- Australia

- /

- Residential REITs

- /

- ASX:INA

Could Macquarie’s Exit Reshape Ingenia Communities Group’s (ASX:INA) Long-Term Investor Base?

Reviewed by Sasha Jovanovic

- Macquarie Group Limited and its controlled entities have recently ceased to be substantial holders in Ingenia Communities Group, a shift announced after the company’s annual general meeting on November 8, 2025.

- This change could alter Ingenia’s shareholder structure and may influence both investor sentiment and future corporate decisions.

- We'll examine how Macquarie’s exit as a substantial holder could shift Ingenia Communities Group’s outlook and investment appeal.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ingenia Communities Group Investment Narrative Recap

To be a shareholder in Ingenia Communities Group, you need confidence in Australia’s underlying demographic tailwinds and Ingenia’s ability to meet growing demand for seniors’ affordable living. Macquarie Group’s recent exit as a substantial holder may cause minor changes in the shareholder structure but is unlikely to materially impact short-term catalysts like accelerating settlement volumes; the chief risk remains ongoing regulatory and cost pressures that threaten net margin growth. Of recent Ingenia announcements, the August 2025 earnings report stands out, the company posted robust growth in revenue and net income, reinforcing management’s focus on recurring rental income and scaling existing communities. These core growth drivers are crucial to weathering near-term cost and policy risks that may limit Ingenia’s ability to raise rents and sustain earnings momentum. By contrast, potential caps on rental growth in key markets could pose earnings headwinds that investors should be aware of...

Read the full narrative on Ingenia Communities Group (it's free!)

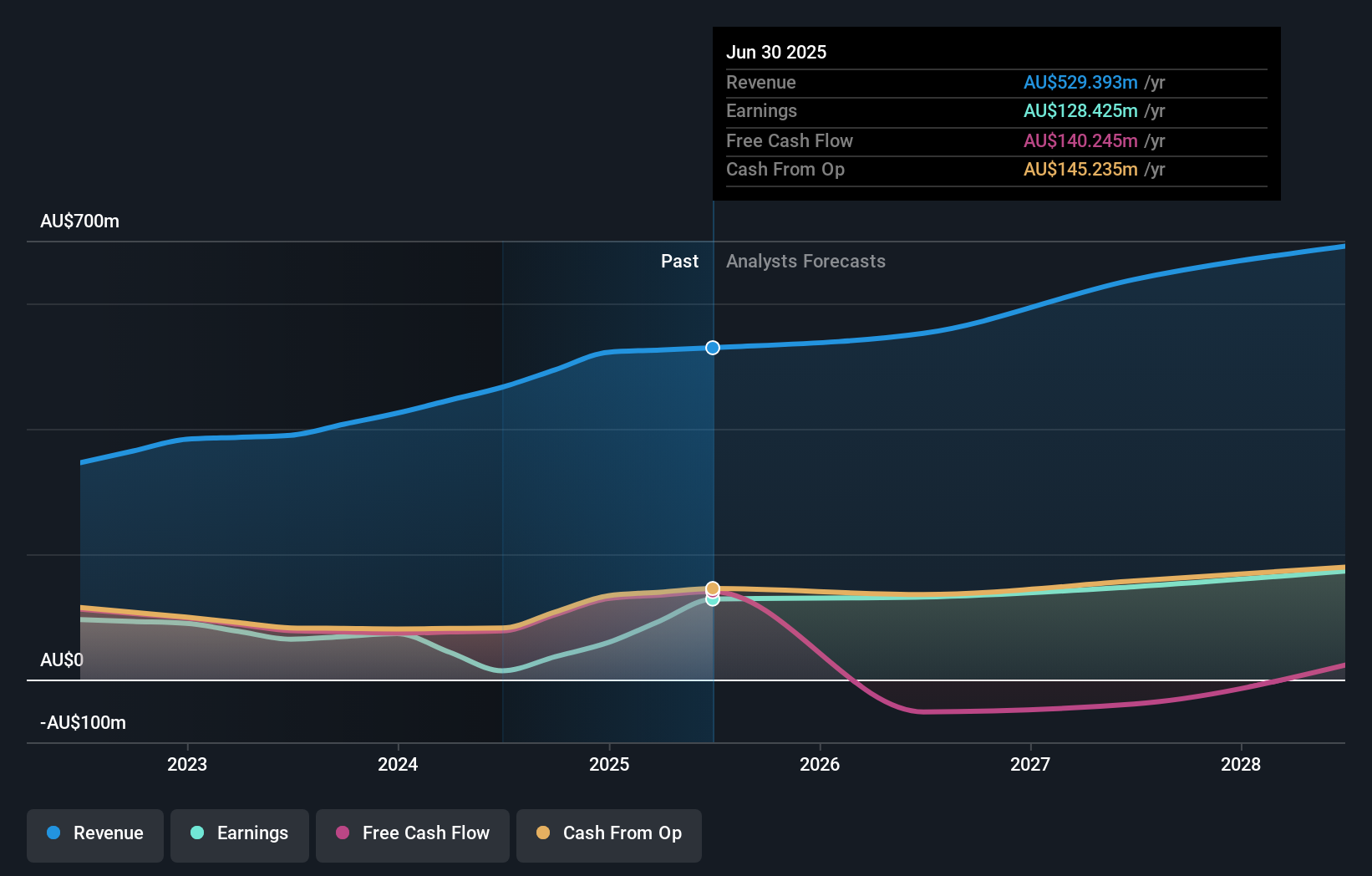

Ingenia Communities Group's outlook anticipates A$692.3 million in revenue and A$172.4 million in earnings by 2028. This is based on projected annual revenue growth of 9.4% and an earnings increase of A$44 million from current earnings of A$128.4 million.

Uncover how Ingenia Communities Group's forecasts yield a A$6.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Individual fair value estimates from the Simply Wall St Community span from A$6.25 to A$11.10, highlighting contrasting expectations across just two investor perspectives. Regulatory and cost risks continue to frame wider debates over Ingenia’s future earnings growth.

Explore 2 other fair value estimates on Ingenia Communities Group - why the stock might be worth over 2x more than the current price!

Build Your Own Ingenia Communities Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingenia Communities Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingenia Communities Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingenia Communities Group's overall financial health at a glance.

No Opportunity In Ingenia Communities Group?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:INA

Ingenia Communities Group

Ingenia Communities Group (ASX: INA) is a leading operator, owner and developer of communities offering quality affordable rental and holiday accommodation focussed on the growing seniors’ market in Australia.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives