Amidst a generally positive trend in the Australian market, with the ASX200 recently closing up by 0.9% and most sectors showing gains, investor sentiment appears cautiously optimistic. Particularly noteworthy is the real estate sector's lead, suggesting a growing confidence that could influence market dynamics across various industries. In such an environment, understanding the significance of insider ownership in growth companies becomes crucial as it often reflects leadership's confidence in their company's future prospects amidst changing economic conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

| Catalyst Metals (ASX:CYL) | 17.1% | 77.1% |

| Liontown Resources (ASX:LTR) | 16.4% | 59.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 96.2% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

We'll examine a selection from our screener results.

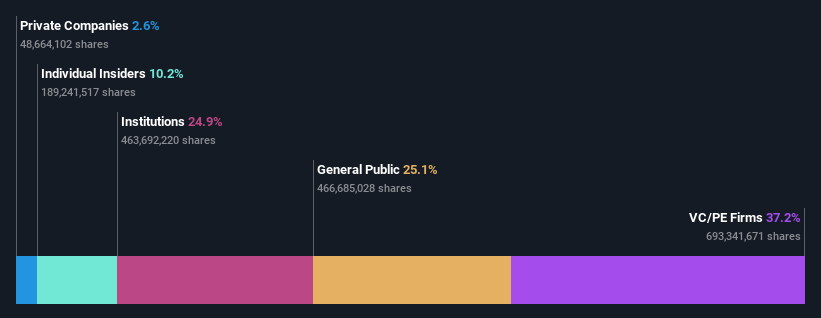

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.64 billion.

Operations: The company generates revenue primarily from mine operations, totaling approximately A$339.32 million.

Insider Ownership: 18.5%

Emerald Resources exhibits notable growth characteristics with a forecasted annual earnings increase of 19.6% and revenue growth at 18.6% per year, outpacing the Australian market's average. Despite this, both metrics fall slightly below the significant growth threshold of 20%. The company has seen substantial earnings growth over the past year (53.4%) and is expected to achieve a high Return on Equity (20.5%) in three years. However, shareholder dilution occurred last year, tempering some positive outlooks.

- Unlock comprehensive insights into our analysis of Emerald Resources stock in this growth report.

- Upon reviewing our latest valuation report, Emerald Resources' share price might be too optimistic.

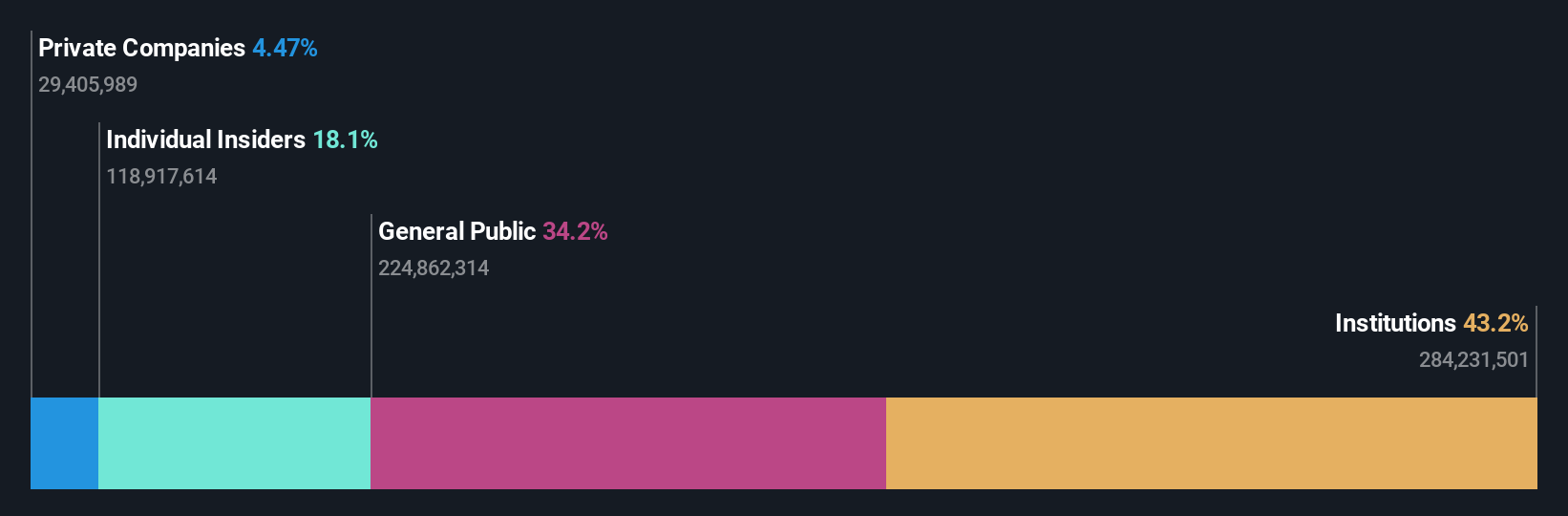

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kogan.com Ltd is an online retailer based in Australia, with a market capitalization of approximately A$447.74 million.

Operations: The company generates revenue through its online retail operations, with A$274.85 million from its Australian segment and A$33.40 million from its New Zealand operations, alongside A$11.39 million and A$142.52 million from Mighty Ape in Australia and New Zealand respectively.

Insider Ownership: 19.9%

Kogan.com, while trading at 58.8% below its estimated fair value, shows a mixed growth outlook in the Australian market. Its revenue growth of 6.2% per year is modest but still outpaces the general market's 5.3%. More impressively, its earnings are expected to surge by approximately 35% annually over the next three years, indicating potential for substantial profit increases despite a forecasted low Return on Equity of 17.7%. Recent strategic moves include extending a buyback plan and presenting at an industry conference, underscoring active management engagement.

- Dive into the specifics of Kogan.com here with our thorough growth forecast report.

- Our valuation report here indicates Kogan.com may be overvalued.

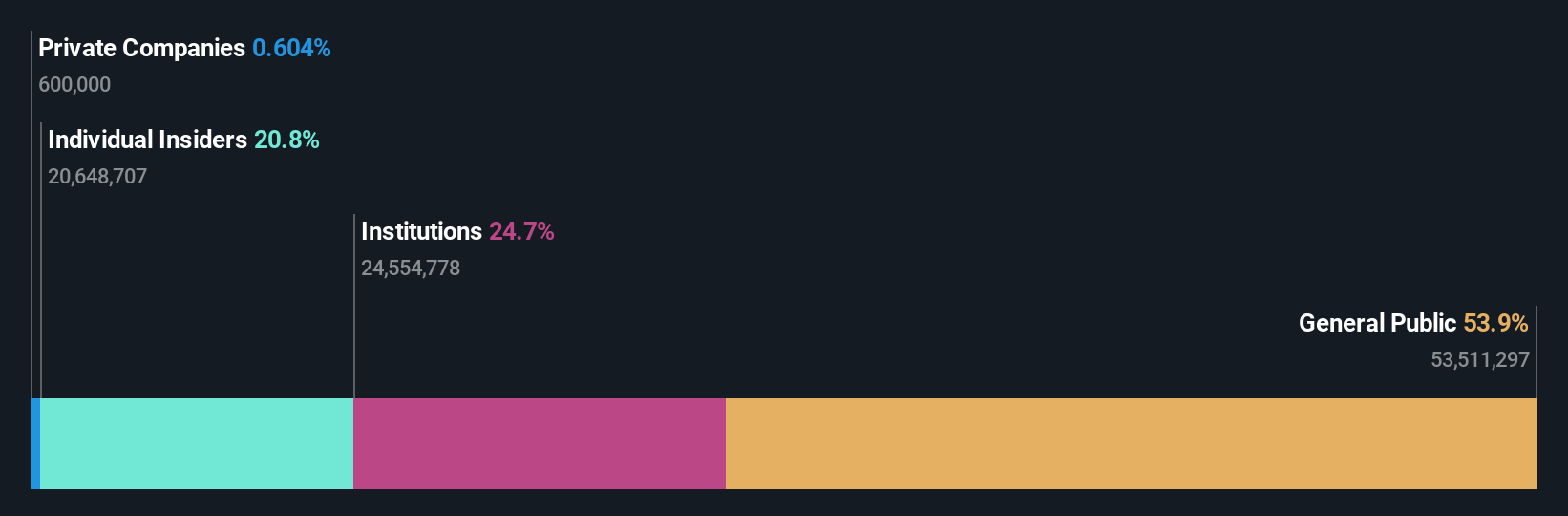

Ora Banda Mining (ASX:OBM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$789.50 million.

Operations: The company generates revenue primarily from gold mining, totaling A$166.66 million.

Insider Ownership: 10.2%

Ora Banda Mining, despite trading at A$93.3% below its estimated fair value, faces challenges with shareholder dilution over the past year. However, the company is on a positive trajectory with expected profitability within three years and substantial annual earnings growth forecasted at 96.22%. Revenue growth is also promising, anticipated to increase by 45.2% annually, significantly outpacing the Australian market average of 5.3%. The recent appointment of Kathryn Cutler as a Non-executive Director adds valuable exploration expertise to the board.

- Delve into the full analysis future growth report here for a deeper understanding of Ora Banda Mining.

- Our comprehensive valuation report raises the possibility that Ora Banda Mining is priced lower than what may be justified by its financials.

Seize The Opportunity

- Dive into all 91 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kogan.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KGN

Flawless balance sheet with reasonable growth potential.