ASX Stocks Possibly Trading Below Estimated Value In November 2024

Reviewed by Simply Wall St

The Australian stock market recently saw the ASX200 close up 0.45% at 8,444 points after reaching a new high during intra-day trading, despite mixed signals from Wall Street. With sectors like Health Care and Financials showing strength while Energy and Industrials lagged, investors are keenly assessing which stocks might be undervalued in this fluctuating environment. Identifying potentially undervalued stocks involves looking for companies with strong fundamentals that may not yet be fully reflected in their current share prices, especially amid varying sector performances.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$23.78 | A$43.87 | 45.8% |

| DUG Technology (ASX:DUG) | A$1.705 | A$3.37 | 49.4% |

| Atlas Arteria (ASX:ALX) | A$4.86 | A$9.51 | 48.9% |

| Charter Hall Group (ASX:CHC) | A$15.85 | A$31.20 | 49.2% |

| Gold Road Resources (ASX:GOR) | A$1.86 | A$3.58 | 48.1% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Vault Minerals (ASX:VAU) | A$0.34 | A$0.64 | 47% |

| Genesis Minerals (ASX:GMD) | A$2.52 | A$4.73 | 46.8% |

| Audinate Group (ASX:AD8) | A$8.79 | A$17.54 | 49.9% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.98 | A$3.80 | 47.9% |

Here we highlight a subset of our preferred stocks from the screener.

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform that facilitates the location of people, pets, and things across North America, Europe, the Middle East, Africa, and other international markets with a market cap of A$5.53 billion.

Operations: The company generates revenue of $342.92 million from its Software & Programming segment.

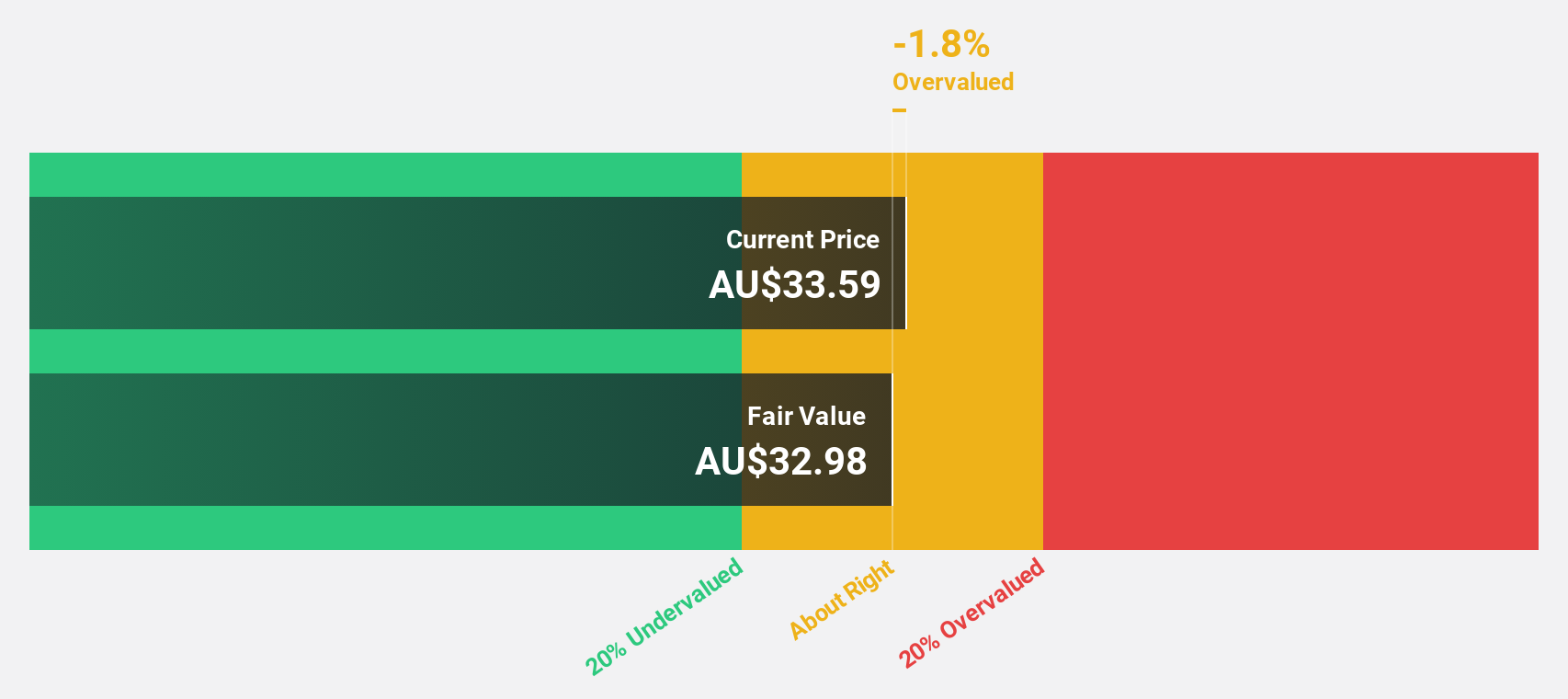

Estimated Discount To Fair Value: 15.2%

Life360's stock is trading at A$24.67, below its estimated fair value of A$29.08, suggesting potential undervaluation based on cash flows. Despite recent insider selling and shareholder dilution, the company reported a positive shift to profitability with Q3 2024 earnings showing net income of US$7.69 million compared to a loss previously. Revenue growth is expected to outpace the broader Australian market, although guidance was slightly lowered due to reduced hardware sales expectations.

- According our earnings growth report, there's an indication that Life360 might be ready to expand.

- Dive into the specifics of Life360 here with our thorough financial health report.

Charter Hall Group (ASX:CHC)

Overview: Charter Hall Group (ASX:CHC) is a leading Australian fully integrated property investment and funds management group with a market cap of A$7.52 billion.

Operations: The company's revenue is derived from three primary segments: Funds Management (A$448.60 million), Property Investments (A$322.80 million), and Development Investments (A$73.30 million).

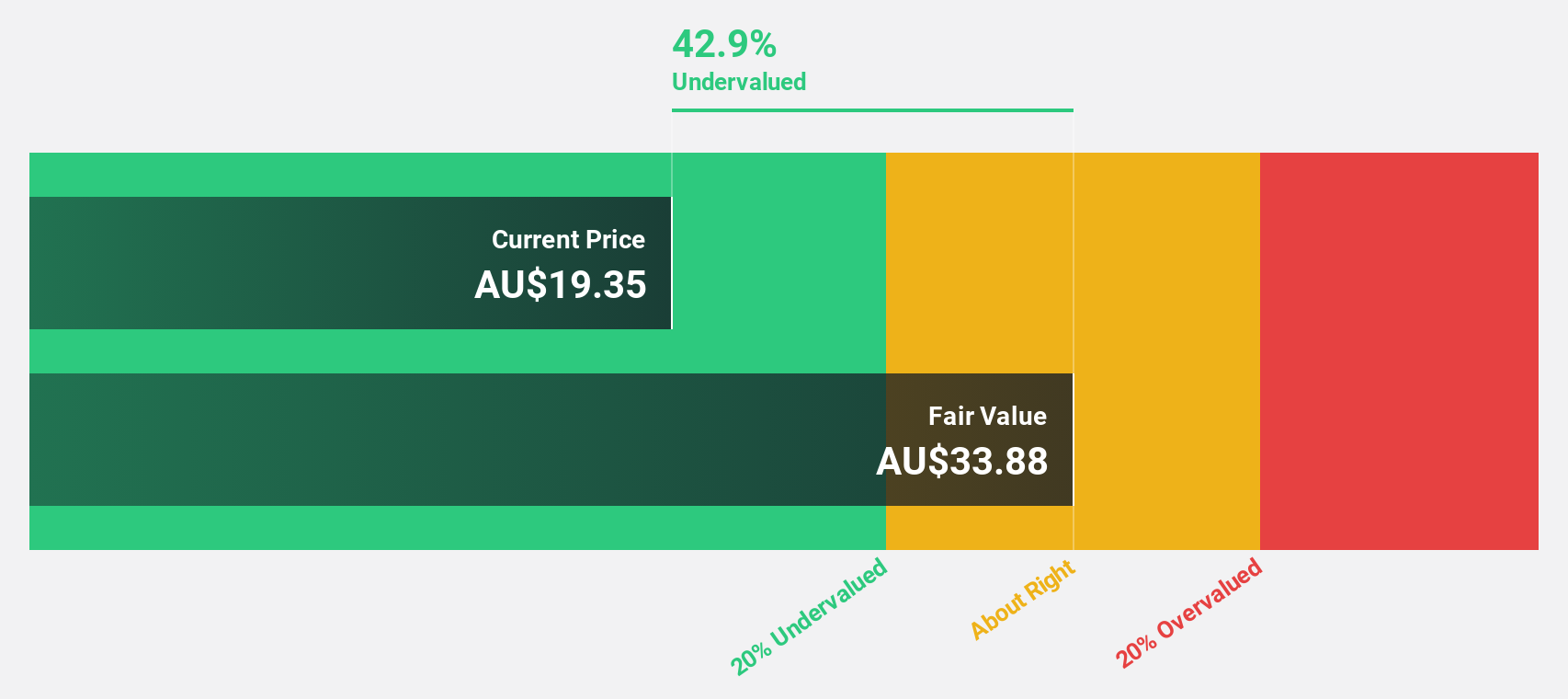

Estimated Discount To Fair Value: 49.2%

Charter Hall Group is trading at A$15.85, significantly below its estimated fair value of A$31.2, reflecting potential undervaluation based on cash flows. The company is forecast to become profitable within three years, outpacing average market growth, with earnings expected to grow 32.12% annually. Despite a low future return on equity of 13%, Charter Hall offers a reliable dividend yield of 2.9%. Recent leadership changes include the appointment of Ms. Karen Penrose as an Independent Non-Executive Director.

- The growth report we've compiled suggests that Charter Hall Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Charter Hall Group.

Viva Energy Group (ASX:VEA)

Overview: Viva Energy Group Limited is an energy company operating in Australia, Singapore, and Papua New Guinea with a market cap of A$4.23 billion.

Operations: The company generates revenue from three main segments: Convenience & Mobility (A$11.43 billion), Commercial & Industrial (A$16.97 billion), and Energy & Infrastructure (A$7.92 billion).

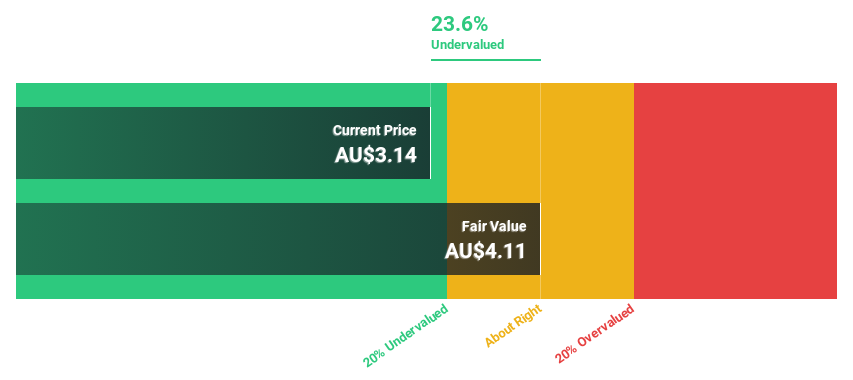

Estimated Discount To Fair Value: 13.3%

Viva Energy Group, trading at A$2.65, is undervalued relative to its estimated fair value of A$3.06. Its earnings are projected to grow significantly at 26.32% annually over the next three years, surpassing market averages despite slower revenue growth of 2.2%. However, the dividend yield of 5.06% is not well covered by earnings, and there has been significant insider selling recently. The company reported a modest sales volume increase for Q3 2024 compared to last year.

- Our earnings growth report unveils the potential for significant increases in Viva Energy Group's future results.

- Take a closer look at Viva Energy Group's balance sheet health here in our report.

Summing It All Up

- Click here to access our complete index of 39 Undervalued ASX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:360

Life360

Operates a technology platform to locate people, pets, and things in North America, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.