News Flash: Analysts Just Made A Sizeable Upgrade To Their Charter Hall Group (ASX:CHC) Forecasts

Shareholders in Charter Hall Group (ASX:CHC) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

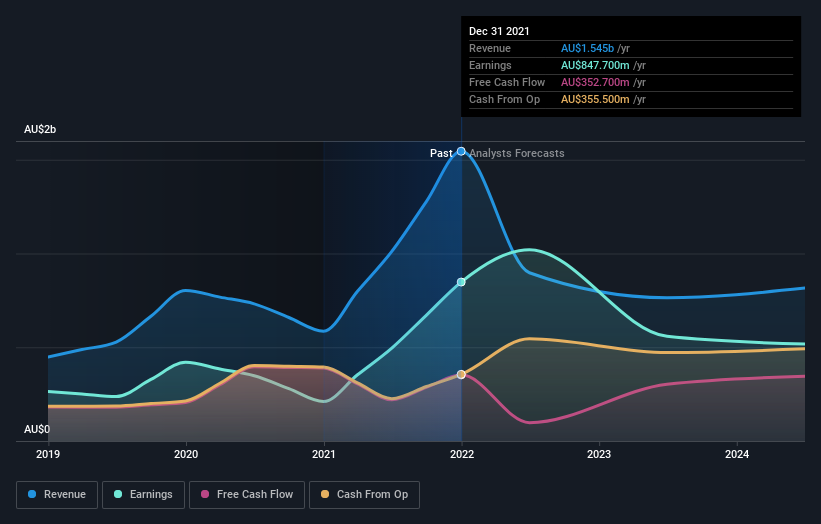

After the upgrade, the consensus from Charter Hall Group's nine analysts is for revenues of AU$897m in 2022, which would reflect a painful 42% decline in sales compared to the last year of performance. Statutory earnings per share are supposed to crater 27% to AU$1.31 in the same period. Prior to this update, the analysts had been forecasting revenues of AU$805m and earnings per share (EPS) of AU$1.20 in 2022. The forecasts seem more optimistic now, with a nice gain to revenue and a slight bump in earnings per share estimates.

See our latest analysis for Charter Hall Group

Despite these upgrades, the analysts have not made any major changes to their price target of AU$20.41, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Charter Hall Group at AU$24.50 per share, while the most bearish prices it at AU$14.00. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Charter Hall Group's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 66% by the end of 2022. This indicates a significant reduction from annual growth of 26% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.0% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Charter Hall Group is expected to lag the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Charter Hall Group.

Using these estimates as a starting point, we've run a discounted cash flow calculation (DCF) on Charter Hall Group that suggests the company could be somewhat undervalued. For more information, you can click through to our platform to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CHC

Charter Hall Group

Charter Hall is one of Australia’s leading fully integrated property investment and funds management groups.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives