- Australia

- /

- Capital Markets

- /

- ASX:PTM

3 ASX Penny Stocks With Market Caps Under A$400M

Reviewed by Simply Wall St

The Australian market has shown mixed performance, with the ASX200 closing up 0.24% at 8,145 points, driven by gains in the IT and Real Estate sectors while Energy and Materials faced declines. In such a varied landscape, identifying stocks with robust financials becomes crucial for investors seeking opportunities beyond the major players. Penny stocks, often representing smaller or newer companies, continue to offer potential for growth when they are backed by solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.715 | A$136.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.88 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.37 | A$66.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.62 | A$407.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$119.22M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.31 | A$2.72B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.94 | A$630.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$857.64M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.71 | A$1.24B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 989 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology, with a market cap of A$151.76 million.

Operations: The company generates revenue of NZ$76.35 million from its operations in developing, manufacturing, and selling products for soft tissue repair.

Market Cap: A$151.76M

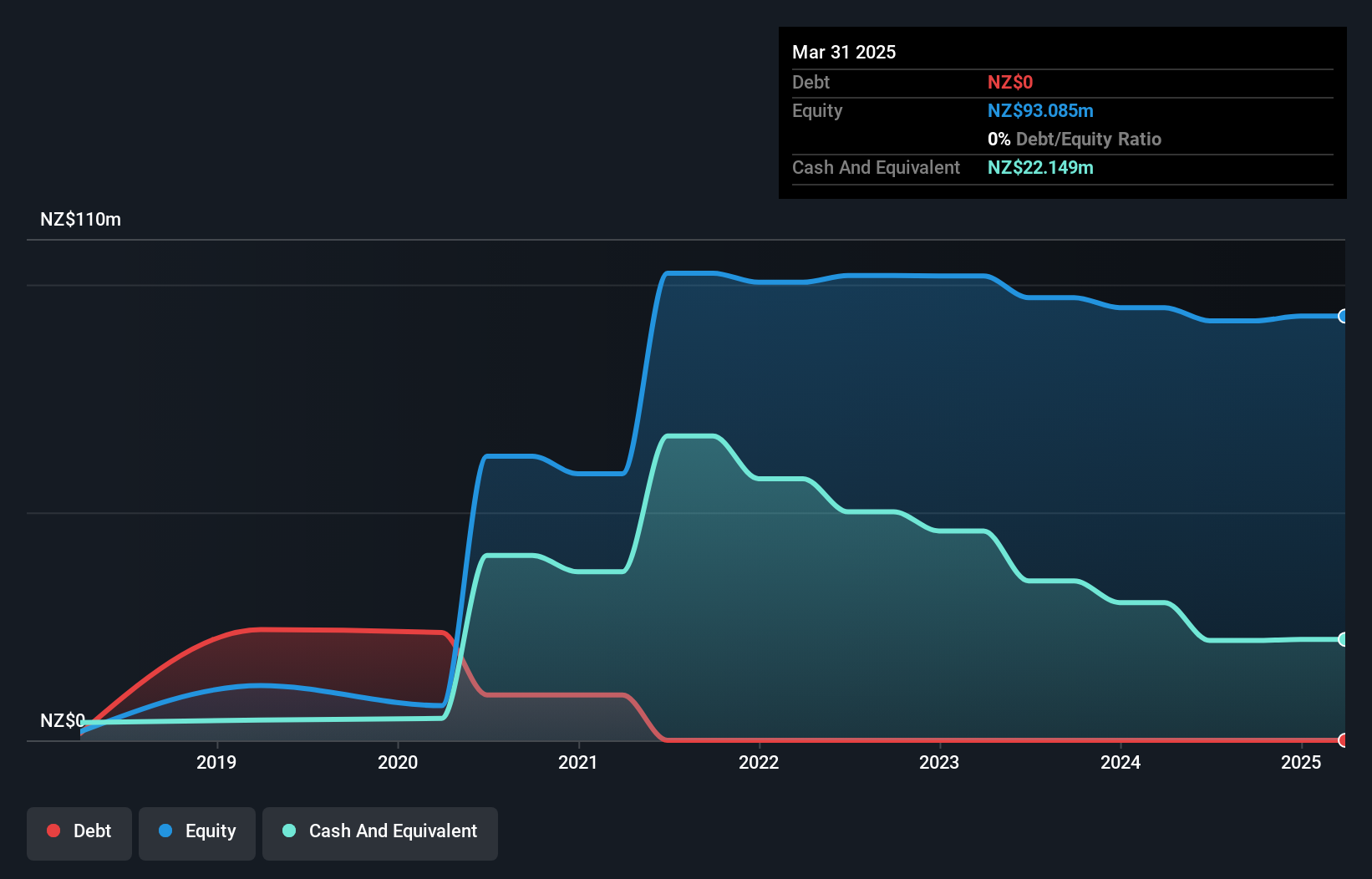

Aroa Biosurgery Limited, with a market cap of A$151.76 million, is trading at a significant discount to its estimated fair value and has not experienced meaningful shareholder dilution over the past year. Despite being unprofitable with a negative return on equity, the company has reduced losses by 20.8% annually over five years and maintains sufficient cash runway for more than a year. Its short-term assets comfortably cover both short- and long-term liabilities, while analysts anticipate an 88.4% stock price increase. The board and management are seasoned, adding stability amid its current financial challenges.

- Click here to discover the nuances of Aroa Biosurgery with our detailed analytical financial health report.

- Explore Aroa Biosurgery's analyst forecasts in our growth report.

Baby Bunting Group (ASX:BBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baby Bunting Group Limited, with a market cap of A$211.15 million, operates as a retailer of maternity and baby goods in Australia and New Zealand.

Operations: The company's revenue is derived from its Retail - Specialty segment, generating A$496.90 million.

Market Cap: A$211.15M

Baby Bunting Group Limited, with a market cap of A$211.15 million, is seeing mixed financial performance. The company's revenue reached A$254.37 million for the half year ended December 2024, but profit margins have decreased to 1.2% from last year's 2.4%. While its net debt to equity ratio is satisfactory at 8.6%, short-term assets exceed liabilities by A$23.7M, though long-term liabilities remain uncovered by these assets. Despite negative earnings growth over the past year and low return on equity at 5.9%, analysts forecast earnings growth of over 42% annually, suggesting potential future improvement in financial health.

- Take a closer look at Baby Bunting Group's potential here in our financial health report.

- Gain insights into Baby Bunting Group's outlook and expected performance with our report on the company's earnings estimates.

Platinum Investment Management (ASX:PTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platinum Investment Management Limited is a publicly owned hedge fund sponsor with a market cap of A$317.17 million.

Operations: The company generates revenue primarily from Funds Management, contributing A$157.13 million, with an additional A$4.63 million from Investments and Other activities.

Market Cap: A$317.17M

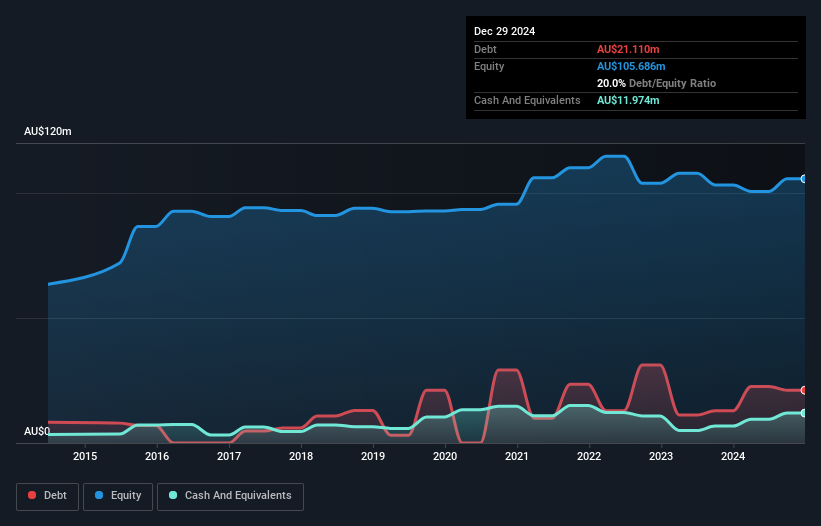

Platinum Investment Management Limited, with a market cap of A$317.17 million, is experiencing financial challenges despite having no debt and sufficient short-term assets to cover liabilities. Recent earnings show a decline in revenue to A$76.63 million for the half-year ended December 2024, down from A$99.78 million the previous year, with net income also dropping significantly. The company's profit margins have contracted from 36.8% to 15.6%. While its management team is experienced and there has been no shareholder dilution recently, its return on equity remains low at 12.8%, and earnings are forecasted to continue declining slightly over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Platinum Investment Management.

- Review our growth performance report to gain insights into Platinum Investment Management's future.

Where To Now?

- Discover the full array of 989 ASX Penny Stocks right here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Platinum Investment Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PTM

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives