- Australia

- /

- Retail REITs

- /

- ASX:CQR

ASX Undervalued Small Caps With Insider Buying In Australia

Reviewed by Simply Wall St

The Australian market has experienced a downturn recently, with consumer discretionary stocks taking a significant hit and broader sentiment impacted by external factors such as U.S. trade policies. In this challenging environment, identifying small-cap stocks that have potential for growth often involves looking at companies where insiders are buying shares, suggesting confidence in their future prospects despite current market volatility.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Amotiv | 17.1x | 1.4x | 48.47% | ★★★★★★ |

| Abacus Storage King | 7.8x | 7.0x | 21.38% | ★★★★★☆ |

| Autosports Group | 9.8x | 0.1x | 31.61% | ★★★★★☆ |

| Abacus Group | NA | 4.6x | 25.47% | ★★★★★☆ |

| Collins Foods | 18.9x | 0.6x | 0.90% | ★★★★☆☆ |

| Schaffer | 9.5x | 1.3x | 29.05% | ★★★★☆☆ |

| Dicker Data | 19.4x | 0.7x | -68.16% | ★★★☆☆☆ |

| Iluka Resources | 8.1x | 1.6x | -44.05% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 5.1x | 19.28% | ★★★☆☆☆ |

| Tabcorp Holdings | NA | 0.6x | -36.35% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

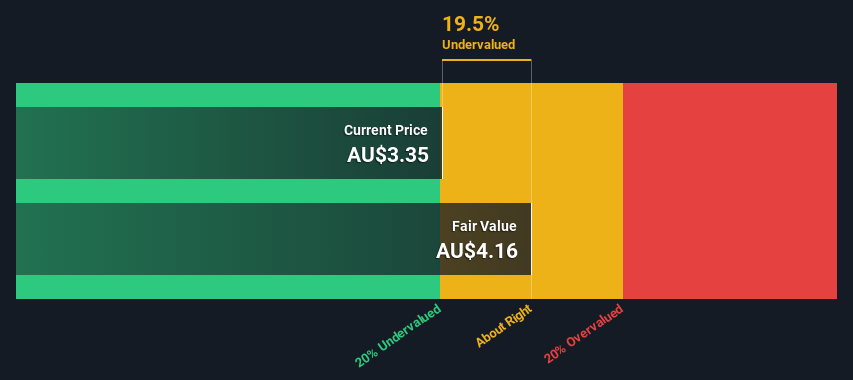

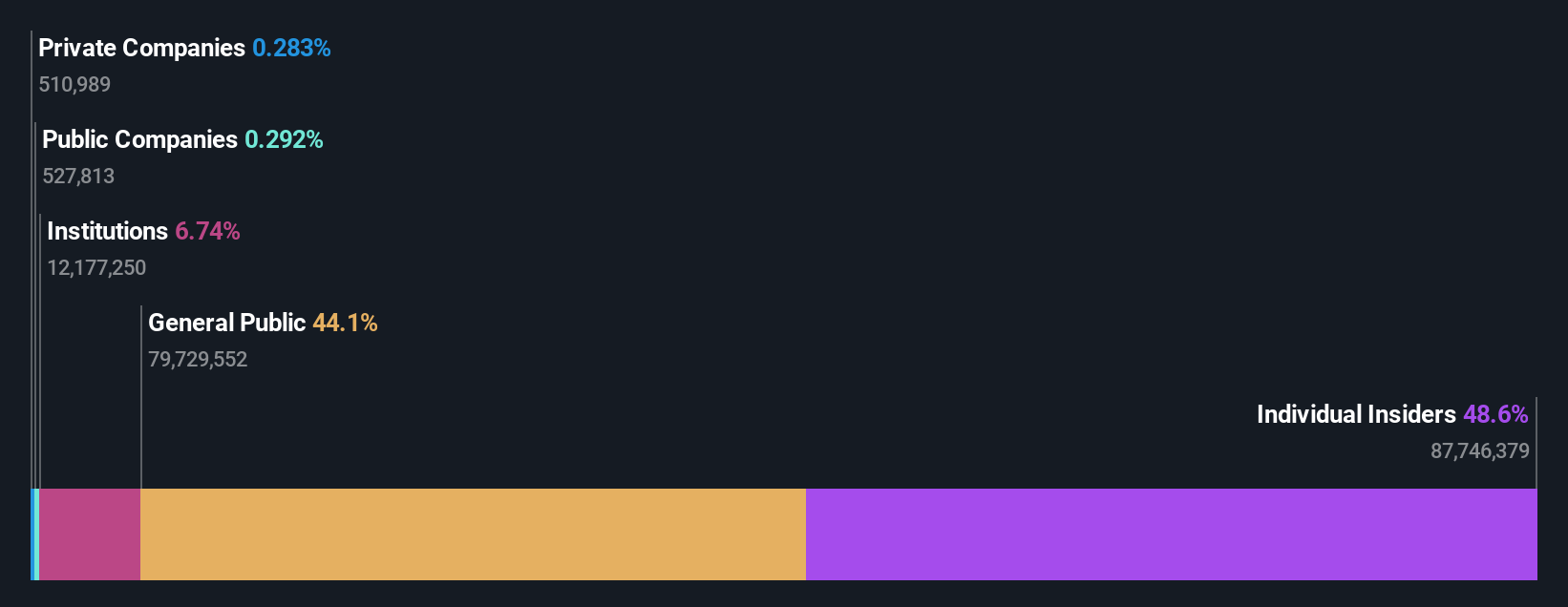

Charter Hall Retail REIT (ASX:CQR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Charter Hall Retail REIT is an Australian real estate investment trust specializing in convenience-based retail properties, with a market capitalization of A$2.37 billion.

Operations: The primary revenue streams are from Convenience Shopping Centre Retail and Convenience Net Lease Retail, contributing A$223.6 million and A$52 million, respectively. Over recent periods, the net income margin showed significant fluctuations, peaking at 1.33% in June 2022 before declining to -0.58% in December 2023 and then recovering to 0.57% by December 2024. Operating expenses have remained relatively low compared to gross profit, with a notable increase in non-operating expenses impacting net income significantly during some periods.

PE: 11.8x

Charter Hall Retail REIT, a smaller player in the Australian market, recently reaffirmed its earnings and distribution guidance for fiscal year 2025, projecting operating earnings of A$0.254 per unit. Despite a drop in sales to A$95.5 million for the half-year ending December 31, 2024, revenue rose to A$193 million from A$149.5 million the previous year. The company reported net income of A$108.6 million compared to a loss previously recorded, showcasing improved financial health amidst high-risk external funding sources and insider confidence through share purchases last quarter signals potential growth prospects ahead.

- Unlock comprehensive insights into our analysis of Charter Hall Retail REIT stock in this valuation report.

Learn about Charter Hall Retail REIT's historical performance.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor specializing in computer peripherals with a market capitalization of A$2.35 billion.

Operations: The company's revenue primarily comes from wholesale computer peripherals, with recent figures showing A$2.24 billion in revenue. The gross profit margin has shown an upward trend, reaching 14.54% as of the latest period. Operating expenses have consistently risen alongside revenue growth, reflecting investment in business operations and infrastructure.

PE: 19.4x

Dicker Data, a key player in Australia's tech distribution sector, stands out for its steady financial footing despite relying entirely on external borrowing. With earnings projected to rise by 9.72% annually, the company demonstrates potential for growth. Insider confidence is evident with recent share purchases over the past year, signaling management's faith in future prospects. A dividend of A$0.11 per share was declared for Q4 2024, reinforcing its commitment to shareholder returns amidst ongoing market challenges.

- Dive into the specifics of Dicker Data here with our thorough valuation report.

Gain insights into Dicker Data's historical performance by reviewing our past performance report.

Iluka Resources (ASX:ILU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Iluka Resources is a company engaged in the exploration, project development, operation, and marketing of mineral sands with a market capitalization of approximately A$4.92 billion.

Operations: Revenue primarily stems from Mineral Sands, with a recent gross profit margin of 56.64%. Cost of goods sold (COGS) is a significant expense, impacting overall profitability. Operating expenses include notable allocations to depreciation and amortization, sales and marketing, and general administrative costs. Net income margin has shown fluctuations over the periods analyzed.

PE: 8.1x

Iluka Resources, a small player in the Australian market, recently reported annual sales of A$1.17 billion and net income of A$231.3 million for 2024, reflecting a decline from the previous year. Despite this, insider confidence is evident with recent share purchases indicating potential value recognition within the company. The announcement of a fully franked dividend and positive government funding discussions for their Eneabba rare earths refinery could bolster future growth prospects amidst leadership changes following Rob Cole's retirement as Chair.

- Click to explore a detailed breakdown of our findings in Iluka Resources' valuation report.

Gain insights into Iluka Resources' past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our Undervalued ASX Small Caps With Insider Buying screener has unearthed 13 more companies for you to explore.Click here to unveil our expertly curated list of 16 Undervalued ASX Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CQR

Charter Hall Retail REIT

Charter Hall Retail REIT is the leading owner of property for convenience retailers.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives