- Australia

- /

- Specialty Stores

- /

- ASX:AX1

Revenue Beat: Accent Group Limited Exceeded Revenue Forecasts By 7.9% And Analysts Are Updating Their Estimates

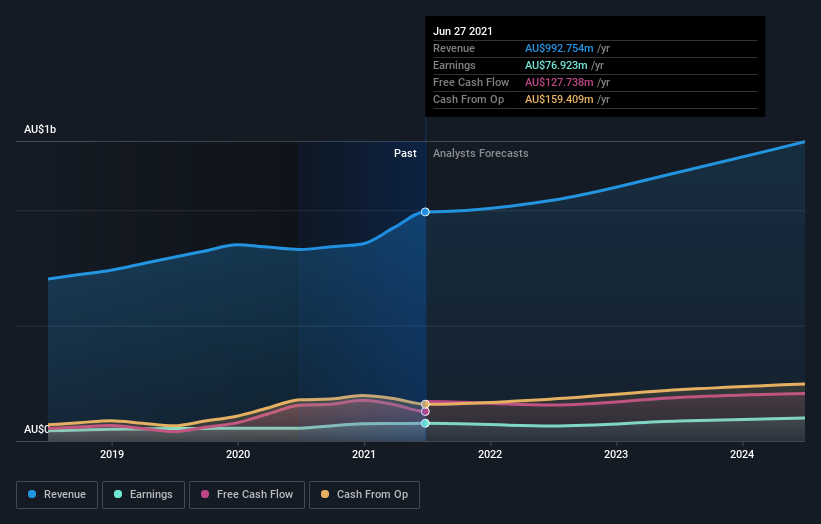

It's been a sad week for Accent Group Limited (ASX:AX1), who've watched their investment drop 18% to AU$2.18 in the week since the company reported its yearly result. It was a workmanlike result, with revenues of AU$993m coming in 7.9% ahead of expectations, and statutory earnings per share of AU$0.14, in line with analyst appraisals. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for Accent Group

After the latest results, the five analysts covering Accent Group are now predicting revenues of AU$1.04b in 2022. If met, this would reflect an okay 5.0% improvement in sales compared to the last 12 months. Statutory earnings per share are forecast to drop 17% to AU$0.12 in the same period. In the lead-up to this report, the analysts had been modelling revenues of AU$1.08b and earnings per share (EPS) of AU$0.15 in 2022. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a pretty serious reduction to earnings per share estimates.

It'll come as no surprise then, to learn that the analysts have cut their price target 14% to AU$2.58. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Accent Group at AU$2.90 per share, while the most bearish prices it at AU$2.40. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Accent Group's revenue growth is expected to slow, with the forecast 5.0% annualised growth rate until the end of 2022 being well below the historical 12% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.9% annually. Factoring in the forecast slowdown in growth, it looks like Accent Group is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Accent Group. They also downgraded their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Accent Group going out to 2024, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 2 warning signs for Accent Group that you need to be mindful of.

If you’re looking to trade Accent Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026