- Australia

- /

- Metals and Mining

- /

- ASX:GNG

Discovering 3 Hidden Gems in Australia with Promising Potential

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close slightly down by 0.1%, with materials and IT sectors showing resilience amid broader economic fluctuations. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes crucial, particularly as we explore three lesser-known companies in Australia that may offer promising opportunities for investors seeking hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services primarily to the mining and mineral processing sectors both in Australia and globally, with a market capitalization of A$385.79 million.

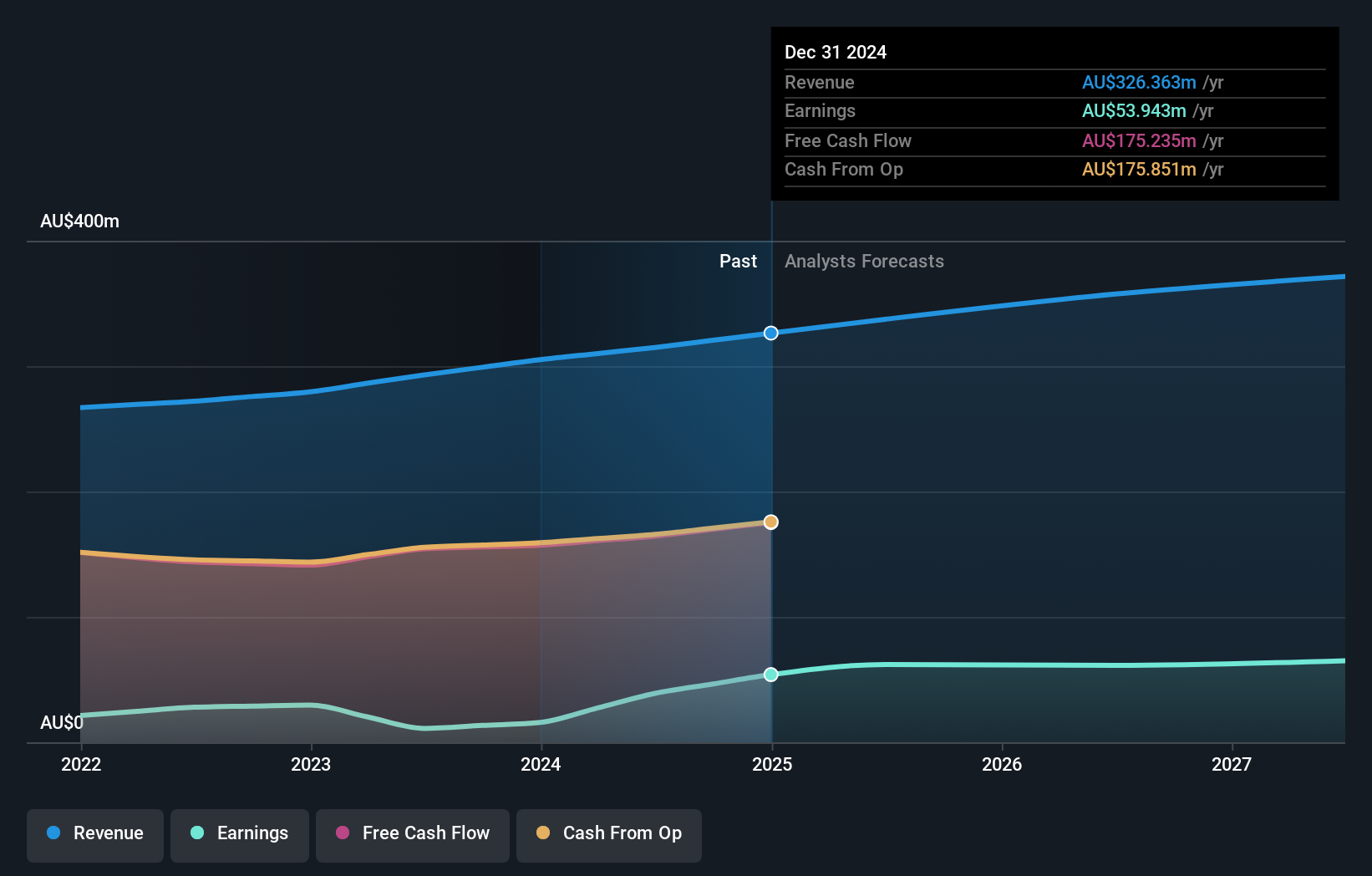

Operations: GR Engineering Services Limited generates revenue primarily from its Mineral Processing segment, contributing A$346.21 million, followed by the Oil and Gas segment at A$77.86 million.

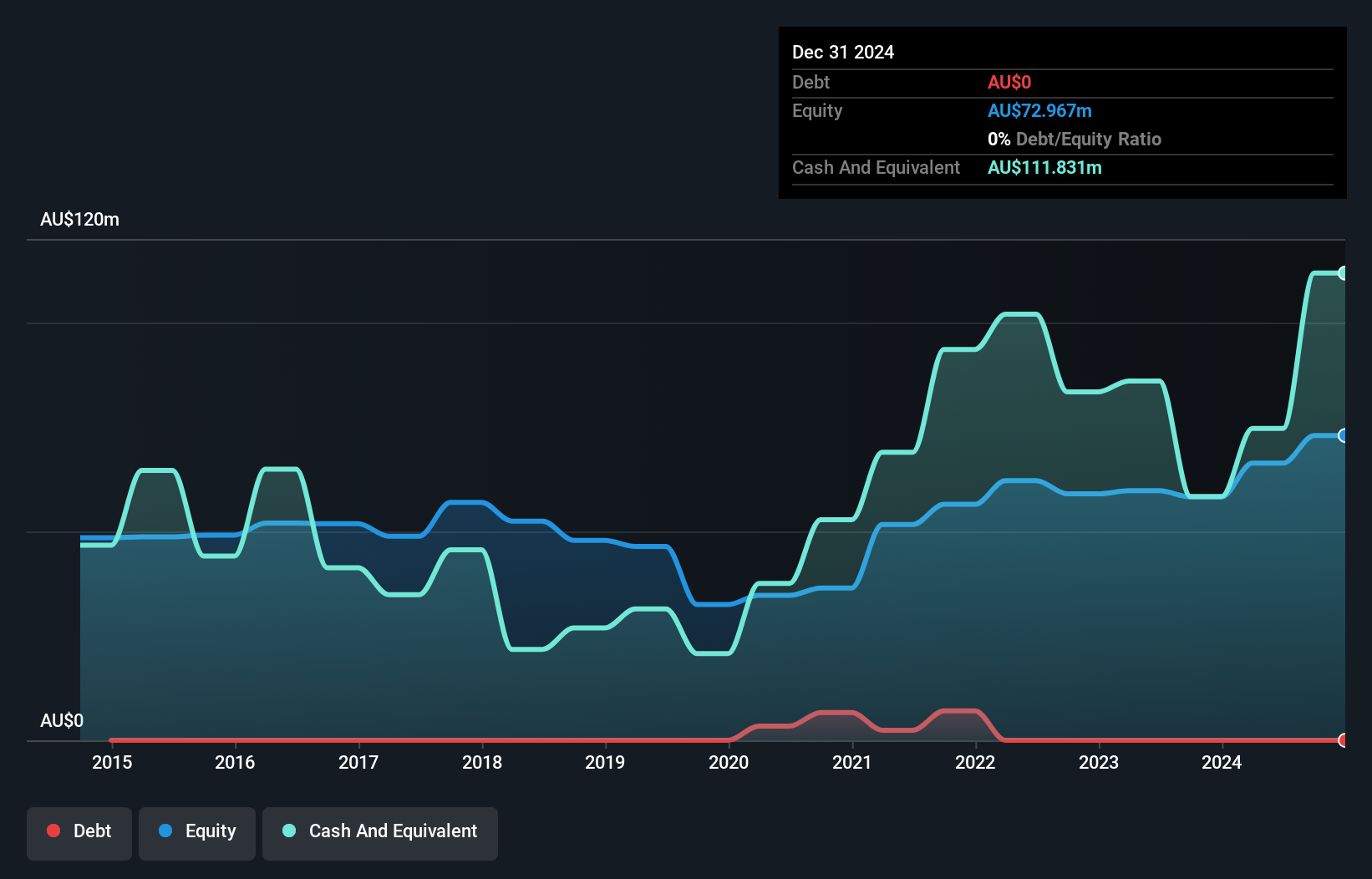

GR Engineering Services, a promising player in the Australian market, showcases notable financial health with no debt on its books over the past five years. This engineering firm has outpaced its industry peers, boasting earnings growth of 13% in the last year compared to the Metals and Mining industry's 4%. Its price-to-earnings ratio stands at 12x, underscoring good value relative to the broader Australian market's 20x. The company maintains positive free cash flow and high-quality earnings, reflecting robust operational efficiency. Recent discussions at their AGM included strategic leadership changes and financial performance reviews for future resilience.

- Click to explore a detailed breakdown of our findings in GR Engineering Services' health report.

Gain insights into GR Engineering Services' past trends and performance with our Past report.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$491.35 million.

Operations: Revenue primarily stems from real estate rental, amounting to A$314.89 million.

Servcorp, a nimble player in the serviced office industry, is making waves with its robust financial health. Its earnings have skyrocketed by 253% over the past year, far outpacing the real estate sector's 25%. This growth trajectory seems promising as earnings are projected to rise by an additional 12% annually. Trading at nearly 83% below its estimated fair value, Servcorp offers compelling relative value compared to industry peers. The company boasts high-quality earnings and operates debt-free, which likely enhances its operational flexibility and positions it well for future strategic endeavors.

- Dive into the specifics of Servcorp here with our thorough health report.

Review our historical performance report to gain insights into Servcorp's's past performance.

Symal Group (ASX:SYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering services such as construction contracting, equipment hire, material sales, recycling, and remediation, with a market capitalization of approximately A$389.67 million.

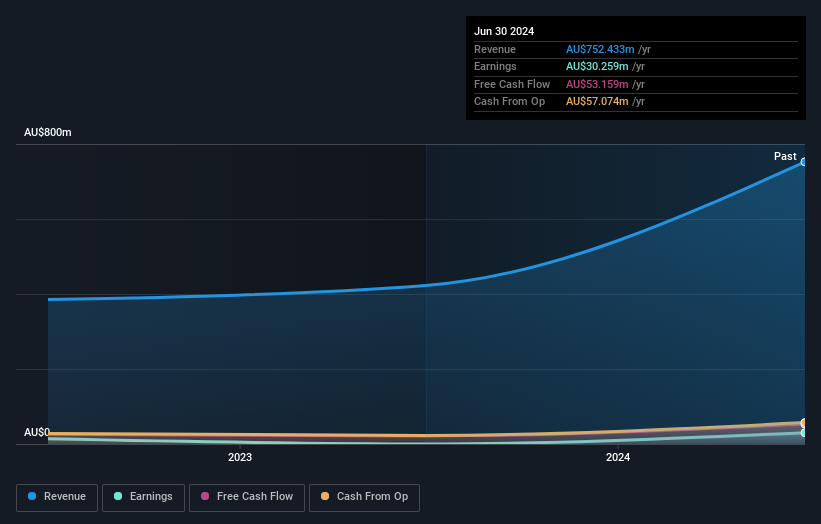

Operations: Symal Group Limited's primary revenue streams include Major Infrastructure and Construction Services, generating A$485.98 million and A$171.86 million respectively. Asset Management contributes A$88.32 million to the total revenue, while Plant, People and Logistics adds A$21.95 million. The company's financial performance is influenced by these segments with a notable focus on Major Infrastructure as the largest contributor to revenue.

Symal Group, a relatively small player in the construction industry, recently completed an IPO raising A$136 million with shares offered at A$1.85 each. The company's earnings surged by an astonishing 133,803%, far outpacing the industry average of 16.3%. Despite its high-quality earnings and profitability that ensures a solid cash runway, Symal's shares remain highly illiquid. Trading significantly below its estimated fair value by about 83.7%, this suggests potential undervaluation opportunities for investors. Recent board appointments could bring fresh perspectives to drive future growth and stability within the company’s operational framework.

- Unlock comprehensive insights into our analysis of Symal Group stock in this health report.

Gain insights into Symal Group's historical performance by reviewing our past performance report.

Make It Happen

- Gain an insight into the universe of 58 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNG

GR Engineering Services

Provides engineering, procurement, and construction services to the mining and mineral processing industries in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives