- Australia

- /

- Industrial REITs

- /

- ASX:CIP

How Investors May Respond To Centuria Industrial REIT (ASX:CIP) Launching a A$60 Million Buyback Program

Reviewed by Simply Wall St

- On August 6, 2025, Centuria Industrial REIT (ASX:CIP) announced a share repurchase program to buy back up to A$60 million of its ordinary units, funded by existing cash and debt resources, and scheduled to run through August 5, 2026.

- This move indicates the company's management is committed to returning capital to investors, signaling confidence in the intrinsic value of its assets even amid broader sector headwinds.

- We will now examine how the buyback program might influence Centuria Industrial REIT's investment narrative and future capital management considerations.

Find companies with promising cash flow potential yet trading below their fair value.

Centuria Industrial REIT Investment Narrative Recap

Centuria Industrial REIT’s appeal rests on belief in the resilience of supply-demand dynamics in Australian urban industrial real estate and the company’s ability to capture rent growth through leasing expiry and asset management. The A$60 million share buyback, while reinforcing management’s confidence and likely supporting near-term investor sentiment, does not materially impact the immediate catalyst: whether the REIT can realize significant rent reversion as lease rollovers accelerate. The greatest risk persists around slowing rental growth and rising incentives on lease renewals, given sector trends.

Of recent announcements, Centuria’s August 2025 guidance for FY 2026 distributions, forecast at 16.8 cents per unit, a 3 percent increase on the prior year, is most directly relevant to the buyback, as both emphasize management’s ongoing commitment to investor returns. The success of this approach hinges on sustainable earnings growth from under-rented assets and the realization of embedded rent reversion rather than relying solely on capital initiatives.

But it’s worth remembering in contrast to management’s recent buyback, investors should be aware that risks from decelerating market rental growth and higher incentives could...

Read the full narrative on Centuria Industrial REIT (it's free!)

Centuria Industrial REIT is projected to deliver A$225.8 million in revenue and A$122.9 million in earnings by 2028. This outlook assumes a revenue decline of 1.8% per year and a decrease in earnings of A$10.2 million from the current A$133.1 million.

Uncover how Centuria Industrial REIT's forecasts yield a A$3.62 fair value, a 7% upside to its current price.

Exploring Other Perspectives

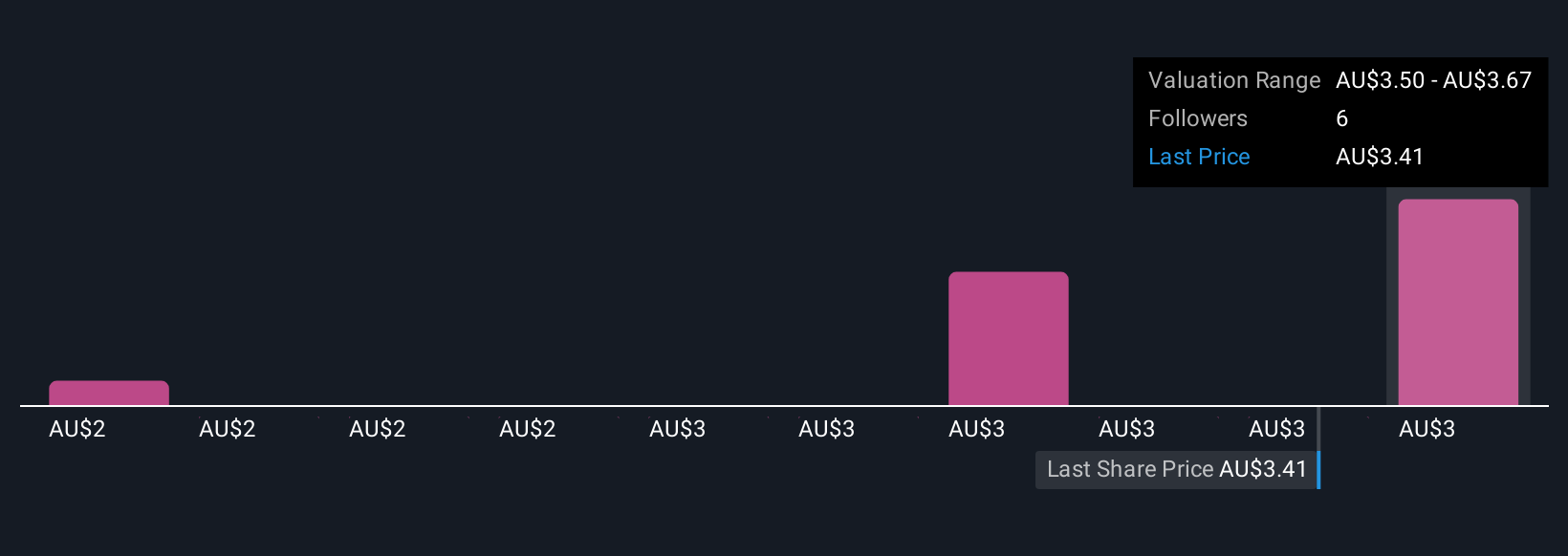

Simply Wall St Community members estimated Centuria’s fair value from A$1.93 to A$3.62 across 3 different analyses. With rental growth rates showing some signs of softening, these broad viewpoints highlight how much future returns may hinge on the pace of lease repricing and market conditions.

Explore 3 other fair value estimates on Centuria Industrial REIT - why the stock might be worth as much as 7% more than the current price!

Build Your Own Centuria Industrial REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuria Industrial REIT research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Centuria Industrial REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuria Industrial REIT's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CIP

Centuria Industrial REIT

CIP is Australia’s largest domestic pure play industrial REIT and is included in the S&P/ASX 200 Index.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives