Telix Pharmaceuticals (ASX:TLX) Valuation After ZIRCON-X Data Highlights TLX250-CDx’s Potential Clinical and Commercial Impact

Reviewed by Simply Wall St

Telix Pharmaceuticals (ASX:TLX) just released ZIRCON-X study data showing its TLX250-CDx kidney imaging agent could have changed clinical decisions for almost half of patients, with more than 20% potentially avoiding invasive biopsy.

See our latest analysis for Telix Pharmaceuticals.

Despite the latest ZIRCON-X update highlighting the potential commercial impact of TLX250-CDx, Telix’s recent share price performance has been choppy, with a 1 month share price return of minus 9.68 percent and a resilient 3 year total shareholder return of 105.47 percent suggesting longer term momentum remains intact.

If this kind of clinical inflection point has your attention, it could be worth exploring other interesting healthcare stocks that might be setting up for their own rerating.

With the share price down sharply this year despite strong multi year returns and Telix trading at a steep discount to analyst targets, is this a mispriced growth story, or is the market already discounting everything ahead?

Price-to-Sales of 4.8x: Is it justified?

On a price-to-sales ratio of 4.8x versus a last close of A$14.28, Telix screens as clearly undervalued relative to peers and its own fair range.

The price-to-sales multiple compares the company’s market value to its revenue, which can be especially useful for high growth or earlier stage biopharma where earnings can be distorted by investment and one off items.

For Telix, trading at 4.8x sales while peers in the Australian Biotechs space sit around 15.3x suggests the market is heavily discounting its revenue base, despite forecasts for earnings to grow strongly and profitability to improve over time. Relative to an estimated fair price-to-sales ratio of 5.9x, there is also room for the market multiple to expand toward a level more in line with what its fundamentals might warrant if execution continues.

Against a peer average multiple of 20.6x, Telix’s 4.8x stands out as deeply conservative, implying investors are assigning it a substantial discount compared to similar biotech names despite its commercial stage assets and pipeline.

Explore the SWS fair ratio for Telix Pharmaceuticals

Result: Price-to-Sales of 4.8x (UNDERVALUED)

However, Telix remains vulnerable to clinical trial setbacks and regulatory delays, while recent share price volatility hints at shifting risk appetite for growth biotech names.

Find out about the key risks to this Telix Pharmaceuticals narrative.

Another View: What Does Our DCF Say?

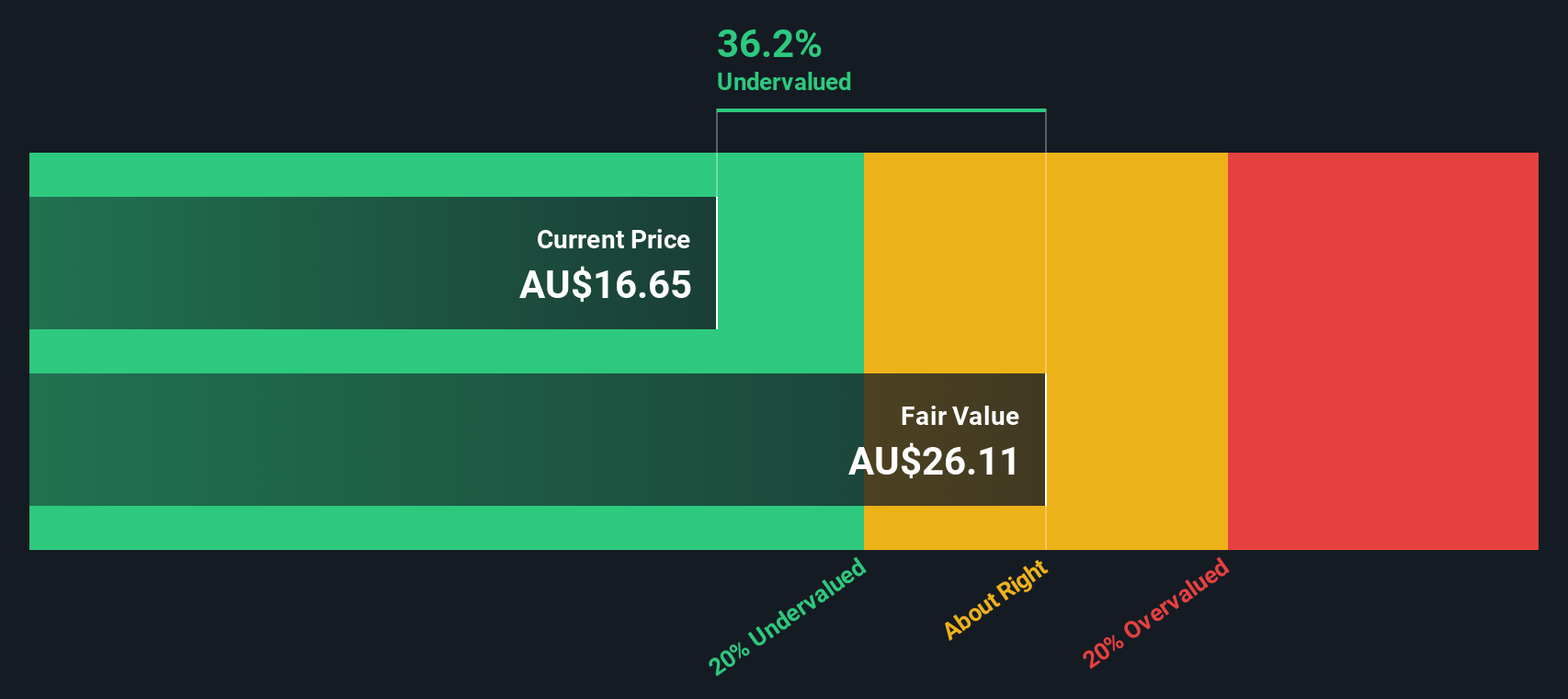

Our DCF model also points to Telix as undervalued, with a fair value estimate of around A$25.19 versus the current A$14.28, a discount of roughly 43 percent. If both sales based and cash flow based methods agree, is sentiment the only thing holding the share price back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telix Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telix Pharmaceuticals Narrative

If you see things differently or want to drill into the numbers yourself, you can build a personalised view in under three minutes: Do it your way.

A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market moves on without you, put Simply Wall St’s Screener to work and stack your watchlist with opportunities that match your strategy.

- Capture potential mispricings by targeting companies trading below their cash flow value using these 928 undervalued stocks based on cash flows tailored to fundamental strength.

- Capitalize on powerful sector trends as these 30 healthcare AI stocks spotlight companies fusing innovation with real world medical impact.

- Supercharge your income strategy by filtering for reliable payers through these 14 dividend stocks with yields > 3% that prioritise yield and sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026