- Australia

- /

- Auto Components

- /

- ASX:PWH

3 ASX Stocks That Might Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As the Australian market looks to close the week with a slight uptick, attention has been drawn to the record-setting performances of U.S. indices like the S&P 500 and Nasdaq Composite, which have dominated global headlines. Amidst these developments and economic tensions between Trump and Powell, investors are keenly evaluating opportunities for undervalued stocks on the ASX that might offer potential value in this fluctuating environment. Identifying such stocks often involves assessing their intrinsic value against current market conditions, making them appealing prospects for those seeking long-term growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ridley (ASX:RIC) | A$2.95 | A$5.78 | 49% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.10 | 43.4% |

| Pantoro Gold (ASX:PNR) | A$3.23 | A$5.50 | 41.3% |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$1.16 | 38% |

| Integral Diagnostics (ASX:IDX) | A$2.52 | A$4.57 | 44.9% |

| Infomedia (ASX:IFM) | A$1.275 | A$2.07 | 38.5% |

| Fenix Resources (ASX:FEX) | A$0.29 | A$0.51 | 42.8% |

| Domino's Pizza Enterprises (ASX:DMP) | A$17.74 | A$29.29 | 39.4% |

| Collins Foods (ASX:CKF) | A$9.19 | A$15.84 | 42% |

| Charter Hall Group (ASX:CHC) | A$19.29 | A$35.43 | 45.6% |

Let's explore several standout options from the results in the screener.

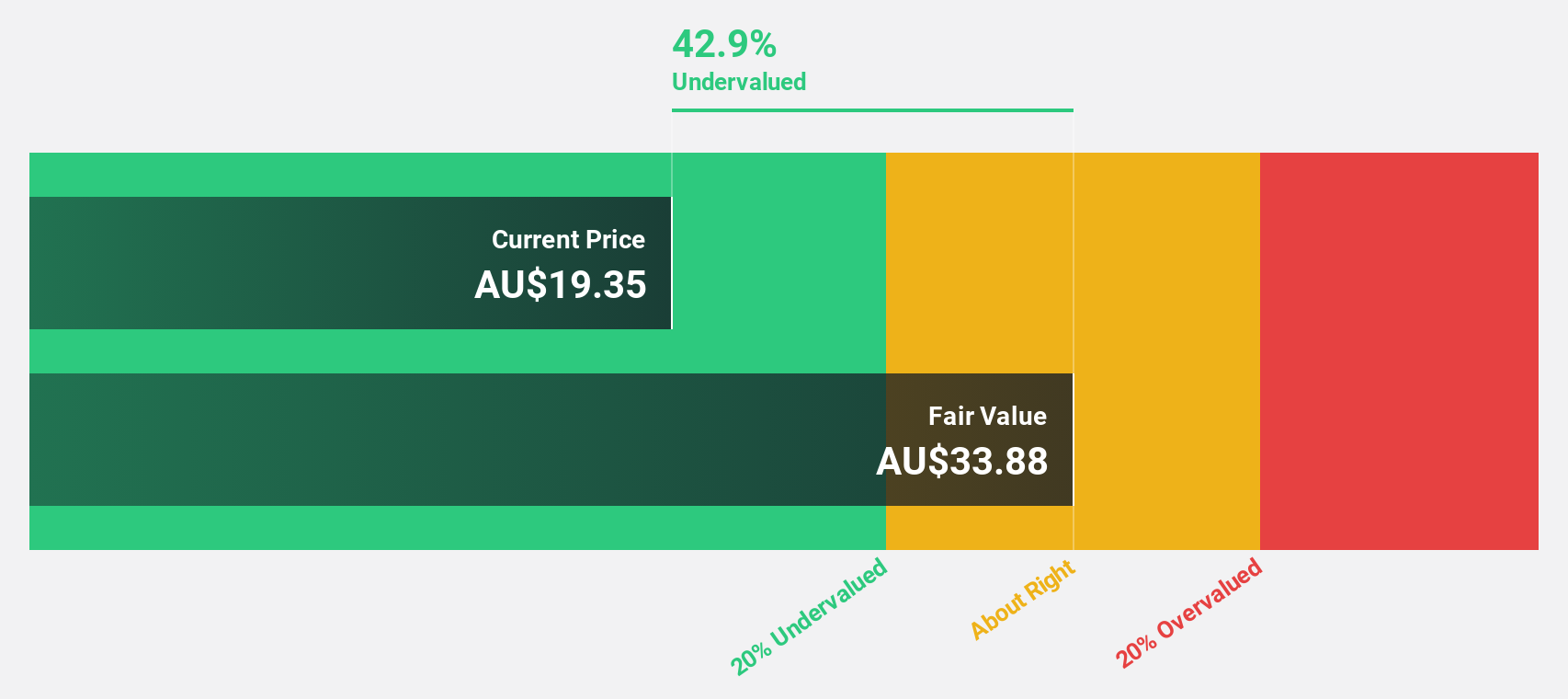

Charter Hall Group (ASX:CHC)

Overview: Charter Hall Group (ASX:CHC) is Australia's leading fully integrated diversified property investment and funds management group, with a market cap of A$9.13 billion.

Operations: The company's revenue is derived from three main segments: Funds Management (A$441.60 million), Property Investments (A$332.50 million), and Development Investments (A$45.30 million).

Estimated Discount To Fair Value: 45.6%

Charter Hall Group is trading at A$19.29, significantly below its estimated fair value of A$35.43, suggesting it may be undervalued based on cash flows. Its revenue growth forecast of 13.6% annually outpaces the Australian market's 5.3%. Although its return on equity is projected to be modest at 14.5%, earnings are expected to grow by 25.22% per year, with profitability anticipated within three years, indicating strong potential for value realization.

- According our earnings growth report, there's an indication that Charter Hall Group might be ready to expand.

- Dive into the specifics of Charter Hall Group here with our thorough financial health report.

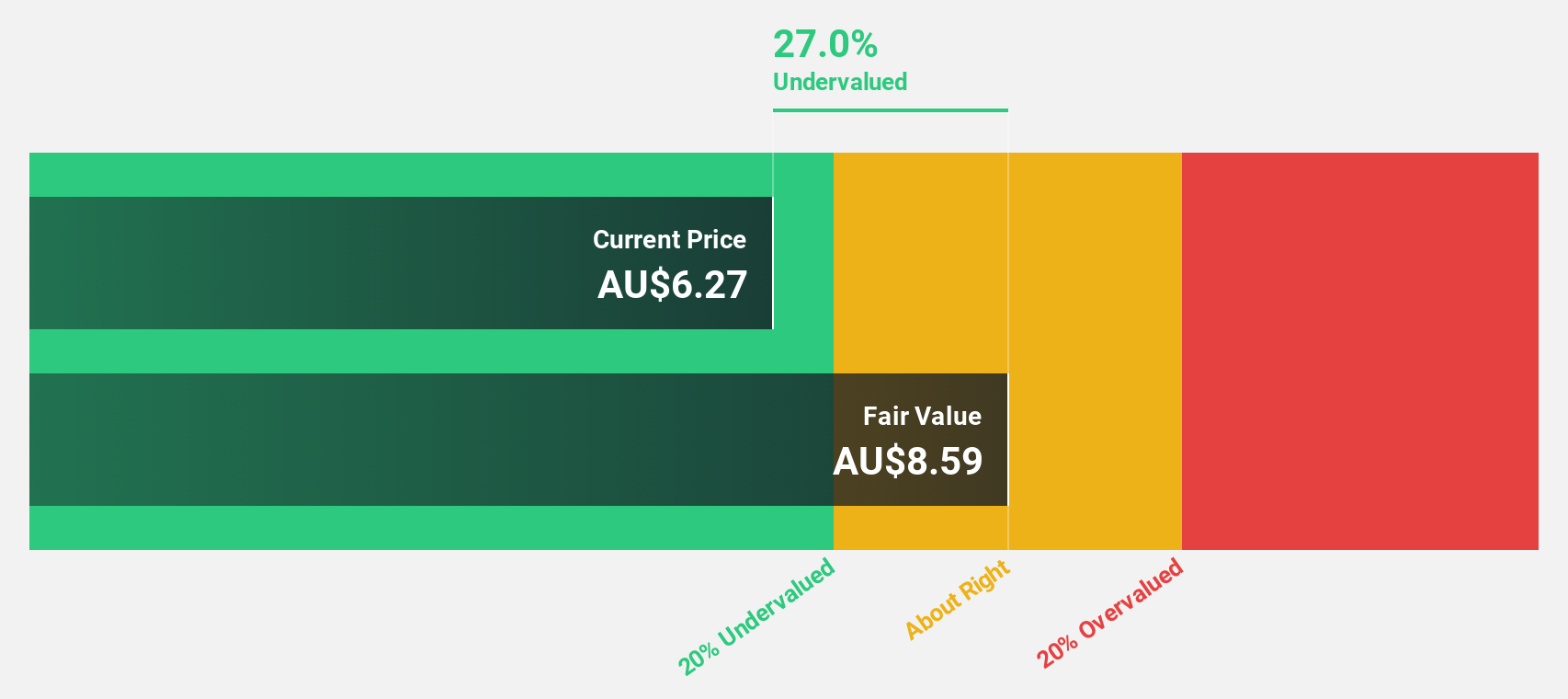

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions across various international markets with a market cap of A$727.08 million.

Operations: The company's revenue segments include PWR C&R at A$46.48 million and PWR Performance Products at A$109.04 million.

Estimated Discount To Fair Value: 29.8%

PWR Holdings, trading at A$7.23, is priced over 29% below its estimated fair value of A$10.3, reflecting potential undervaluation based on cash flows. Its revenue growth forecast of 12.6% annually surpasses the broader Australian market's rate of 5.3%. With an expected earnings growth rate of 22% per year and a projected return on equity reaching 26.4% in three years, PWR Holdings shows strong prospects for future financial performance.

- Our comprehensive growth report raises the possibility that PWR Holdings is poised for substantial financial growth.

- Get an in-depth perspective on PWR Holdings' balance sheet by reading our health report here.

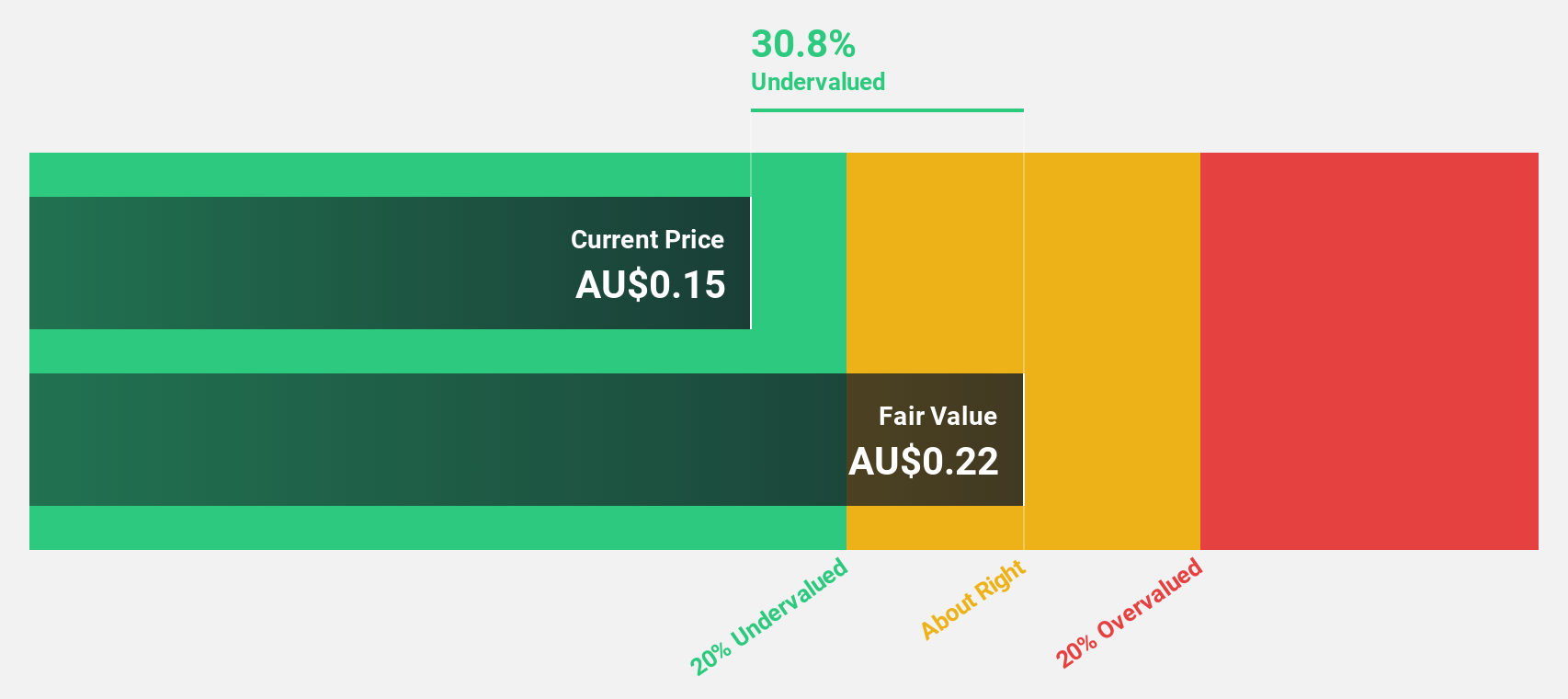

Strike Energy (ASX:STX)

Overview: Strike Energy Limited is an independent gas producer focused on exploring and developing oil and gas resources in Australia, with a market cap of A$415.70 million.

Operations: Strike Energy Limited generates its revenue primarily through the exploration and development of oil and gas resources in Australia.

Estimated Discount To Fair Value: 33.1%

Strike Energy, trading at A$0.15, is undervalued by over 30% relative to its fair value of A$0.22 based on cash flow analysis. Revenue growth is projected at 24.9% annually, significantly outpacing the Australian market's average of 5.5%. Despite a short cash runway under a year, analysts anticipate the stock price could rise by 75%, with profitability expected within three years and earnings growth forecasted at more than 52% annually.

- The growth report we've compiled suggests that Strike Energy's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Strike Energy.

Summing It All Up

- Unlock our comprehensive list of 36 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives