This article will reflect on the compensation paid to Greg Goodman who has served as CEO of Goodman Group (ASX:GMG) since 1998. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Goodman Group.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

Check out our latest analysis for Goodman Group

How Does Total Compensation For Greg Goodman Compare With Other Companies In The Industry?

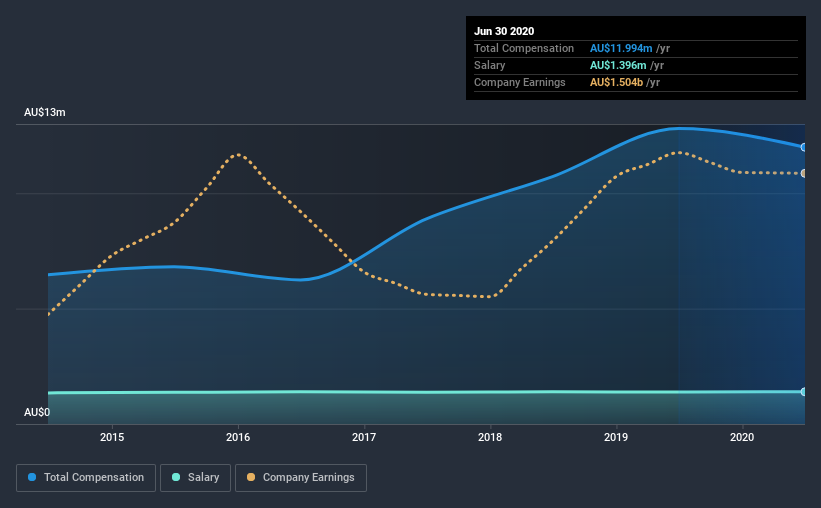

At the time of writing, our data shows that Goodman Group has a market capitalization of AU$34b, and reported total annual CEO compensation of AU$12m for the year to June 2020. We note that's a small decrease of 6.3% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$1.4m.

In comparison with other companies in the industry with market capitalizations over AU$11b , the reported median total CEO compensation was AU$9.4m. So it looks like Goodman Group compensates Greg Goodman in line with the median for the industry. Moreover, Greg Goodman also holds AU$727m worth of Goodman Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$1.4m | AU$1.4m | 12% |

| Other | AU$11m | AU$11m | 88% |

| Total Compensation | AU$12m | AU$13m | 100% |

Talking in terms of the industry, salary represented approximately 51% of total compensation out of all the companies we analyzed, while other remuneration made up 49% of the pie. Goodman Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Goodman Group's Growth Numbers

Goodman Group's earnings per share (EPS) grew 24% per year over the last three years. In the last year, its revenue is down 11%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Goodman Group Been A Good Investment?

Boasting a total shareholder return of 131% over three years, Goodman Group has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we noted earlier, Goodman Group pays its CEO in line with similar-sized companies belonging to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. So one could argue that CEO compensation is quite modest, if you consider company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Goodman Group that investors should think about before committing capital to this stock.

Important note: Goodman Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Goodman Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:GMG

Goodman Group

A global industrial property and digital infrastructure specialist group with operations in key consumer markets across Australia, New Zealand, Asia, Europe, the United Kingdom, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives