Harvey Norman Holdings Limited's (ASX:HVN) Price Is Right But Growth Is Lacking

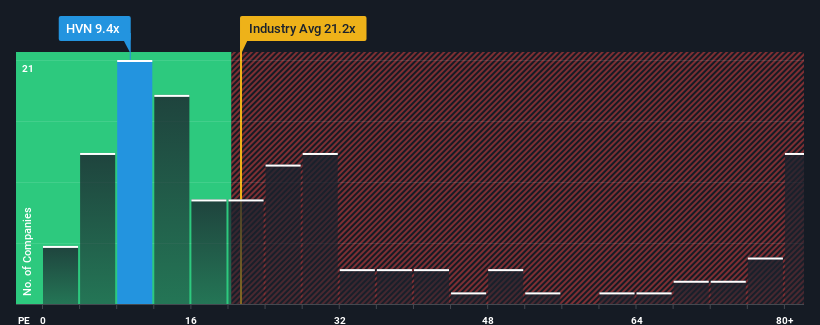

With a price-to-earnings (or "P/E") ratio of 9.4x Harvey Norman Holdings Limited (ASX:HVN) may be sending bullish signals at the moment, given that almost half of all companies in Australia have P/E ratios greater than 19x and even P/E's higher than 37x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Harvey Norman Holdings has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Harvey Norman Holdings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Harvey Norman Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 10% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings growth is heading into negative territory, declining 7.7% per year over the next three years. With the market predicted to deliver 18% growth each year, that's a disappointing outcome.

With this information, we are not surprised that Harvey Norman Holdings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Harvey Norman Holdings' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Harvey Norman Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Harvey Norman Holdings is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Harvey Norman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HVN

Harvey Norman Holdings

Engages in the integrated retail, franchise, property, and digital system businesses.

Undervalued with excellent balance sheet and pays a dividend.