Here's Why I Think Charter Hall Group (ASX:CHC) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Charter Hall Group (ASX:CHC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Charter Hall Group

How Quickly Is Charter Hall Group Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Charter Hall Group has managed to grow EPS by 24% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

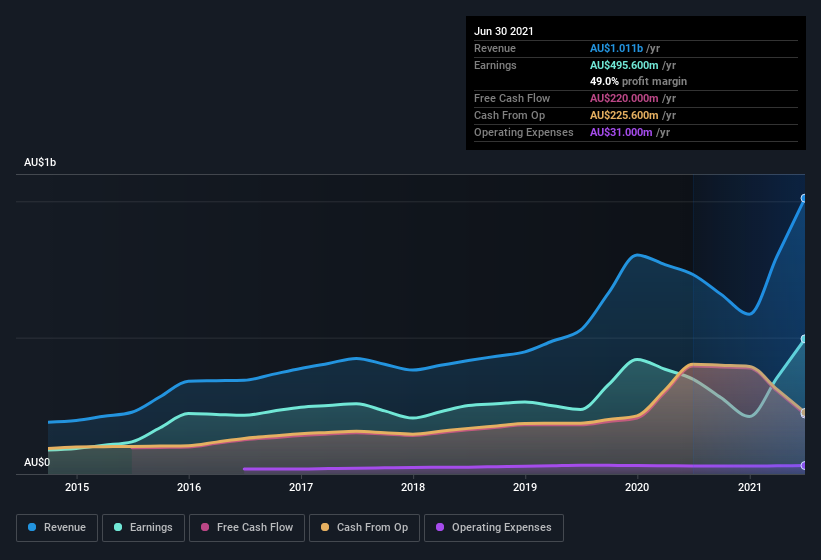

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Charter Hall Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Charter Hall Group shareholders can take confidence from the fact that EBIT margins are up from 62% to 81%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Charter Hall Group's future profits.

Are Charter Hall Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Charter Hall Group insiders did net -AU$449k selling stock over the last year, they invested AU$889k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by MD, Group CEO & Director David Harrison for AU$863k worth of shares, at about AU$12.33 per share.

The good news, alongside the insider buying, for Charter Hall Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$34m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Charter Hall Group Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Charter Hall Group's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for Charter Hall Group (1 is concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Charter Hall Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Charter Hall Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CHC

Charter Hall Group

Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives