- Australia

- /

- Real Estate

- /

- ASX:CWP

Exploring 3 Undervalued Small Caps In Global With Recent Insider Action

Reviewed by Simply Wall St

In recent weeks, global markets have been experiencing heightened volatility, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 facing declines amid escalating geopolitical tensions in the Middle East and trade uncertainties. Despite these challenges, optimism has been bolstered by better-than-expected inflation data and improving sentiment among small business owners, creating a complex backdrop for investors seeking opportunities in undervalued small-cap stocks. In such an environment, identifying promising small caps requires careful consideration of market conditions and insider actions that may signal potential value.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 19.1x | 1.8x | 44.38% | ★★★★☆☆ |

| Hemisphere Energy | 5.3x | 2.2x | 7.34% | ★★★★☆☆ |

| Information Services | 21.8x | 2.4x | 48.77% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.6x | 2.9x | 19.72% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.50% | ★★★★☆☆ |

| AKVA group | 17.5x | 0.8x | 48.78% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -66.69% | ★★★★☆☆ |

| AInnovation Technology Group | NA | 2.3x | 48.95% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.8x | 1.9x | 8.31% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 41.76% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Cedar Woods Properties (ASX:CWP)

Simply Wall St Value Rating: ★★★☆☆☆

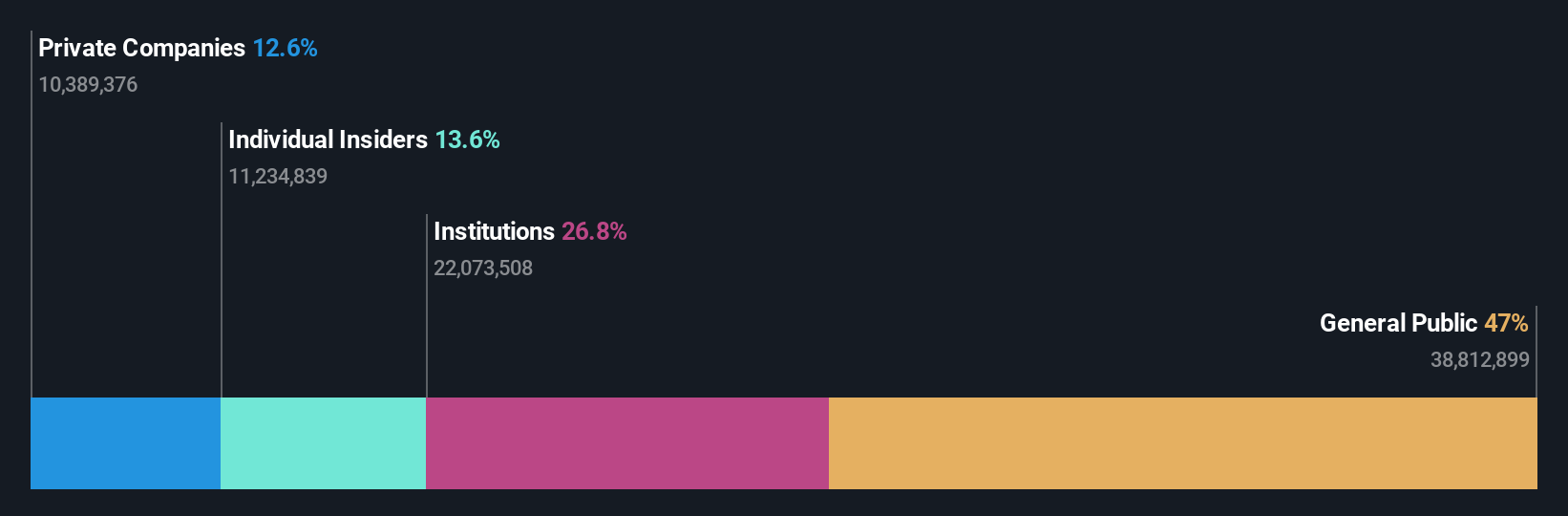

Overview: Cedar Woods Properties is a property development and investment company with operations primarily in Australia, focusing on residential communities, commercial properties, and mixed-use developments, and has a market cap of A$0.37 billion.

Operations: Cedar Woods Properties generates revenue primarily from property development and investment, with recent figures showing A$459.01 million in revenue. Over the years, the company's net income margin has shown fluctuations, reaching 11.52% in late 2024. The gross profit margin has varied as well, recorded at 21.01% for the same period. Operating expenses have been a consistent component of their cost structure, with general and administrative expenses contributing significantly to these costs over time.

PE: 10.8x

Cedar Woods Properties, a smaller company in the property development sector, is experiencing insider confidence with William Hames purchasing 14,466 shares for A$75,223. Despite high debt levels and reliance on external borrowing for funding, the company forecasts a promising 15% growth in NPAT for FY25. With secured presales expected to boost profits further in FY26 and projected earnings growth of 11.06% annually, Cedar Woods presents potential value amidst its financial challenges.

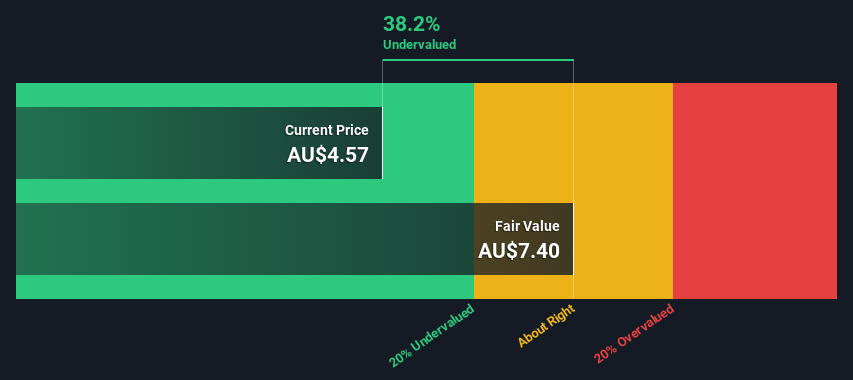

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMC Capital operates in the real estate sector with a focus on investment management, and it has a market cap of A$1.09 billion.

Operations: HMC Capital's revenue is primarily derived from its real estate segment, with a notable segment adjustment contributing to the total. The company has experienced a significant improvement in gross profit margin, reaching 100% in recent periods. Operating expenses have increased over time, but non-operating expenses have turned into income due to negative values in recent periods.

PE: 9.2x

HMC Capital, a smaller stock with potential, recently caught attention due to insider confidence. Isaac Fried acquired 1 million shares for A$4.8 million, reflecting belief in the company's prospects. Despite forecasted revenue growth of 12% annually, earnings are expected to decline by 4.6% over three years. The company is exploring M&A opportunities with Healthscope to protect its interests in HealthCo REIT. With higher-risk funding sources and recent presentations at industry conferences, HMC remains an intriguing watch for investors seeking value plays amidst challenges and opportunities.

- Take a closer look at HMC Capital's potential here in our valuation report.

Evaluate HMC Capital's historical performance by accessing our past performance report.

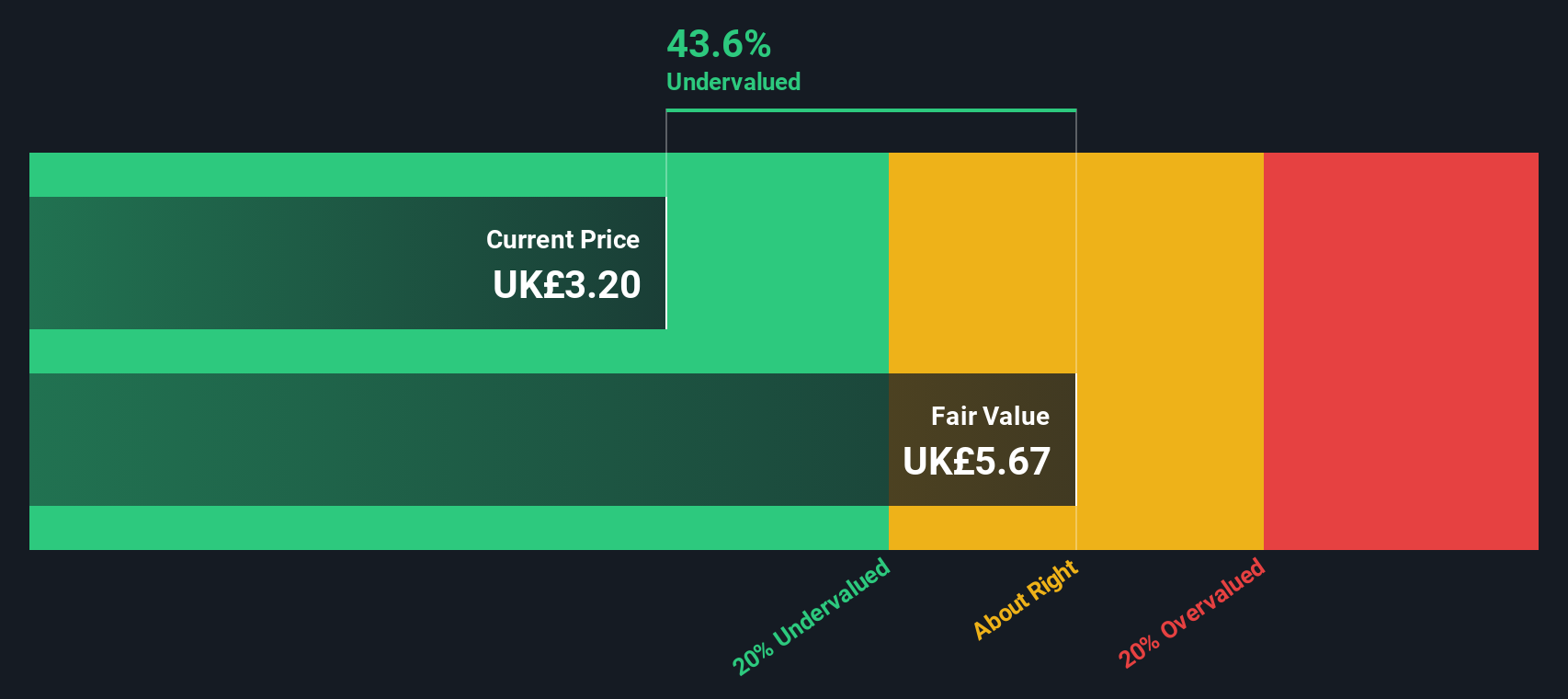

LSL Property Services (LSE:LSL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LSL Property Services operates in the UK as a provider of financial services, surveying and valuation, and estate agency services with a market cap of £0.27 billion.

Operations: The company's revenue streams are primarily derived from Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million). Operating expenses have been significant, with General & Administrative Expenses consistently being a major component, reaching £106.12 million in the latest period. The net income margin has shown variability, recently recorded at 10.24%.

PE: 17.4x

LSL Property Services, a smaller company in the property sector, has shown potential for value with its recent financial turnaround. Reporting sales of £173.18 million and net income of £17.36 million for 2024, it rebounded from a prior loss. Insider confidence is evident as they have been purchasing shares over recent months, indicating belief in future prospects. The company extended its buyback plan and declared a final dividend of 7.4 pence per share at their AGM on May 28, 2025, reinforcing shareholder returns amidst ongoing profit growth expectations for 2025.

Where To Now?

- Reveal the 171 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CWP

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives