- Australia

- /

- Metals and Mining

- /

- ASX:SFX

Kogan.com And Two Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market is poised for a slight retreat, with traders eyeing potential impacts from international tariff tensions and awaiting the Reserve Bank's decision on interest rates. Amidst these broader economic shifts, investors often seek opportunities in lesser-known sectors that could offer unique growth prospects. Penny stocks, though considered niche today, remain relevant as they represent smaller or newer companies that may provide significant returns when supported by strong financials. In this context, we explore three promising penny stocks on the ASX worth watching for their balance sheet strength and potential long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.40 | A$113.22M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.64 | A$122.06M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.92 | A$450.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.70 | A$449.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.73 | A$847.84M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.49 | A$895.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.03 | A$191.22M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 469 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer based in Australia, with a market capitalization of A$388.32 million.

Operations: Kogan.com Ltd generates revenue through its operations in Australia, with A$309.36 million from Kogan Parent and A$9.96 million from Mighty Ape, and in New Zealand, with A$40.02 million from Kogan Parent and A$124.88 million from Mighty Ape.

Market Cap: A$388.32M

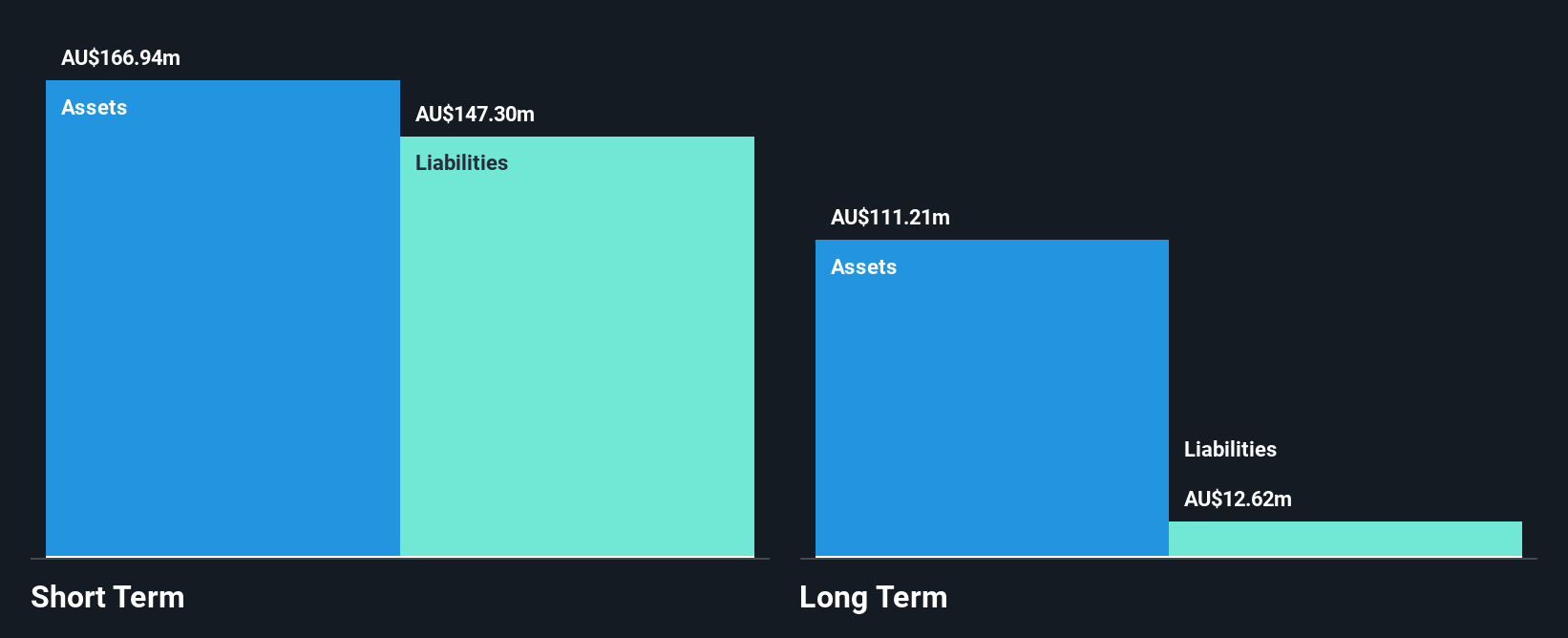

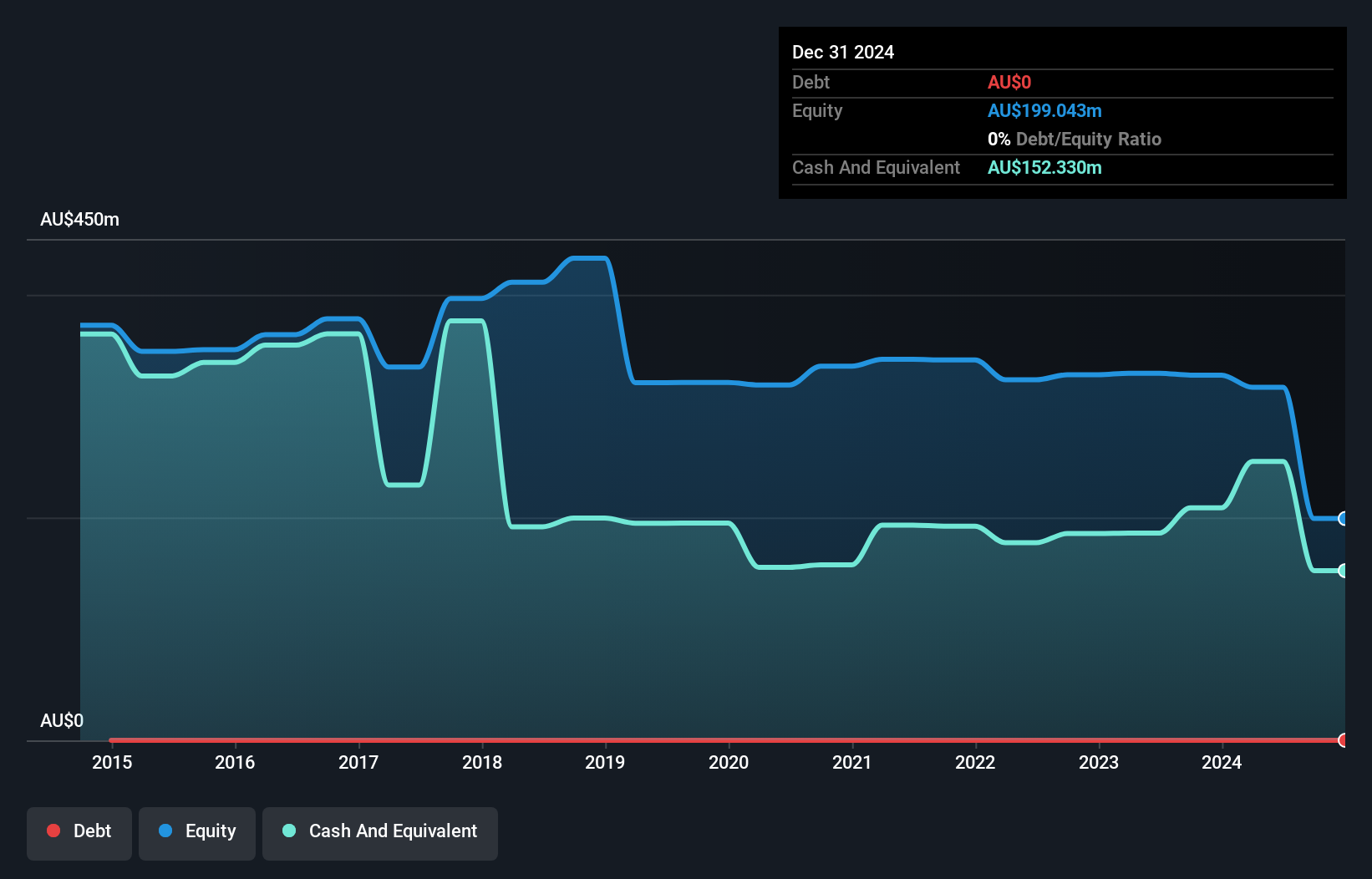

Kogan.com Ltd, with a market capitalization of A$388.32 million, is trading significantly below its estimated fair value. Despite negative earnings growth of 73.9% over the past year and declining profits over five years, the company remains debt-free with sufficient short-term assets to cover both short and long-term liabilities. Recent executive changes include appointing Belinda Cleminson as Company Secretary. The company extended its buyback plan duration until May 2026, indicating confidence in future performance despite current challenges such as low profit margins and a dividend not well covered by earnings. Earnings are forecasted to grow annually by 34.52%.

- Jump into the full analysis health report here for a deeper understanding of Kogan.com.

- Review our growth performance report to gain insights into Kogan.com's future.

Platinum Investment Management (ASX:PTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platinum Investment Management Limited is a publicly owned hedge fund sponsor with a market cap of A$278.22 million.

Operations: The company generates revenue primarily from Funds Management, contributing A$157.13 million, with an additional A$4.63 million from Investments and Other activities.

Market Cap: A$278.22M

Platinum Investment Management Limited, with a market cap of A$278.22 million, is trading at 32.6% below its fair value estimate, suggesting potential undervaluation. The company remains debt-free and has robust short-term assets (A$169.7M) exceeding liabilities, yet faces challenges with declining earnings and lower profit margins compared to last year. Despite high-quality earnings and stable volatility, the dividend yield of 6% isn't well covered by current earnings. The management team is experienced; however, the board's average tenure suggests inexperience. Recent M&A discussions may impact future strategic direction amidst forecasted earnings decline of 10.4% annually over three years.

- Click to explore a detailed breakdown of our findings in Platinum Investment Management's financial health report.

- Learn about Platinum Investment Management's future growth trajectory here.

Sheffield Resources (ASX:SFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheffield Resources Limited focuses on the evaluation and development of mineral sands in Australia, with a market cap of A$78.96 million.

Operations: Sheffield Resources Limited has not reported any specific revenue segments.

Market Cap: A$78.96M

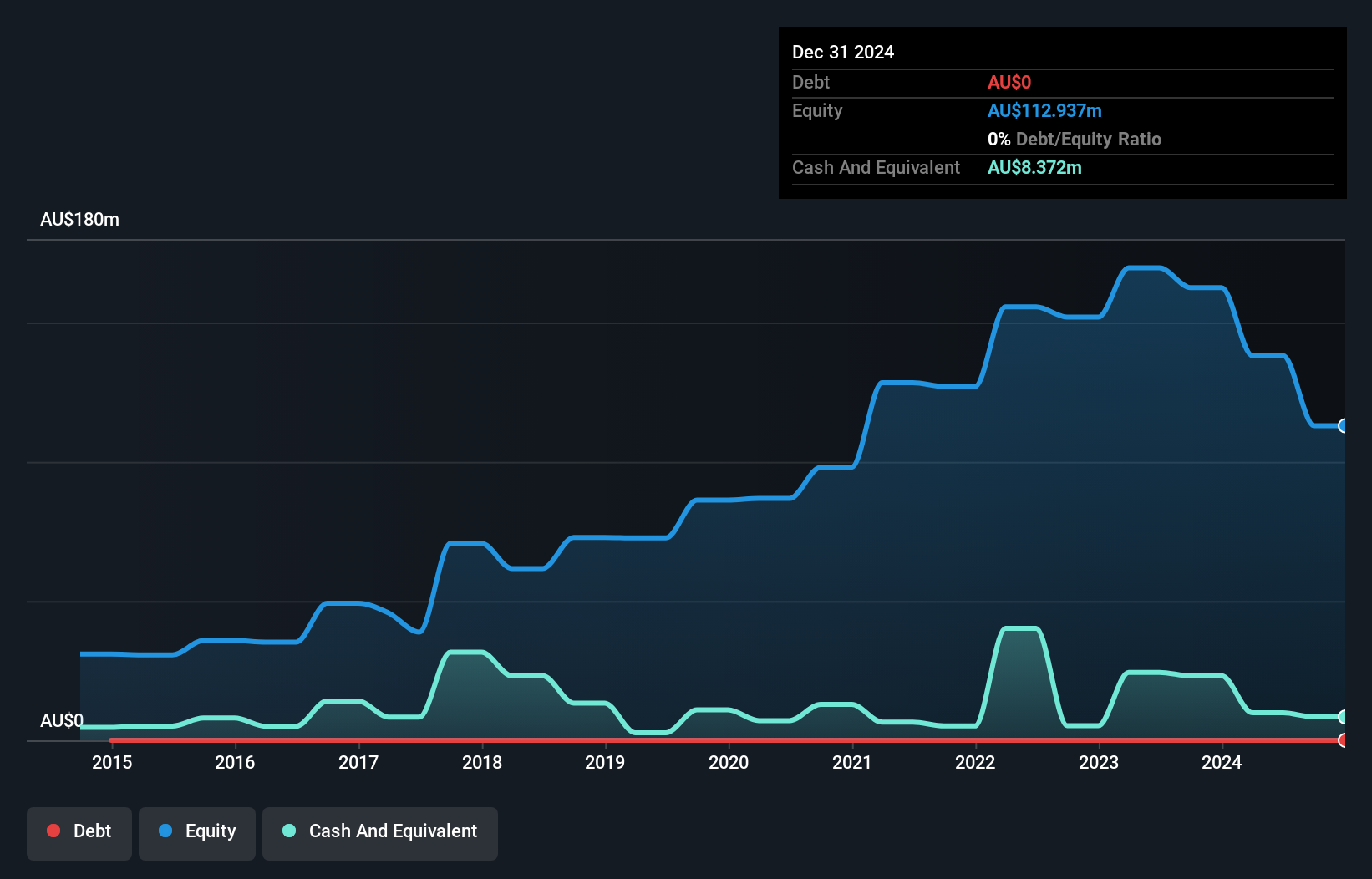

Sheffield Resources Limited, with a market cap of A$78.96 million, is pre-revenue and unprofitable, experiencing increasing losses over the past five years. Despite this, it has no debt and a solid cash runway exceeding three years if free cash flow growth continues at historical rates. The company's short-term assets (A$8.4M) comfortably cover its short-term liabilities (A$310K), indicating sound liquidity management. Its board of directors is considered experienced with an average tenure of 5.1 years, although there's insufficient data on management experience. Earnings are forecast to grow significantly at 79.69% annually despite current challenges.

- Take a closer look at Sheffield Resources' potential here in our financial health report.

- Gain insights into Sheffield Resources' outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Embark on your investment journey to our 469 ASX Penny Stocks selection here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SFX

Sheffield Resources

Engages in the evaluation and development of mineral sands in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.