Shareholders have faith in loss-making PYC Therapeutics (ASX:PYC) as stock climbs 27% in past week, taking five-year gain to 198%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the PYC Therapeutics Limited (ASX:PYC) share price has soared 192% in the last half decade. Most would be very happy with that. And in the last month, the share price has gained 49%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

Since the stock has added AU$140m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for PYC Therapeutics

PYC Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, PYC Therapeutics can boast revenue growth at a rate of 53% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 24% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes PYC Therapeutics worth investigating - it may have its best days ahead.

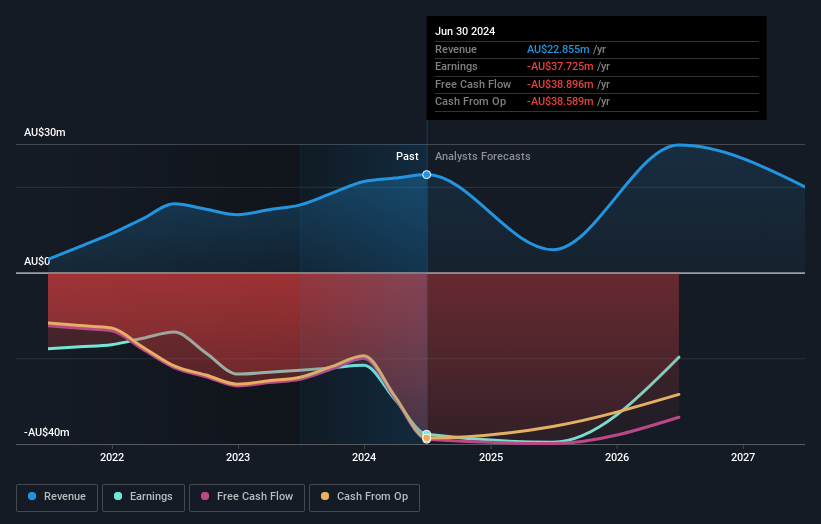

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think PYC Therapeutics will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between PYC Therapeutics' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that PYC Therapeutics' TSR, at 198% is higher than its share price return of 192%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that PYC Therapeutics shareholders have received a total shareholder return of 144% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand PYC Therapeutics better, we need to consider many other factors. For example, we've discovered 3 warning signs for PYC Therapeutics that you should be aware of before investing here.

PYC Therapeutics is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives