Singapore, Japan, and the United States.

Estimated Discount To Fair Value: 39.1%

Guzman y Gomez is trading at A$23.95, significantly below its estimated fair value of A$39.31, suggesting it could be undervalued based on cash flows. The company has turned profitable with a net income of A$14.48 million and plans to repurchase shares worth A$100 million, potentially enhancing shareholder returns while supporting growth ambitions like opening 32 new restaurants in FY26. Earnings are forecast to grow at 32.5% annually, outpacing the Australian market's growth rate.

- Our expertly prepared growth report on Guzman y Gomez implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Guzman y Gomez with our detailed financial health report.

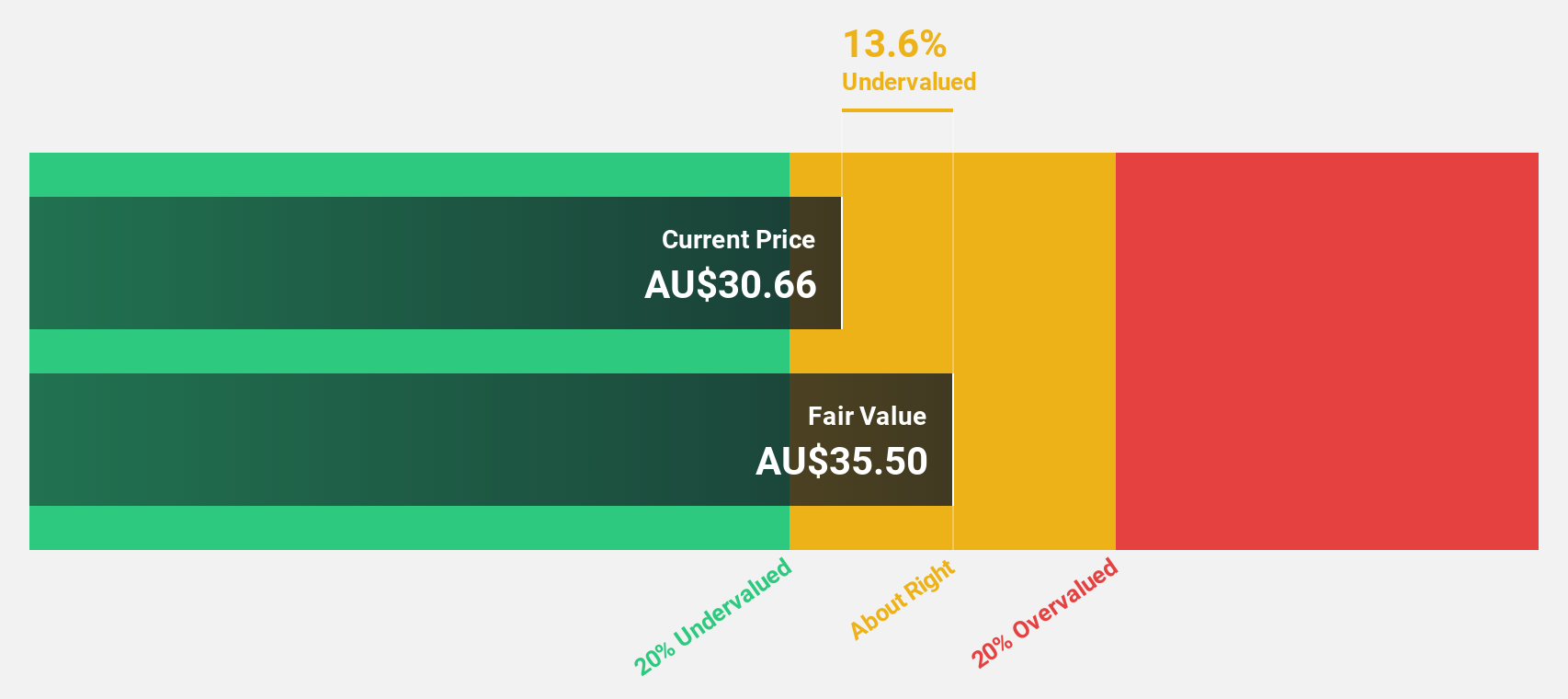

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sector, focusing on the sale of fashion jewelry and accessories, with a market capitalization of A$3.94 billion.

Operations: The company's revenue is primarily derived from its retail sale of fashion jewelry and accessories, amounting to A$798.13 million.

Estimated Discount To Fair Value: 20.7%

Lovisa Holdings, trading at A$35.59, is priced below its estimated fair value of A$44.86, indicating potential undervaluation based on cash flows. The company's earnings grew 4.8% over the past year and are expected to rise by 16.2% annually, outpacing the Australian market's growth rate of 12%. Recent earnings reported sales of A$798.13 million with a net income increase to A$86.33 million for FY25, despite a reduced dividend payout of A$0.27 per share.

- Insights from our recent growth report point to a promising forecast for Lovisa Holdings' business outlook.

- Unlock comprehensive insights into our analysis of Lovisa Holdings stock in this financial health report.

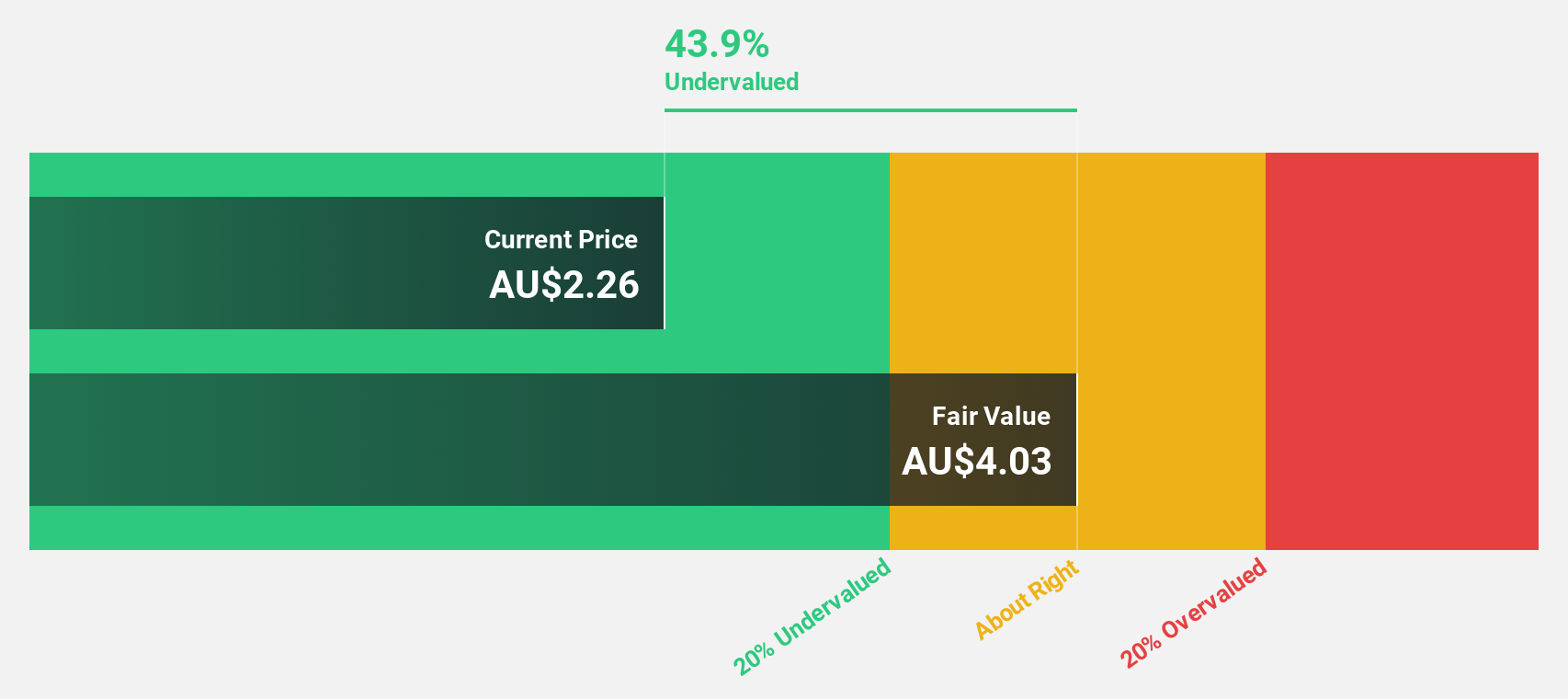

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions, including the Asia Pacific, Americas, Europe, the Middle East, and Africa, with a market cap of A$660.95 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated A$221.50 million.

Estimated Discount To Fair Value: 13.4%

Nuix, trading at A$1.98, is valued below its estimated fair value of A$2.28, reflecting potential undervaluation based on cash flows. The company reported sales of A$221.5 million for FY25 but faced a net loss of A$9.21 million compared to the previous year's profit. Despite this setback, Nuix's revenue is projected to grow at 8.9% annually, surpassing the market average of 5.9%, with profitability expected within three years amidst executive changes and index exclusion challenges.

- The analysis detailed in our Nuix growth report hints at robust future financial performance.

- Get an in-depth perspective on Nuix's balance sheet by reading our health report here.

Next Steps

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 32 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GYG

Guzman y Gomez

Operates and manages quick service restaurants in Australia, Singapore, Japan, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives