- Australia

- /

- Metals and Mining

- /

- ASX:DVP

ASX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Australian market has recently shown positive momentum, with the ASX200 closing up 0.92% at 8,070 points, driven by strong performances in sectors like Energy and Utilities. In this environment of growth and sectoral strength, identifying stocks with high insider ownership can be particularly appealing as it often suggests confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Fenix Resources (ASX:FEX) | 21.1% | 47.8% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Echo IQ (ASX:EIQ) | 19.8% | 87.1% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Plenti Group (ASX:PLT) | 12.7% | 85% |

| Image Resources (ASX:IMA) | 16.1% | 127.3% |

| BETR Entertainment (ASX:BBT) | 38.6% | 77.5% |

Let's dive into some prime choices out of the screener.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Develop Global Limited, with a market cap of A$837.02 million, is involved in the exploration and development of mineral resource properties in Australia through its subsidiaries.

Operations: The company generates revenue primarily from its Mining Services segment, which accounts for A$194.45 million.

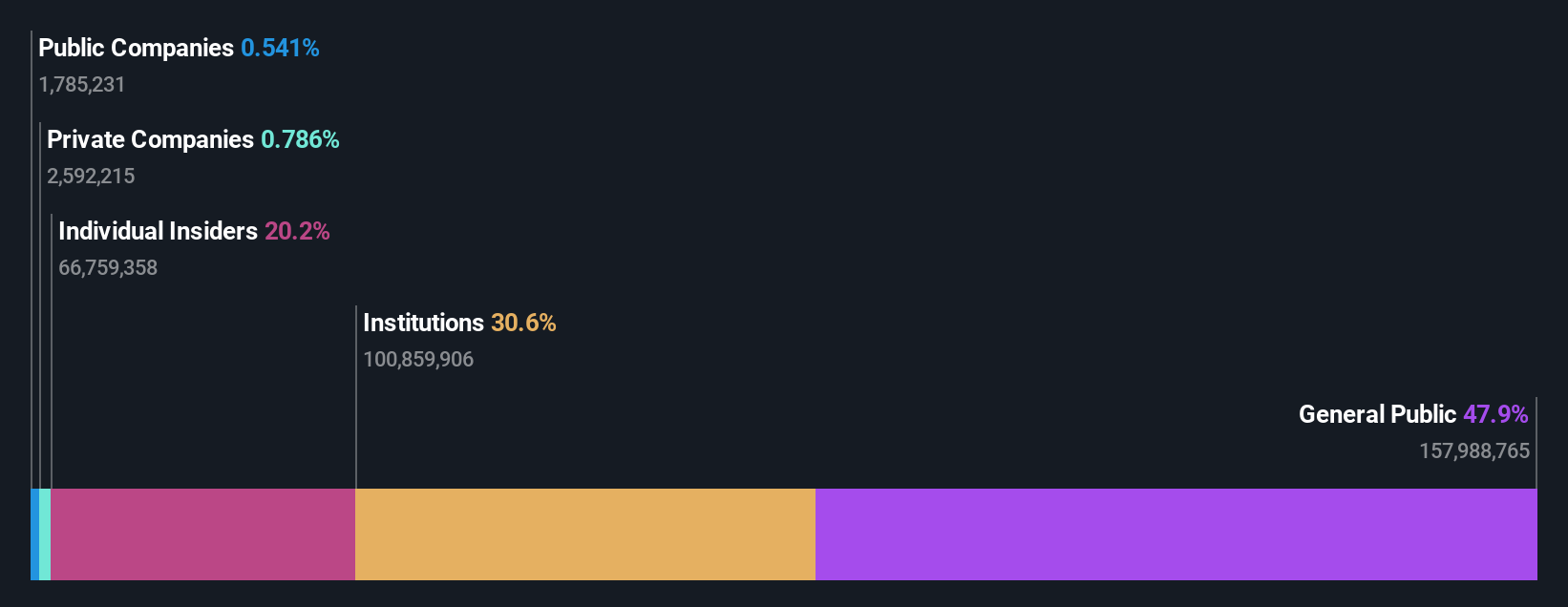

Insider Ownership: 20.8%

Revenue Growth Forecast: 47.5% p.a.

Develop Global's recent earnings report showed significant revenue growth to A$113.02 million, up from A$65.8 million a year ago, and a shift from a net loss to a net income of A$0.94 million. Despite limited insider trading activity recently, the company is forecast to grow its revenue at 47.5% annually, outpacing the market average of 5.6%. It trades at good value compared to peers and is expected to achieve profitability within three years with high return on equity projections.

- Unlock comprehensive insights into our analysis of Develop Global stock in this growth report.

- In light of our recent valuation report, it seems possible that Develop Global is trading behind its estimated value.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited operates and franchises quick service restaurants across Australia, Singapore, Japan, and the United States with a market cap of A$3.37 billion.

Operations: The company's revenue segment primarily consists of its restaurant operations, generating A$413.26 million.

Insider Ownership: 14.1%

Revenue Growth Forecast: 18.4% p.a.

Guzman y Gomez Limited's recent sales figures show strong growth, with Q1 2025 network sales reaching A$289.5 million, up from A$234.2 million the previous year. The company has transitioned to profitability, reporting a net income of A$7.3 million for H1 2024-25 compared to a loss previously. Despite substantial insider selling over the past three months, revenue is forecasted to grow at 18.4% annually, surpassing market averages and contributing to expected profitability within three years.

- Click to explore a detailed breakdown of our findings in Guzman y Gomez's earnings growth report.

- Our expertly prepared valuation report Guzman y Gomez implies its share price may be too high.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is an Australian drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases, with a market capitalization of A$658.38 million.

Operations: The company's revenue segment includes A$24.99 million from the discovery and development of RNA therapeutics targeting genetic diseases.

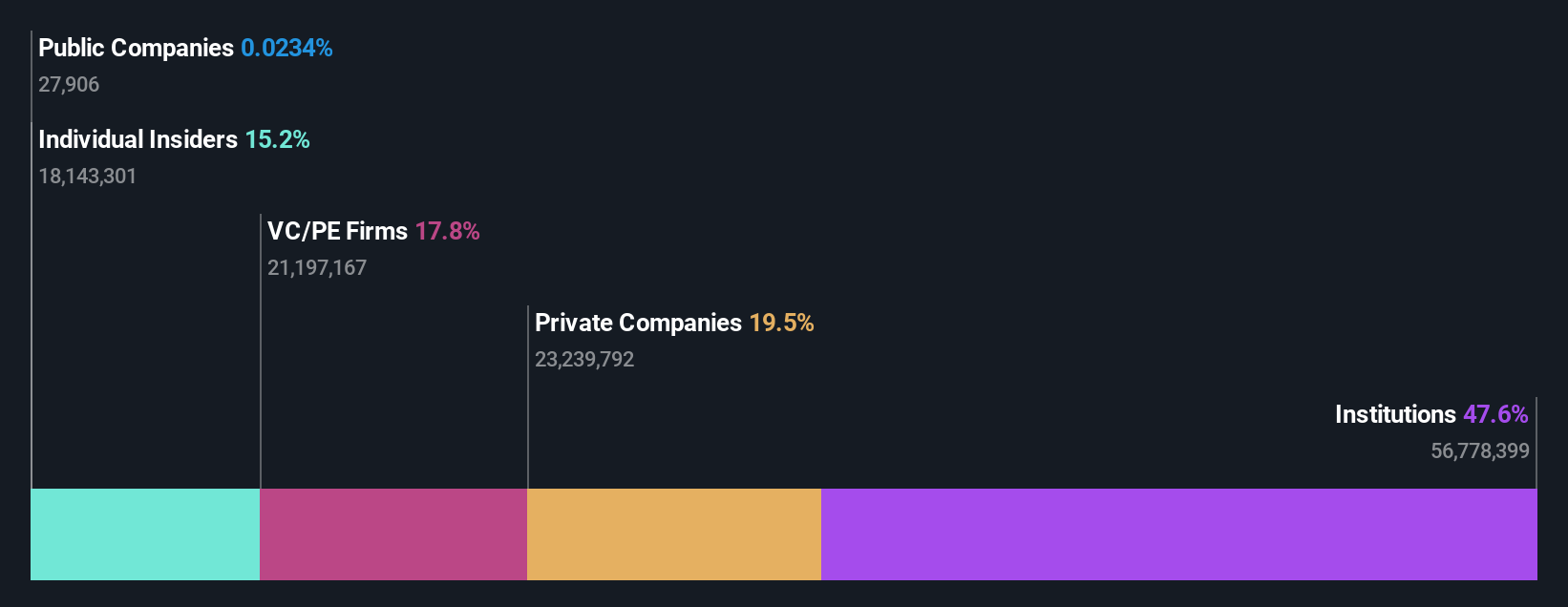

Insider Ownership: 38%

Revenue Growth Forecast: 25% p.a.

PYC Therapeutics is trading significantly below its estimated fair value and forecasts suggest robust growth, with earnings expected to rise 29.69% annually. The company anticipates profitability within three years, outpacing market averages. Recent developments include a completed A$145.82 million equity offering and progress in clinical trials for PYC-003, indicating potential future revenue streams despite current net losses of A$25.57 million for H2 2024 compared to last year’s figures.

- Delve into the full analysis future growth report here for a deeper understanding of PYC Therapeutics.

- Our valuation report unveils the possibility PYC Therapeutics' shares may be trading at a premium.

Next Steps

- Navigate through the entire inventory of 96 Fast Growing ASX Companies With High Insider Ownership here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Develop Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives