As the Australian market navigates the mixed signals from a higher-than-expected CPI reading and fluctuating sector performances, investors are closely monitoring how these dynamics impact dividend stocks. In such an environment, a good dividend stock is often characterized by its ability to maintain stable payouts and resilience amidst economic uncertainties, making them a focal point for those seeking consistent income in volatile times.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.97% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.91% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.70% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.73% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.98% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.73% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.85% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.61% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.03% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.07% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

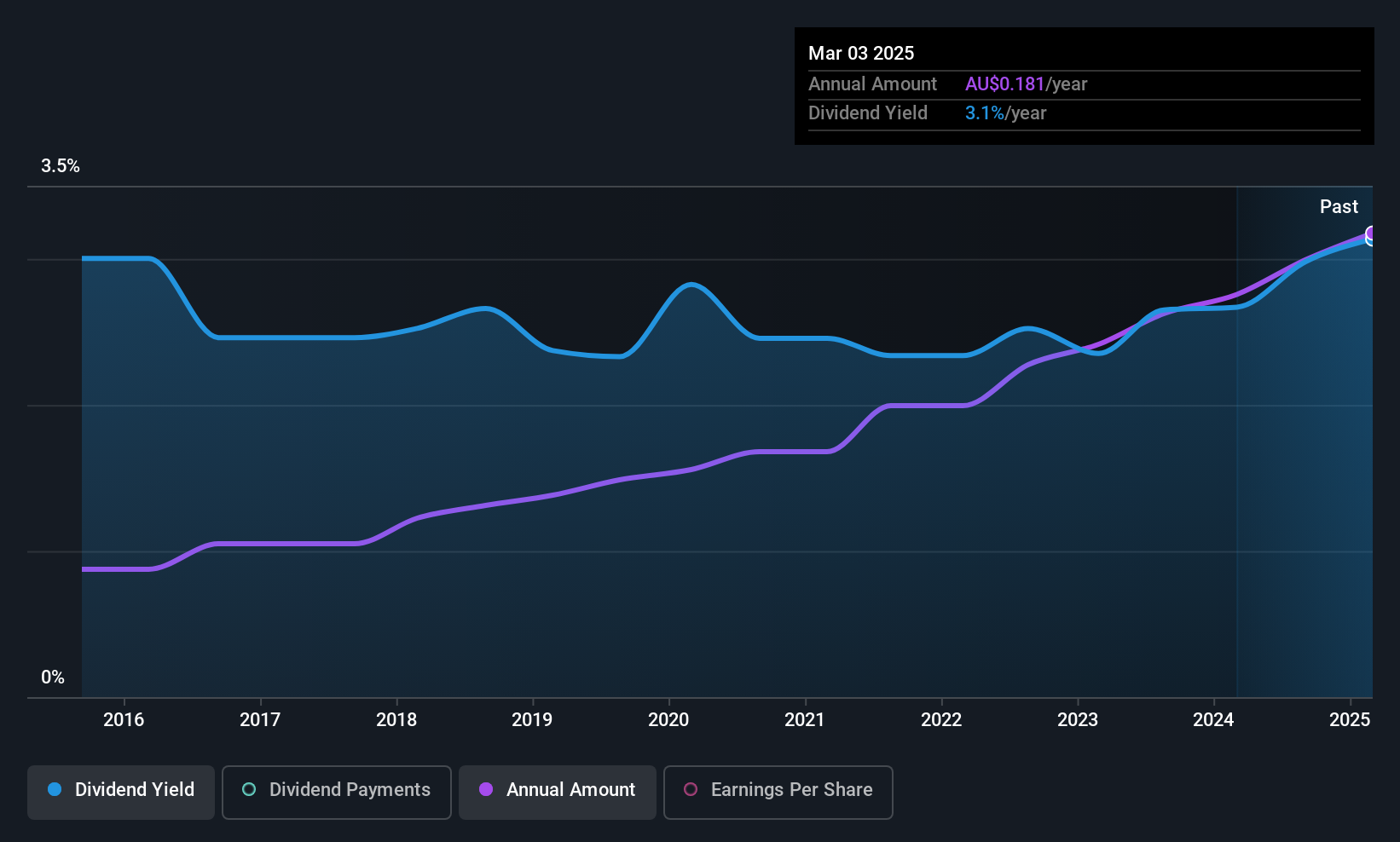

Cedar Woods Properties (ASX:CWP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company that develops and invests in properties, with a market cap of A$753.77 million.

Operations: Cedar Woods Properties Limited generates revenue of A$465.94 million from its property development and investment activities in Australia.

Dividend Yield: 3.3%

Cedar Woods Properties offers a mixed dividend profile. While its dividends are well-covered by earnings (payout ratio of 49.7%) and cash flows (cash payout ratio of 72.8%), the yield is relatively low at 3.27% compared to top Australian payers. The dividend history is volatile, yet payments have increased over the past decade. Recent inclusion in the S&P Global BMI Index may enhance visibility, but significant insider selling could raise concerns for potential investors.

- Dive into the specifics of Cedar Woods Properties here with our thorough dividend report.

- Our valuation report here indicates Cedar Woods Properties may be overvalued.

Joyce (ASX:JYC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joyce Corporation Ltd (ASX:JYC) is an Australian company that retails kitchen and wardrobe products, with a market cap of A$155.24 million.

Operations: Joyce Corporation Ltd generates revenue through its Retail Bedding - Franchise Operation (A$6.10 million), Retail Bedding Stores - Company-owned (A$21.11 million), and Retail Kitchen and Wardrobe Showrooms (A$120.39 million).

Dividend Yield: 5.2%

Joyce Corporation's dividend profile shows a complex picture. Trading significantly below its estimated fair value, the company offers a dividend yield of 5.24%, slightly below top-tier Australian payers. Although dividends are covered by earnings (88.5% payout ratio) and cash flows (33.4% cash payout ratio), their history is marked by volatility and unreliability over the past decade, despite recent increases. Recent amendments to the company's constitution highlight ongoing governance adjustments amidst stable financial performance with A$148.15 million in sales for FY2025.

- Get an in-depth perspective on Joyce's performance by reading our dividend report here.

- Our valuation report unveils the possibility Joyce's shares may be trading at a discount.

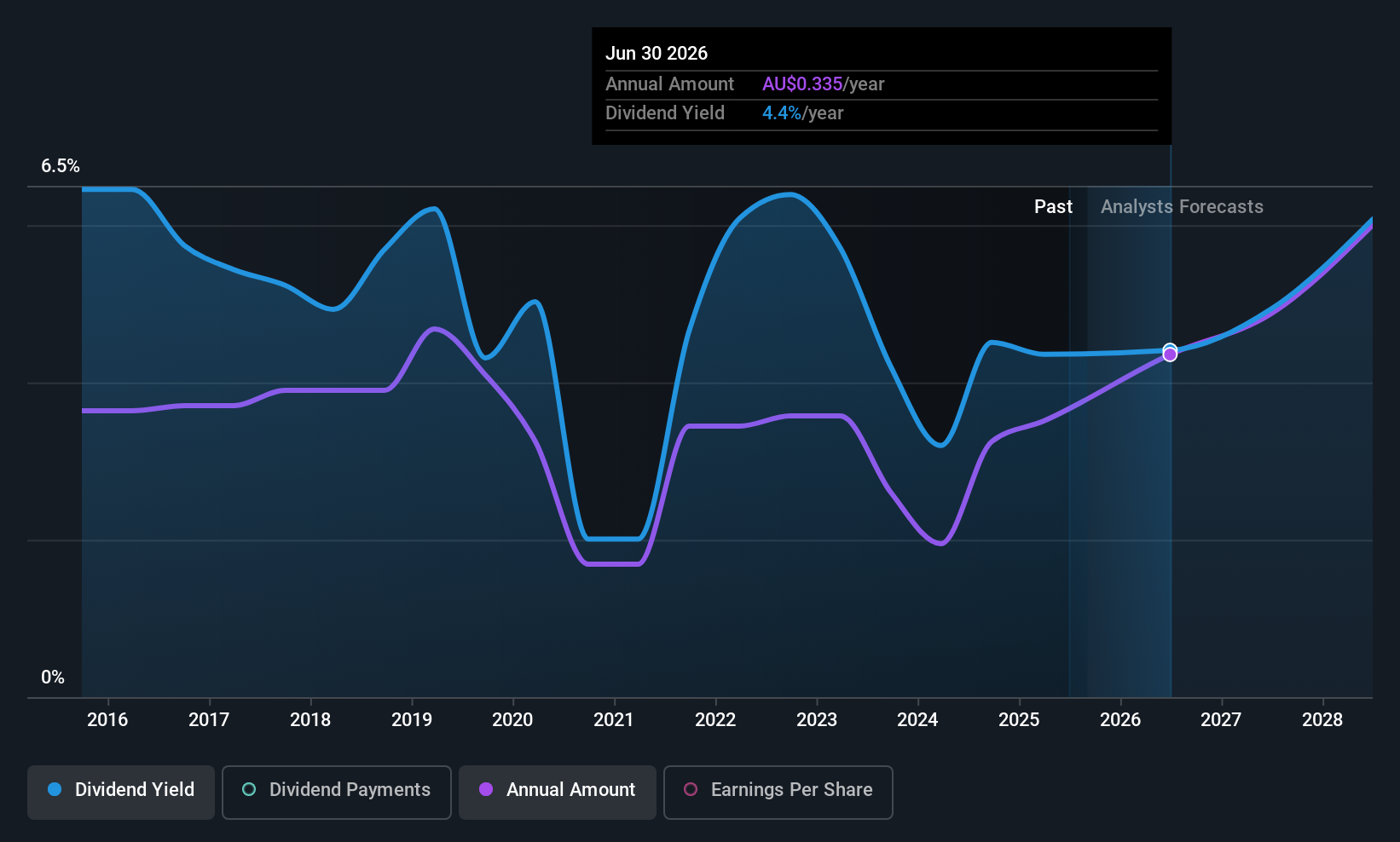

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Steadfast Group Limited operates as a general insurance brokerage service provider across Australasia, Asia, and Europe, with a market capitalization of A$5.80 billion.

Operations: Steadfast Group Limited generates revenue primarily through its Insurance Intermediary segment, which accounts for A$1.68 billion, and its Premium Funding segment, contributing A$123.50 million.

Dividend Yield: 3.7%

Steadfast Group's dividend profile reveals stability, with consistent growth over the past decade and a current yield of 3.73%, below Australia's top payers. Dividends are well-covered by earnings (64.2% payout ratio) and cash flows (44.1% cash payout ratio). Despite insider selling and high debt levels, the company trades at a discount to its estimated fair value, suggesting potential upside. Recent executive changes include Robert Kelly's return as CEO after an investigation concluded confidentially.

- Click here and access our complete dividend analysis report to understand the dynamics of Steadfast Group.

- Insights from our recent valuation report point to the potential undervaluation of Steadfast Group shares in the market.

Key Takeaways

- Click this link to deep-dive into the 32 companies within our Top ASX Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success