- Australia

- /

- Real Estate

- /

- ASX:CWP

Top ASX Dividend Stocks Cedar Woods Properties And Two More For Your Portfolio

Reviewed by Simply Wall St

As the ASX navigates a period of uncertainty with futures looking red amidst earnings season, the buoyant performance of Wall Street, driven by strong U.S. economic growth, offers a glimmer of optimism for Australian investors. In this context, dividend stocks such as Cedar Woods Properties present an attractive option for those seeking stability and income in their portfolios amid fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 8.08% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.21% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.58% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.26% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.81% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 6.97% | ★★★★★☆ |

| GWA Group (ASX:GWA) | 6.15% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 3.70% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 3.80% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

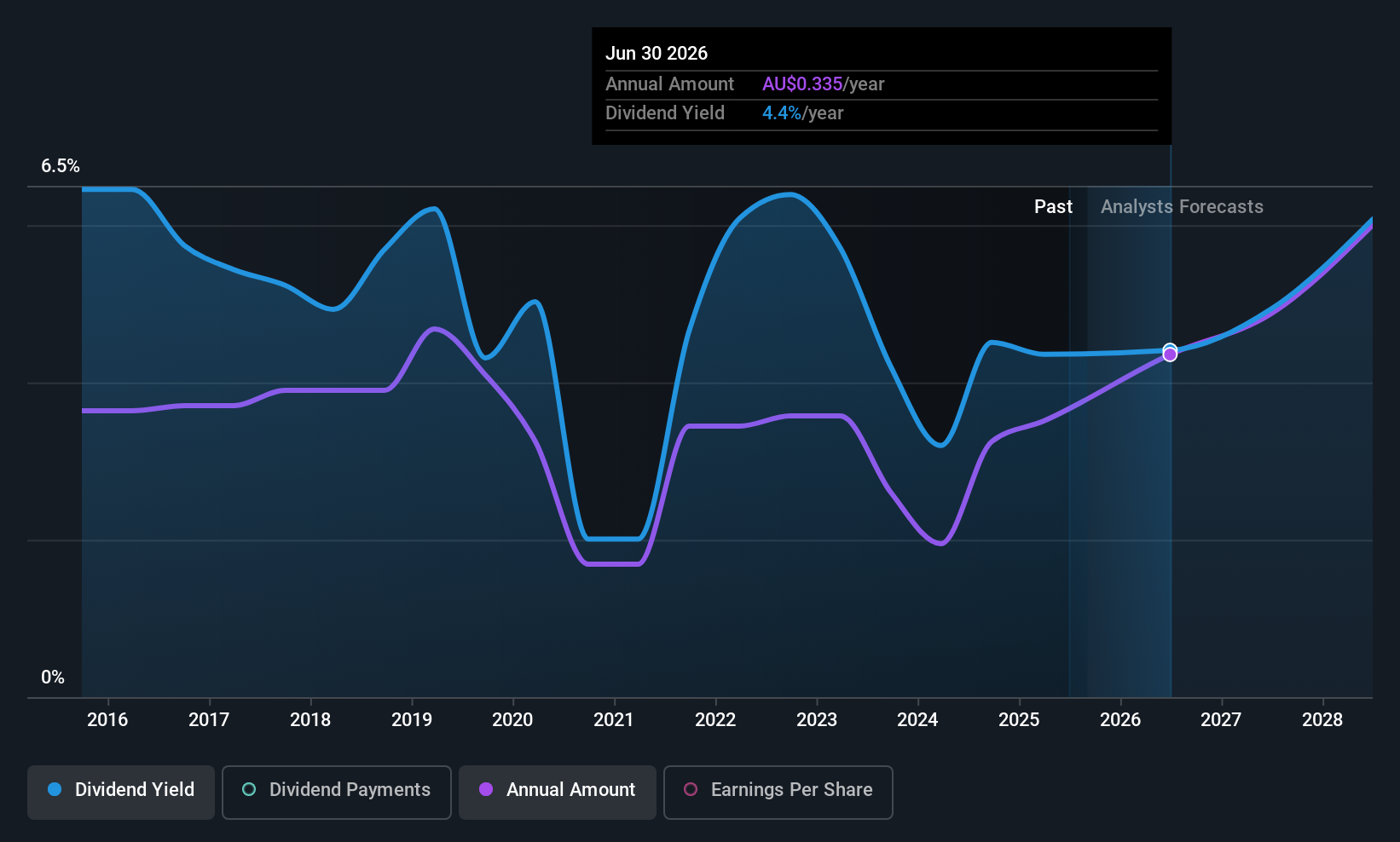

Cedar Woods Properties (ASX:CWP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company involved in property investment and development, with a market cap of A$624.61 million.

Operations: Cedar Woods Properties Limited generates revenue through its property development and investment segment, amounting to A$465.94 million.

Dividend Yield: 3.9%

Cedar Woods Properties recently declared a fully franked dividend of A$0.19 per share, reflecting its commitment to shareholder returns despite an unstable dividend history. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 49.7% and 71.4%, respectively. Recent earnings growth and strategic acquisitions in key Australian states bolster future prospects, though the current yield of 3.87% is below the top tier in the market.

- Click to explore a detailed breakdown of our findings in Cedar Woods Properties' dividend report.

- Our comprehensive valuation report raises the possibility that Cedar Woods Properties is priced lower than what may be justified by its financials.

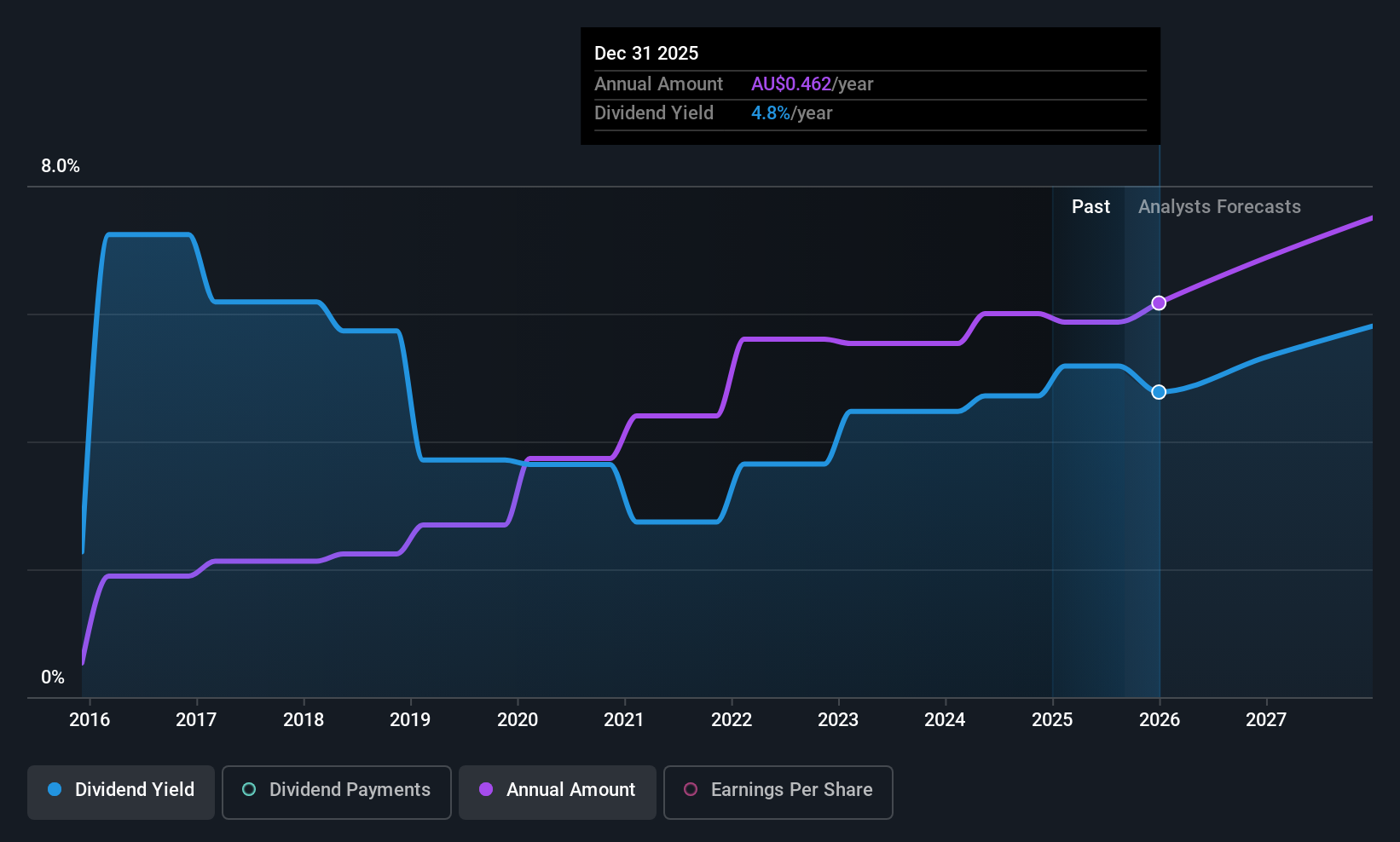

Dicker Data (ASX:DDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dicker Data Limited is a wholesale distributor of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand, with a market cap of A$1.65 billion.

Operations: Dicker Data Limited generates revenue primarily from the wholesale distribution of computer peripherals, amounting to A$2.44 billion.

Dividend Yield: 4.8%

Dicker Data's dividend payments have been reliable and stable over the past decade, with recent affirmations of A$0.11 per share for Q2 2025. Despite a high payout ratio of 96.2%, dividends are covered by cash flows but not by earnings, raising sustainability concerns. The company trades at a favorable P/E ratio of 20x compared to industry averages, yet its dividend yield of 4.82% is below top-tier Australian payers. Recent earnings growth shows improved profitability with net income reaching A$39.38 million for H1 2025.

- Unlock comprehensive insights into our analysis of Dicker Data stock in this dividend report.

- According our valuation report, there's an indication that Dicker Data's share price might be on the cheaper side.

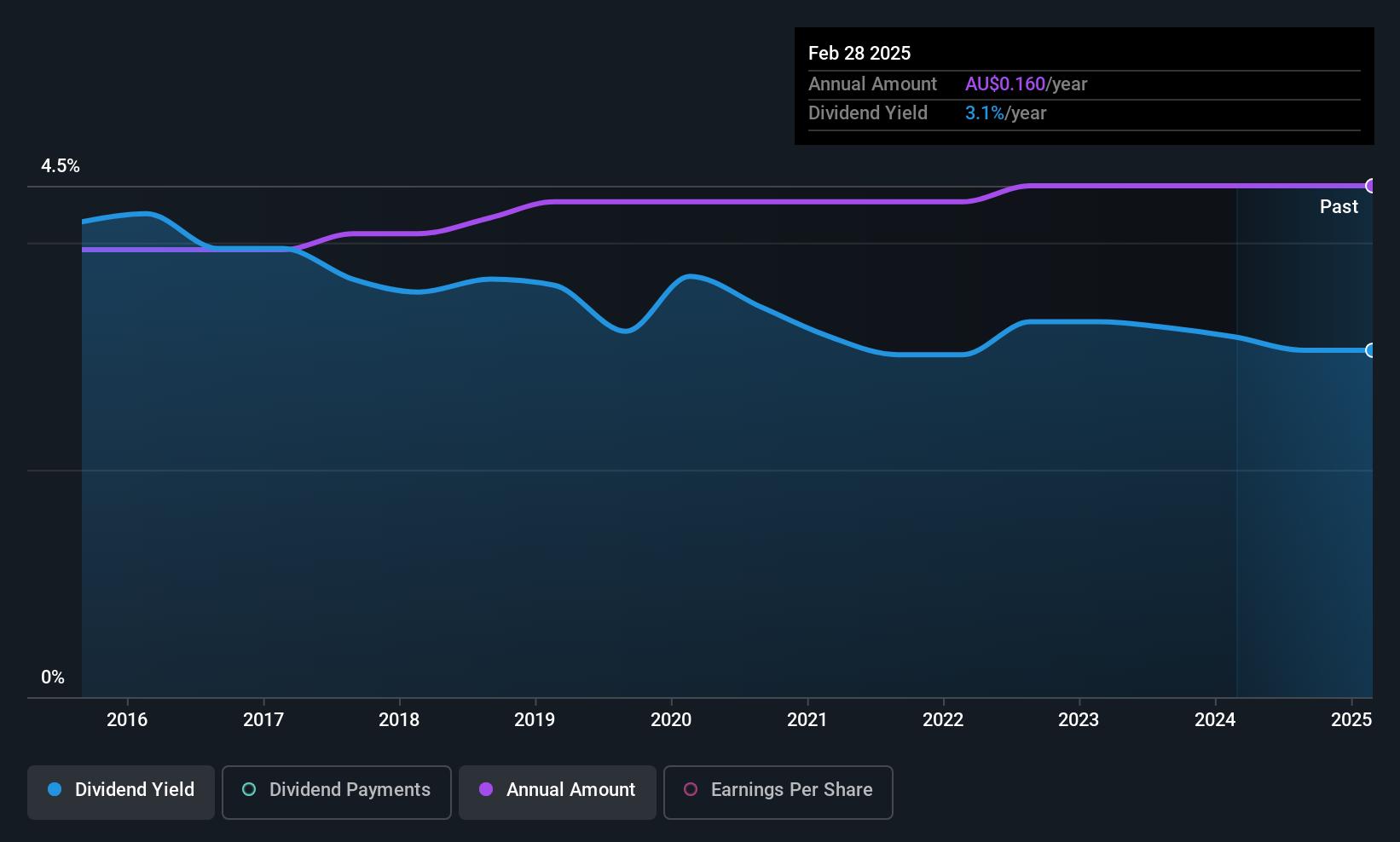

Diversified United Investment (ASX:DUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.14 billion.

Operations: Diversified United Investment Limited generates revenue primarily from its investment company segment, amounting to A$46.71 million.

Dividend Yield: 3%

Diversified United Investment's dividends have been reliable and stable over the past decade, with recent affirmations of A$0.09 per share for H1 2025. Despite a high payout ratio of 90.8%, dividends are covered by cash flows but not by earnings, raising sustainability concerns. The dividend yield of 3.01% is below top-tier Australian payers, though earnings growth has been modest at 5% annually over five years, with net income reaching A$37.99 million for FY2025.

- Take a closer look at Diversified United Investment's potential here in our dividend report.

- Our valuation report unveils the possibility Diversified United Investment's shares may be trading at a premium.

Turning Ideas Into Actions

- Access the full spectrum of 32 Top ASX Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CWP

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)