ASX Growth Companies With High Insider Ownership In July 2025

Reviewed by Simply Wall St

As the ASX 200 begins the new financial year on a flat note, with sectors like Utilities and IT showing modest gains, investors are keenly observing market movements to identify promising opportunities. In this environment, growth companies with high insider ownership often stand out as they can signal strong confidence from those who know the business best, potentially offering resilience and strategic advantage amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.6% | 106.7% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 19.9% | 88.8% |

We'll examine a selection from our screener results.

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

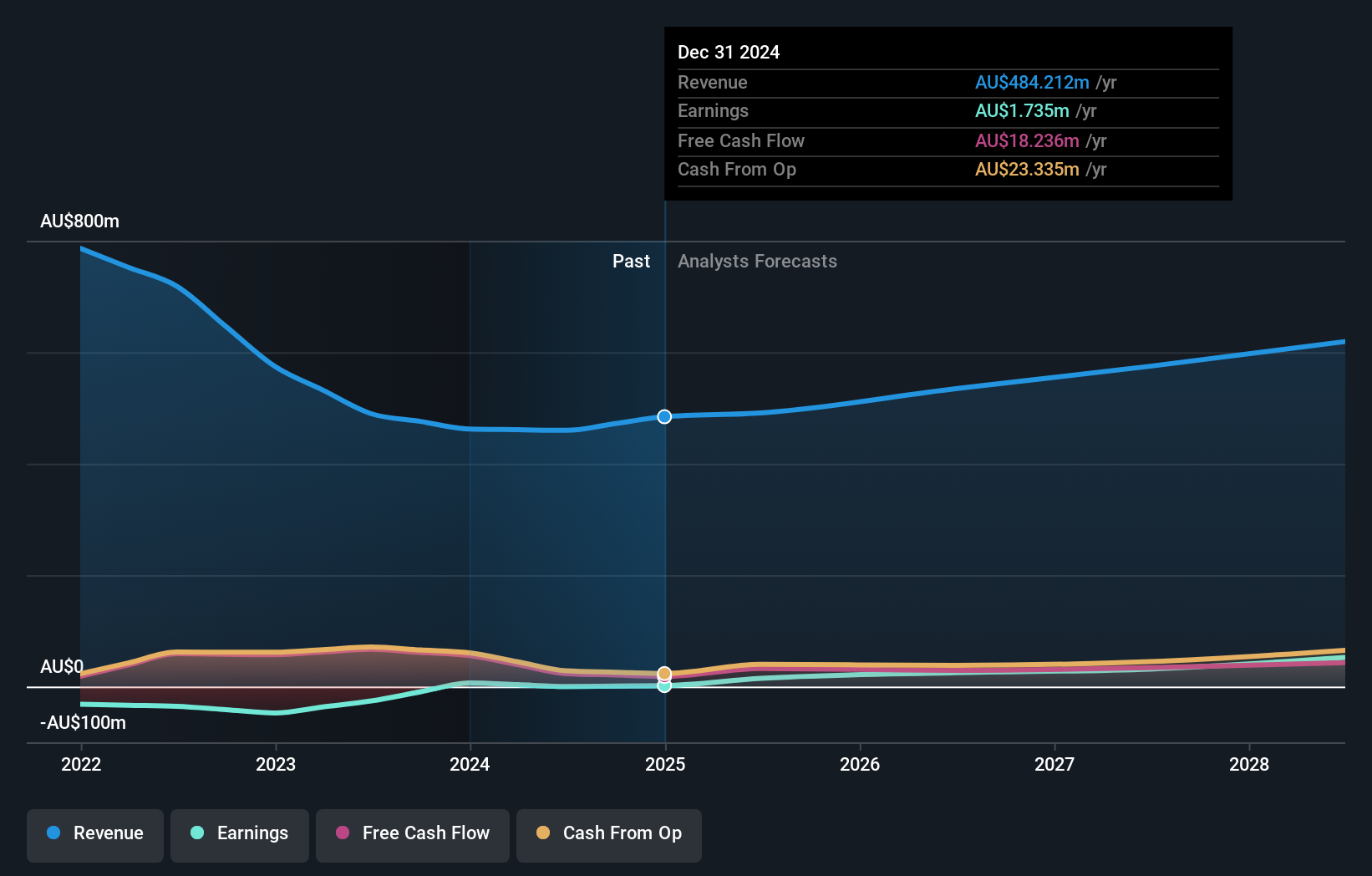

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$384.35 million.

Operations: The company generates revenue through its operations in Australia, with A$309.36 million from Kogan Parent and A$9.96 million from Mighty Ape, as well as in New Zealand, earning A$40.02 million from Kogan Parent and A$124.88 million from Mighty Ape.

Insider Ownership: 20.8%

Kogan.com is poised for significant earnings growth, forecasted at 34.5% annually, outpacing the Australian market's 10.9%. Despite a dip in profit margins to 0.4% from last year's 1.4%, the company trades at a substantial discount of 63.4% below its estimated fair value, presenting potential value opportunities. Recent executive changes include Belinda Cleminson's appointment as Company Secretary, enhancing corporate governance with her extensive experience in listed companies.

- Take a closer look at Kogan.com's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Kogan.com is priced lower than what may be justified by its financials.

Meeka Metals (ASX:MEK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Meeka Metals Limited focuses on the exploration and development of gold properties in Western Australia, with a market cap of A$422.78 million.

Operations: Meeka Metals Limited's revenue segments are currently not specified in the provided text.

Insider Ownership: 12%

Meeka Metals is set for strong growth, with earnings forecasted to rise 54.14% annually and revenue expected to grow at 56.1% per year, significantly outpacing the Australian market. Despite generating less than US$1 million in revenue (A$329K), it trades at a 28.6% discount to its estimated fair value. A recent A$60 million equity offering supports expansion efforts, while high insider ownership aligns management interests with shareholders despite no recent insider trading activity noted.

- Get an in-depth perspective on Meeka Metals' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Meeka Metals shares in the market.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

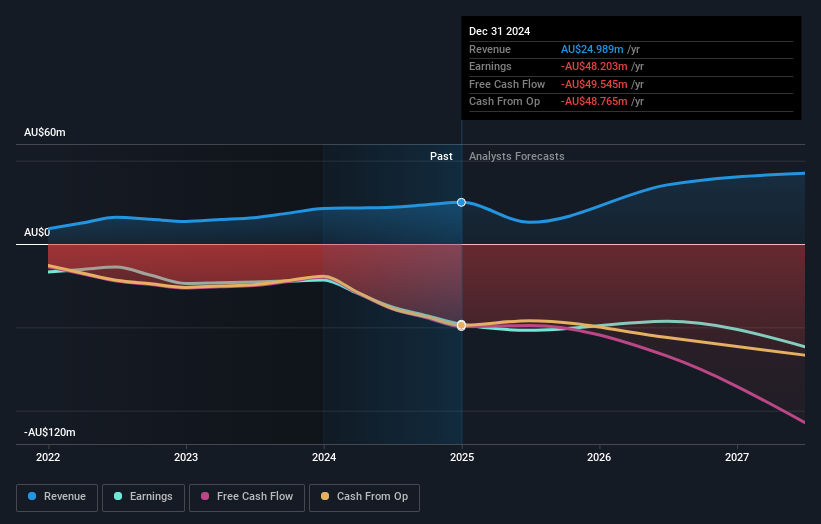

Overview: PYC Therapeutics Limited is an Australian drug-development company focused on discovering and developing novel RNA therapeutics for genetic diseases, with a market capitalization of A$755.32 million.

Operations: The company generates revenue of A$24.99 million from its activities in the discovery and development of novel RNA therapeutics for genetic diseases.

Insider Ownership: 35.9%

PYC Therapeutics is poised for growth, with earnings expected to increase by 24.3% annually and become profitable within three years, outperforming the market. Despite recent shareholder dilution, it trades at a significant discount to its estimated fair value. Insider ownership remains high, aligning management interests with shareholders. Recent developments include dosing in a Phase 1a trial of PYC-003, indicating progress in their clinical pipeline and potential future revenue catalysts despite slower revenue growth forecasts of 12.6% annually.

- Unlock comprehensive insights into our analysis of PYC Therapeutics stock in this growth report.

- The analysis detailed in our PYC Therapeutics valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 94 companies by clicking here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kogan.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KGN

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives