Syntara Limited (ASX:SNT) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

Syntara Limited (ASX:SNT) shares have had a horrible month, losing 29% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

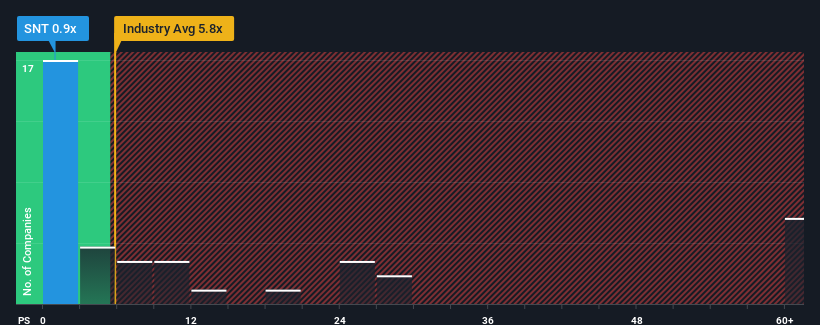

Following the heavy fall in price, Syntara may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Pharmaceuticals industry in Australia have P/S ratios greater than 5.8x and even P/S higher than 26x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Syntara

What Does Syntara's Recent Performance Look Like?

Syntara could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Syntara will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Syntara would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 143%. Still, revenue has fallen 14% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company are not good at all, suggesting revenue should decline by 61% over the next year. With the rest of the industry predicted to shrink by 32%, it's a sub-optimal result.

With this in consideration, it's clear to us why Syntara's P/S isn't quite up to scratch with its industry peers. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Final Word

Having almost fallen off a cliff, Syntara's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Syntara's analyst forecasts confirms that the company's even more precarious outlook against the industry is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. Given the current circumstances, it's difficult to envision any significant increase in the share price in the near term.

You should always think about risks. Case in point, we've spotted 3 warning signs for Syntara you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on Syntara, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SNT

Syntara

Operates as a clinical-stage drug development company that focuses on blood-related cancers in Australia.

Excellent balance sheet moderate.