- Australia

- /

- Consumer Finance

- /

- ASX:FPR

Discover ASX's Undervalued Small Caps With Insider Buying For November 2024

Reviewed by Simply Wall St

As the Australian market continues to experience fluctuations, with the ASX200 recently closing up 0.28% at 8417 points after hitting a new all-time high, investors are keeping a keen eye on small-cap stocks for potential opportunities amidst broader market movements. In this dynamic environment, identifying small-cap companies that exhibit strong fundamentals and insider buying can be key to uncovering promising investment opportunities, especially as sectors like Real Estate and Health Care show robust performance.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.1x | 1.5x | 42.11% | ★★★★★★ |

| Magellan Financial Group | 8.1x | 5.1x | 30.87% | ★★★★★☆ |

| SHAPE Australia | 14.7x | 0.3x | 30.78% | ★★★★☆☆ |

| Collins Foods | 18.0x | 0.7x | 4.21% | ★★★★☆☆ |

| Dicker Data | 18.9x | 0.7x | -57.79% | ★★★★☆☆ |

| Eagers Automotive | 11.6x | 0.3x | 37.07% | ★★★★☆☆ |

| FINEOS Corporation Holdings | NA | 3.4x | 47.71% | ★★★★☆☆ |

| Coventry Group | 246.2x | 0.4x | -24.67% | ★★★☆☆☆ |

| Corporate Travel Management | 23.6x | 2.8x | 42.20% | ★★★☆☆☆ |

| Eureka Group Holdings | 18.9x | 6.1x | 25.17% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading automotive retail group in Australia, primarily engaged in car retailing with a market cap of A$3.64 billion.

Operations: Car retailing contributes the majority of revenue at A$10.50 billion, with a gross profit margin showing fluctuations from 18.60% to 18.17% in recent periods. Operating expenses, including general and administrative costs, are significant components of the cost structure, impacting net income margins which range from 3.05% to 2.47%.

PE: 11.6x

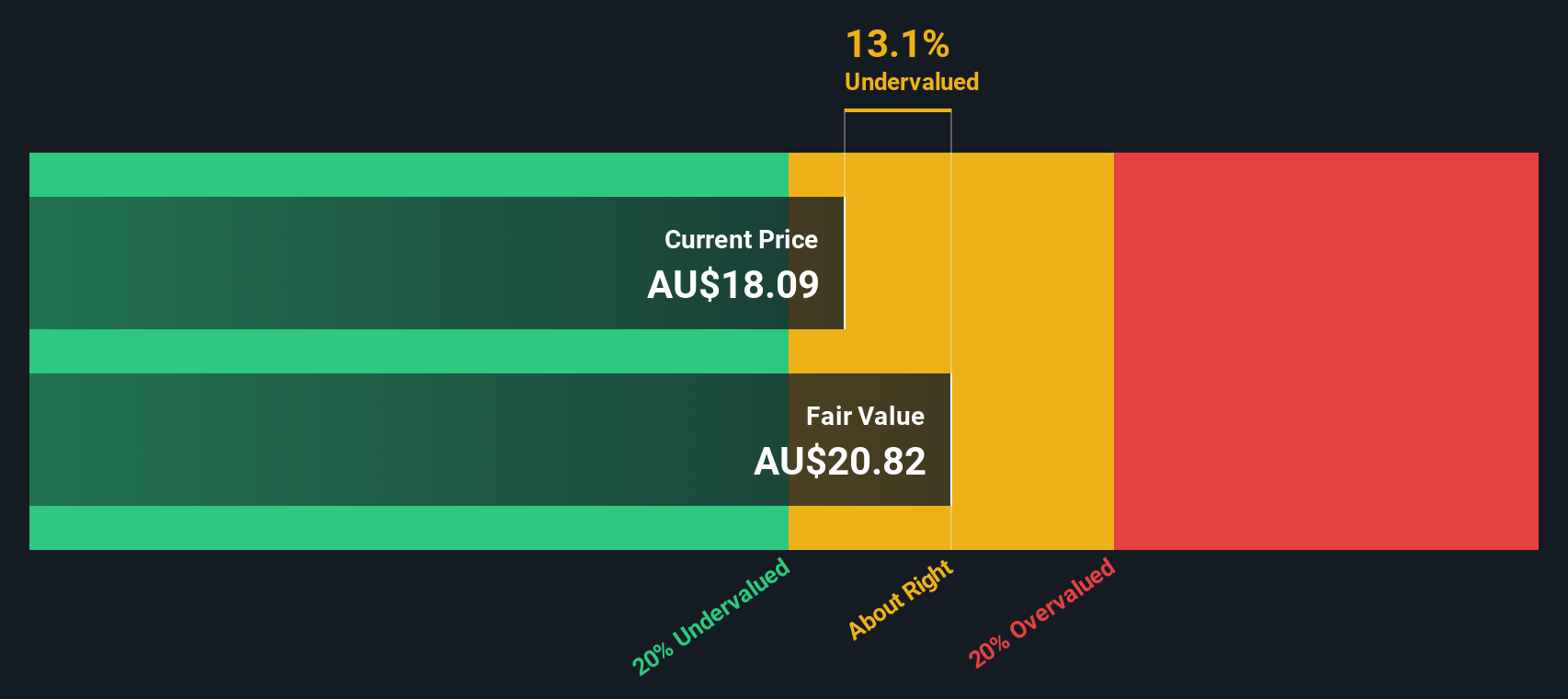

Eagers Automotive, a player in the Australian market, recently showcased its strategies at a Morgans Conference on October 17, 2024. Despite relying entirely on external borrowing for funding—considered riskier than customer deposits—the company maintains a solid financial position with debt well-covered by operating cash flow. Insider confidence is evident as Nicholas Politis purchased 200,000 shares for A$2.09 million between January and November 2024, reflecting potential value recognition within this segment.

- Get an in-depth perspective on Eagers Automotive's performance by reading our valuation report here.

Abacus Storage King (ASX:ASK)

Simply Wall St Value Rating: ★★★☆☆☆

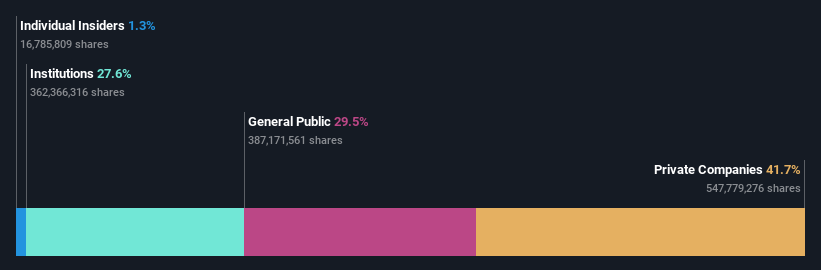

Overview: Abacus Storage King operates in the self-storage industry, focusing on rental and merchandising services, with a market capitalization of A$1.43 billion.

Operations: ASK generates revenue primarily from rental and merchandising, with the latest figure reported at A$220.48 million. The company's gross profit margin has shown an upward trend, reaching 80.99% in recent periods. Operating expenses have also increased, with general and administrative expenses being a significant component. Net income margin experienced fluctuations but recently surged to 62.67%.

PE: 11.3x

Abacus Storage King, a smaller player in the Australian market, recently saw insider confidence with share purchases made between September and October 2024. Despite forecasts of a 1.7% annual earnings decline over the next three years, revenue is expected to grow by 7.42% annually. However, their financial position shows some vulnerability due to reliance on higher-risk external borrowing without customer deposits. Recent board changes include appointing Sally Herman as an Independent Non-Executive Director and Chair of the Audit & Risk Committee, reflecting strategic shifts for future growth potential in storage solutions.

- Click here and access our complete valuation analysis report to understand the dynamics of Abacus Storage King.

Assess Abacus Storage King's past performance with our detailed historical performance reports.

FleetPartners Group (ASX:FPR)

Simply Wall St Value Rating: ★★★★★☆

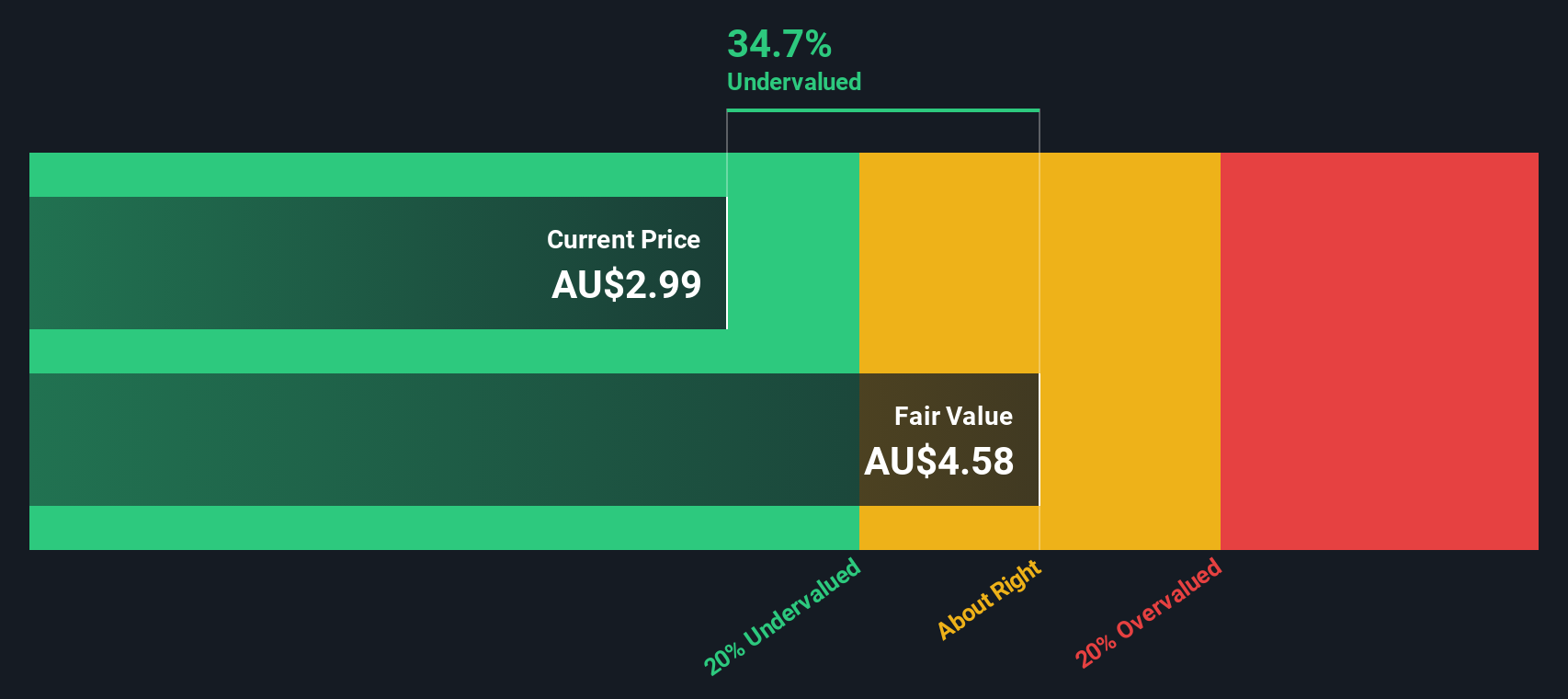

Overview: FleetPartners Group is a company that specializes in vehicle leasing and fleet management services, with a market capitalization of A$1.2 billion.

Operations: FPR generates revenue primarily from its core business operations, with a recent reported revenue of A$761.63 million. The company's cost structure includes significant costs of goods sold (COGS) and operating expenses, contributing to a gross profit margin of 29.20%. Over time, net income margins have shown variability, with the latest figure at 10.23%.

PE: 9.6x

FleetPartners Group, a small player in the Australian market, has recently reported annual sales of A$761.63 million, up from A$676.77 million last year, yet their net income slightly dipped to A$77.88 million from A$81.02 million. Despite this mixed financial performance, insider confidence is evident with recent share purchases by company leaders over the past year. However, reliance on external borrowing poses risks as earnings are projected to decline by 5.4% annually over the next three years without robust cash flow coverage for debt obligations.

Seize The Opportunity

- Navigate through the entire inventory of 25 Undervalued ASX Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FPR

FleetPartners Group

Provides fleet management services in Australia and New Zealand.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives