The Australian market has been navigating a cautious phase, with ASX futures reflecting a slight downturn amid broader concerns over recent economic data and global financial conditions. In such times, investors often look beyond the established giants to explore opportunities in lesser-known corners of the market. Penny stocks, though an outdated term, continue to represent intriguing possibilities for growth and diversification by focusing on smaller or newer companies that may offer strong fundamentals and potential upside.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$121.8M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.86 | A$87.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.845 | A$52.62M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.71 | A$274.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.71 | A$3.09B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.51 | A$232.38M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.37 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$320.78 million.

Operations: The company's revenue is derived from its operations in Australia, with Kogan.Com generating A$330.44 million and Mighty Ape contributing A$7.30 million, as well as its presence in New Zealand where Kogan.Com accounts for A$35.56 million and Mighty Ape brings in A$114.81 million.

Market Cap: A$320.78M

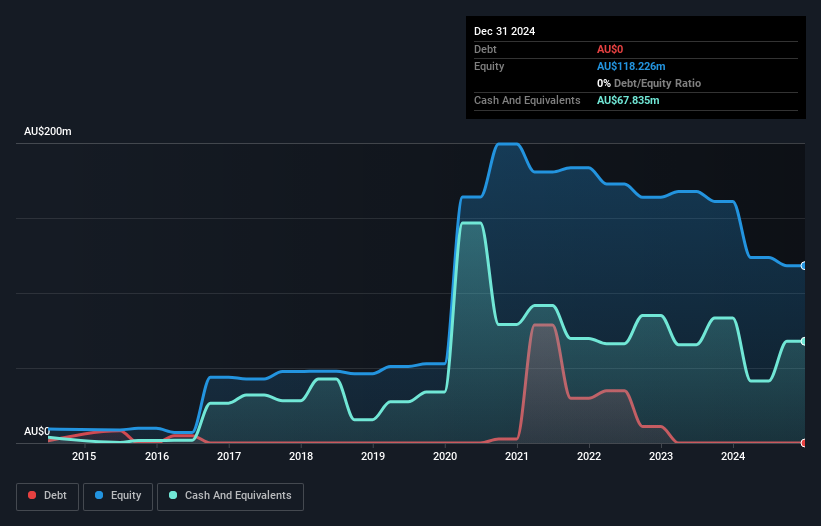

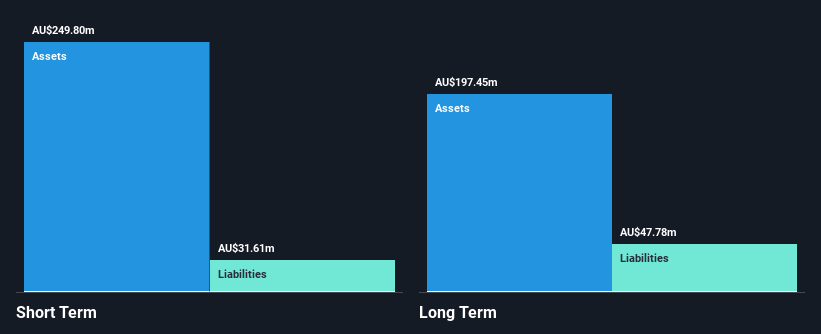

Kogan.com Ltd, with a market capitalization of A$320.78 million, is navigating challenges typical for penny stocks. Despite being unprofitable and experiencing increased losses over the past five years, Kogan.com has a robust cash position with short-term assets exceeding both short and long-term liabilities. The company is debt-free and maintains a positive free cash flow, providing a runway of over three years. Recent developments include share buybacks totaling A$45.8 million and board changes following the resignation of an independent director. However, its removal from key indices like the S&P/ASX 300 highlights ongoing volatility concerns for investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Kogan.com.

- Understand Kogan.com's earnings outlook by examining our growth report.

PharmX Technologies (ASX:PHX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PharmX Technologies Limited operates as a technology and software development company in Australia, with a market cap of A$98.92 million.

Operations: PharmX Technologies generates revenue primarily from its Health Services segment, which accounts for A$7.53 million.

Market Cap: A$98.92M

PharmX Technologies, with a market cap of A$98.92 million, is navigating the complexities of penny stocks in Australia. Despite being unprofitable and having increased losses over the past five years, it remains debt-free and has short-term assets that exceed its liabilities. Recent strategic moves include launching a new Marketplace platform to enhance pharmacy ordering processes, addressing significant market demand from 6,000 pharmacies in Australia. This initiative aims to diversify revenue streams through volume-based fees and data monetization while consolidating PharmX's position as a leader in digital pharmacy solutions across Australia and New Zealand.

- Dive into the specifics of PharmX Technologies here with our thorough balance sheet health report.

- Explore historical data to track PharmX Technologies' performance over time in our past results report.

Qualitas (ASX:QAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across all real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$1.14 billion.

Operations: The company generates revenue from two main segments: Direct Lending, which accounts for A$10.17 million, and Funds Management, contributing A$15.03 million.

Market Cap: A$1.14B

Qualitas, with a market cap of A$1.14 billion, demonstrates robust financial health and growth potential despite its classification among penny stocks. The company has significantly reduced its debt-to-equity ratio from over 1000% to 11.8% in five years, while maintaining strong interest coverage and cash flow to debt ratios. Its earnings have grown by 27.6% over the past year, outpacing industry averages and accelerating beyond its five-year growth rate of 20.8%. However, the dividend yield of 2.57% is not well covered by free cash flows, indicating potential sustainability concerns in that area.

- Jump into the full analysis health report here for a deeper understanding of Qualitas.

- Assess Qualitas' future earnings estimates with our detailed growth reports.

Next Steps

- Click this link to deep-dive into the 413 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PHX

PharmX Technologies

Operates as a technology and software development company in Australia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.