- Australia

- /

- Specialty Stores

- /

- ASX:APE

Earnings Working Against Eagers Automotive Limited's (ASX:APE) Share Price

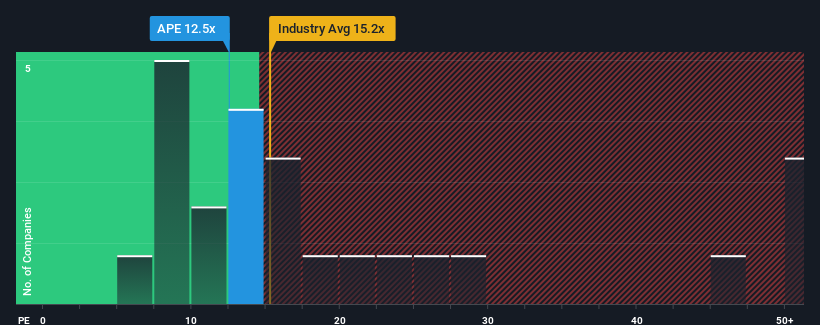

With a price-to-earnings (or "P/E") ratio of 12.5x Eagers Automotive Limited (ASX:APE) may be sending bullish signals at the moment, given that almost half of all companies in Australia have P/E ratios greater than 21x and even P/E's higher than 37x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Eagers Automotive has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Eagers Automotive

How Is Eagers Automotive's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Eagers Automotive's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.7% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 52% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 0.7% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 17% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Eagers Automotive's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Eagers Automotive's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Eagers Automotive (of which 1 is concerning!) you should know about.

If these risks are making you reconsider your opinion on Eagers Automotive, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Eagers Automotive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:APE

Eagers Automotive

Owns and operates motor vehicle dealerships in Australia and New Zealand.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives