- United Kingdom

- /

- Real Estate

- /

- LSE:HWG

Exploring 3 Undervalued Small Caps With Insider Buying In Global Markets

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performance, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 showing gains despite broader market challenges. Economic uncertainty, particularly around trade policies and interest rates, continues to influence investor sentiment across various sectors. In this environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and positive insider activity that may offer potential opportunities amid volatility.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Chorus Aviation | NA | 0.4x | 20.28% | ★★★★★★ |

| Savills | 23.4x | 0.5x | 43.87% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.56% | ★★★★☆☆ |

| Italmobiliare | 10.9x | 1.4x | -256.53% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.5x | 1.6x | 49.12% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -3.28% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.2x | 3.8x | 39.38% | ★★★☆☆☆ |

| Calfrac Well Services | 34.7x | 0.2x | 26.49% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.5x | 0.4x | -3.94% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 1.6x | -139.64% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

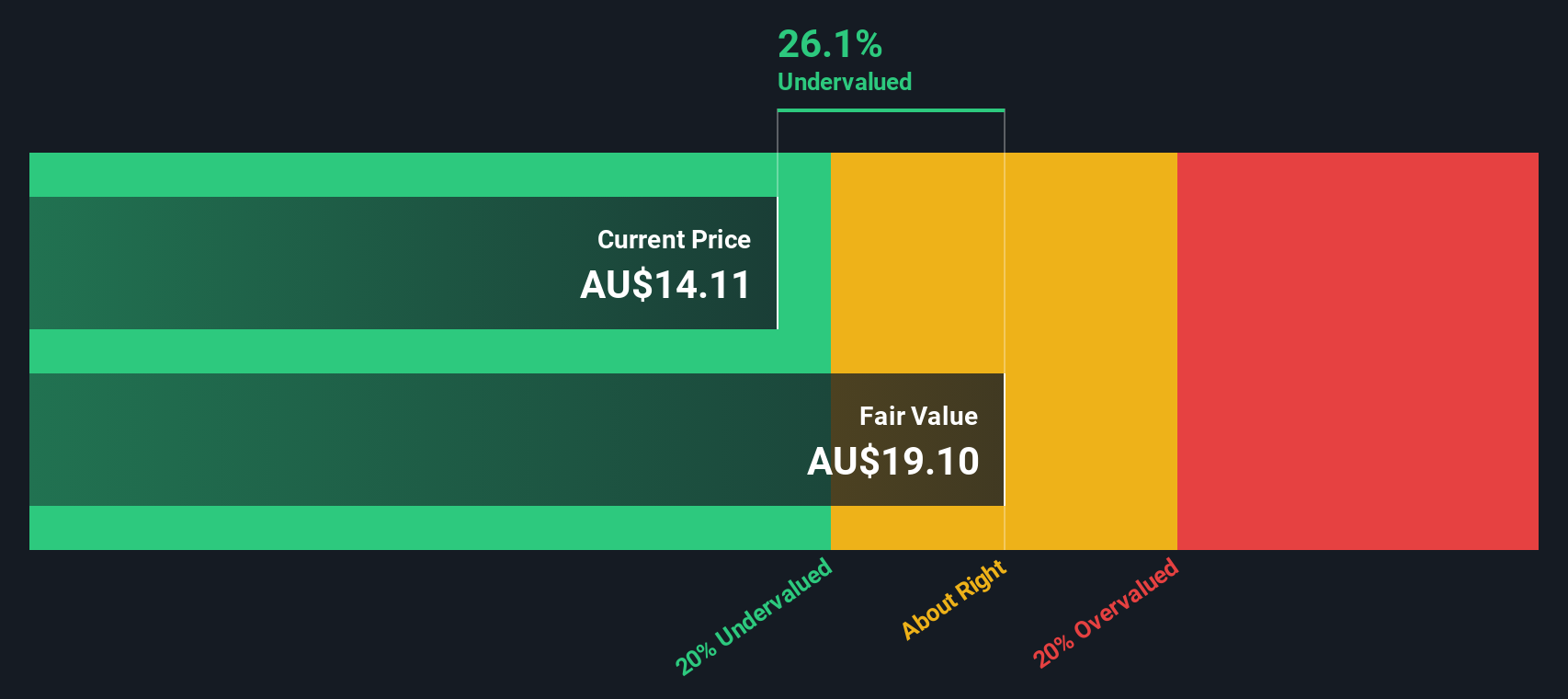

Cedar Woods Properties (ASX:CWP)

Simply Wall St Value Rating: ★★★★★★

Overview: Cedar Woods Properties is a property development and investment company with operations primarily focused on residential communities, commercial properties, and industrial developments, boasting a market cap of A$0.36 billion.

Operations: The company generates revenue primarily from property development and investment, with a recent revenue figure of A$459.01 million. The gross profit margin has shown variability, reaching 21.01% in the latest period, reflecting changes in cost management and pricing strategies over time. Operating expenses are a significant component of costs, impacting net income margins which stood at 11.52% in the most recent data point provided.

PE: 8.0x

Cedar Woods Properties, a smaller company in its sector, shows potential for value with recent insider confidence as William Hames acquired 16,000 shares valued at approximately A$71,200. Despite relying on external borrowing for funding and having a high debt level, the company reported significant growth in sales and net income for the half-year ending December 2024. With earnings expected to grow by 3.55% annually and strong presale contracts worth over A$642 million, Cedar Woods anticipates at least 10% NPAT growth in fiscal year 2025.

- Navigate through the intricacies of Cedar Woods Properties with our comprehensive valuation report here.

Assess Cedar Woods Properties' past performance with our detailed historical performance reports.

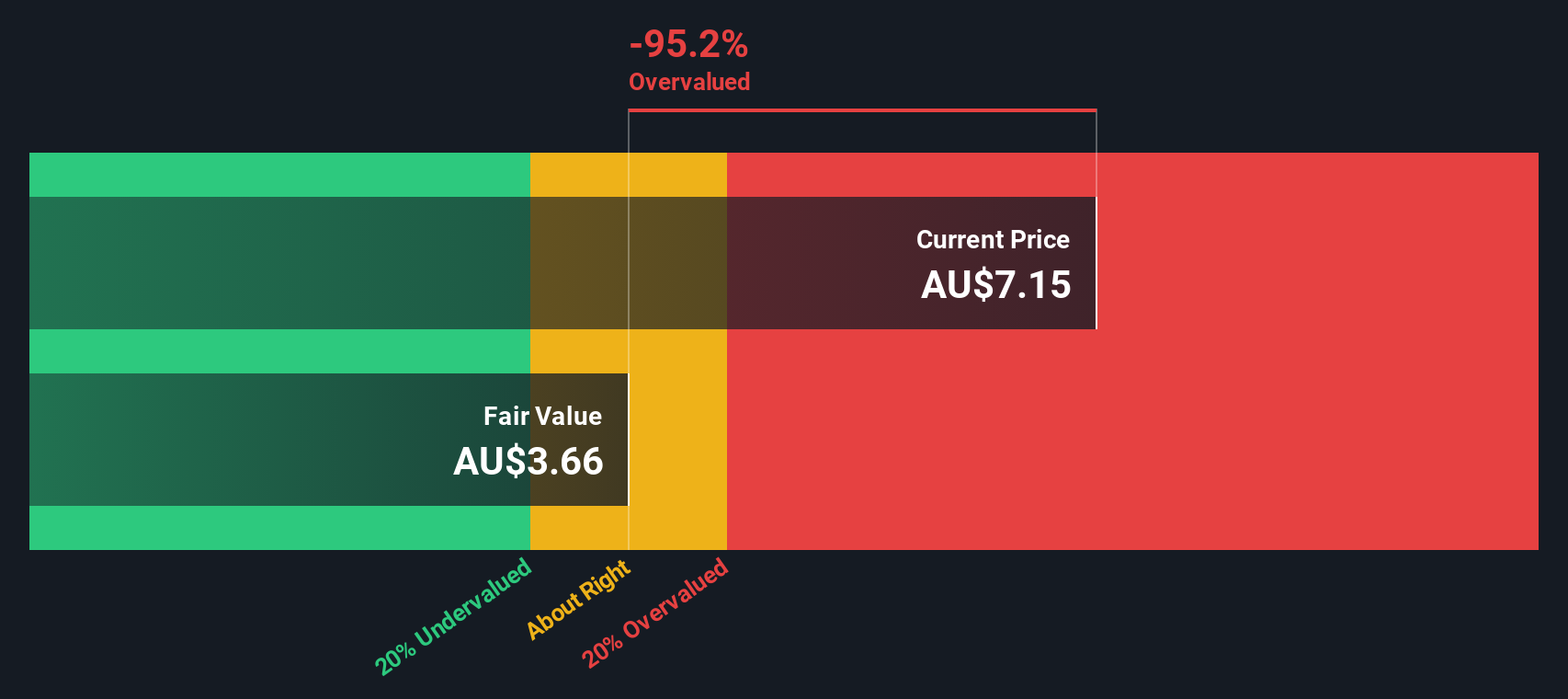

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a biopharmaceutical company focused on developing therapies for neurodevelopmental disorders, with a market cap of A$1.25 billion.

Operations: Neuren Pharmaceuticals derives its revenue primarily from commercial products, with recent figures reaching A$216.83 million. The company has shown a significant increase in gross profit margin, peaking at 88.47% as of December 2024, reflecting improved cost management and revenue growth over time. Operating expenses have remained relatively stable, with general and administrative expenses being a consistent part of the cost structure.

PE: 9.7x

Neuren Pharmaceuticals, a small player in the biotech industry, is making strides with its development of NNZ-2591 for treating hypoxic-ischemic encephalopathy (HIE), a severe neonatal brain injury. This potential breakthrough could earn Orphan Drug status from the FDA. Despite a slight dip in 2024 earnings, with net income at A$142 million compared to A$157 million the previous year, insider confidence remains strong as insiders have been purchasing shares since early 2025. Earnings are projected to grow by 4.68% annually, indicating potential for future growth despite current reliance on external borrowing for funding.

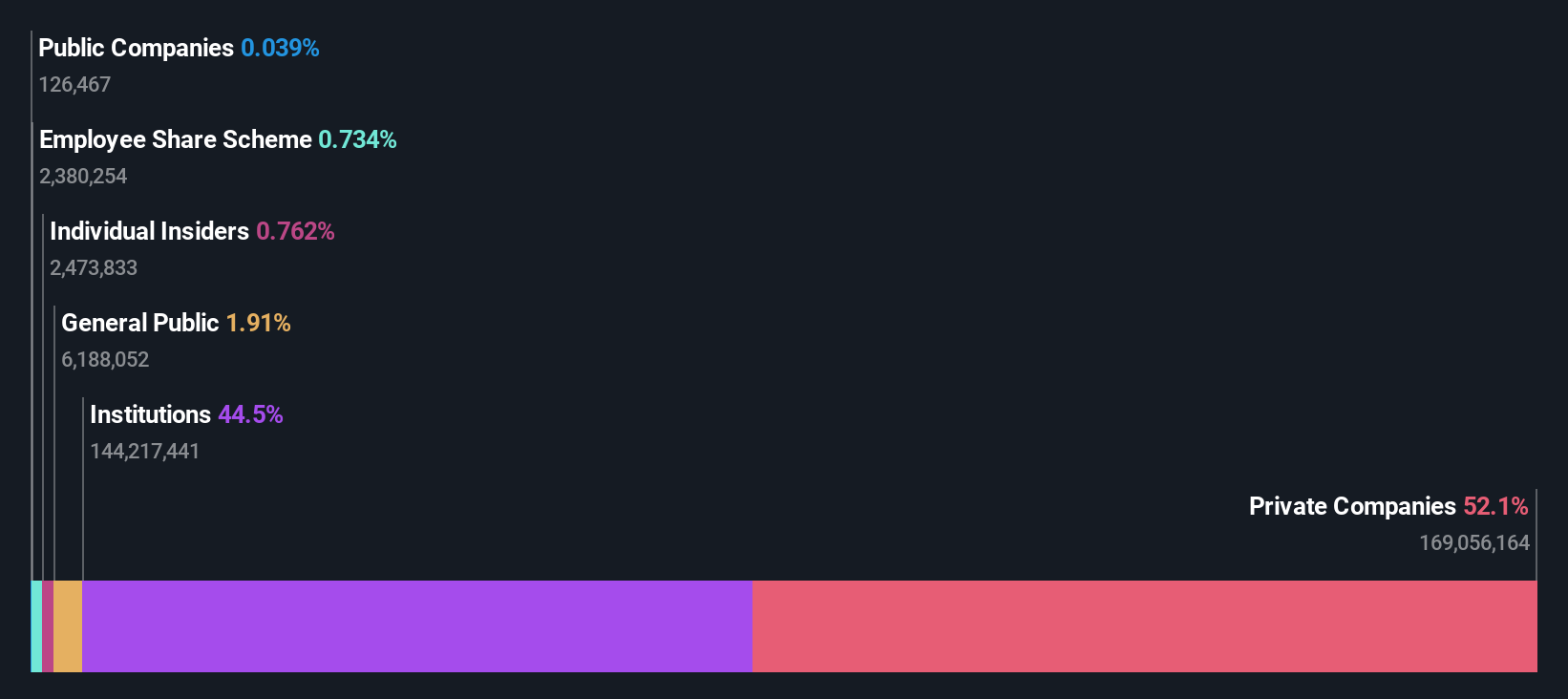

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group is a UK-based company focused on land and property regeneration, with operations in income generation and capital growth through property development, and has a market cap of £4.09 billion.

Operations: Harworth Group generates revenue primarily from the sale of development properties, which significantly surpasses income from other property activities and income generation. The company's cost of goods sold (COGS) often accounts for a substantial portion of its revenue, impacting its gross profit margin, which has seen fluctuations over time. Notably, the net income margin has experienced both positive and negative trends across different periods.

PE: 10.1x

Harworth Group, a smaller company in its sector, has seen insider confidence with recent share purchases. The company's sales surged to £181.59 million for 2024 from £72.43 million the previous year, while net income rose to £57.24 million from £37.96 million. Despite lower profit margins than last year and reliance on external borrowing, earnings are projected to grow annually by 16.73%. A consistent dividend increase over eight years highlights management's commitment to shareholder returns amidst fluctuating financials.

Seize The Opportunity

- Reveal the 154 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harworth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HWG

Harworth Group

Operates as a land and property regeneration company in the North of England and the Midlands.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion