ASX Penny Stocks: Prescient Therapeutics Among 3 Noteworthy Picks

Reviewed by Simply Wall St

The Australian stock market is showing resilience, with the ASX200 rising by 0.80% and sectors like Materials and Real Estate leading the charge after recent volatility. In such a dynamic market landscape, investors often look for stocks that offer both value and growth potential, which can sometimes be found in smaller or newer companies. Though the term "penny stocks" might seem outdated, these investments can still provide significant opportunities when backed by solid financials; we'll explore three noteworthy examples that stand out for their financial strength and potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$301.21M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.555 | A$344.18M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.82 | A$100.68M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.195 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$132.44M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.32 | A$112.68M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Prescient Therapeutics (ASX:PTX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prescient Therapeutics Limited is a clinical-stage oncology company focused on developing cancer treatments in Australia, with a market cap of A$34.63 million.

Operations: The company generates revenue from its Clinical Stage Oncology segment, amounting to A$3.71 million.

Market Cap: A$34.63M

Prescient Therapeutics, a clinical-stage oncology company in Australia with a market cap of A$34.63 million, is currently pre-revenue and unprofitable, reporting a net loss of A$8.24 million for the year ended June 30, 2024. The company has experienced management and board members with average tenures over nine years each. Despite its financial challenges, Prescient maintains a strong cash position with short-term assets significantly exceeding liabilities and sufficient runway for over a year based on current cash flow trends. Recent executive changes include the planned departure of CEO Steven Yatomi-Clarke by February 2025.

- Click to explore a detailed breakdown of our findings in Prescient Therapeutics' financial health report.

- Assess Prescient Therapeutics' previous results with our detailed historical performance reports.

Quickstep Holdings (ASX:QHL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quickstep Holdings Limited manufactures and sells advanced composites for the defense, commercial aerospace, automotive, and other industries in Australia, the United Kingdom, and the United States with a market cap of A$27.26 million.

Operations: The company generates revenue from its Quickstep Structures segment, which amounted to A$88.97 million.

Market Cap: A$27.26M

Quickstep Holdings, with a market cap of A$27.26 million, faces financial challenges as it remains unprofitable despite generating A$88.97 million in revenue from its Quickstep Structures segment. The company's net debt to equity ratio is high at 53.2%, though short-term assets exceed both short and long-term liabilities, providing some financial stability. Recent executive changes include the departure of CEO Mark Burgess and CFO Dexter Clarke, with Demi Stefanova stepping in as interim CEO and Martyn Dominy as interim CFO. Additionally, ASDAM Operations Pty Ltd proposed acquiring Quickstep for A$28.7 million on November 6, 2024.

- Click here to discover the nuances of Quickstep Holdings with our detailed analytical financial health report.

- Gain insights into Quickstep Holdings' historical outcomes by reviewing our past performance report.

Viking Mines (ASX:VKA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Viking Mines Limited is a mineral exploration company based in Australia with a market cap of A$12.75 million.

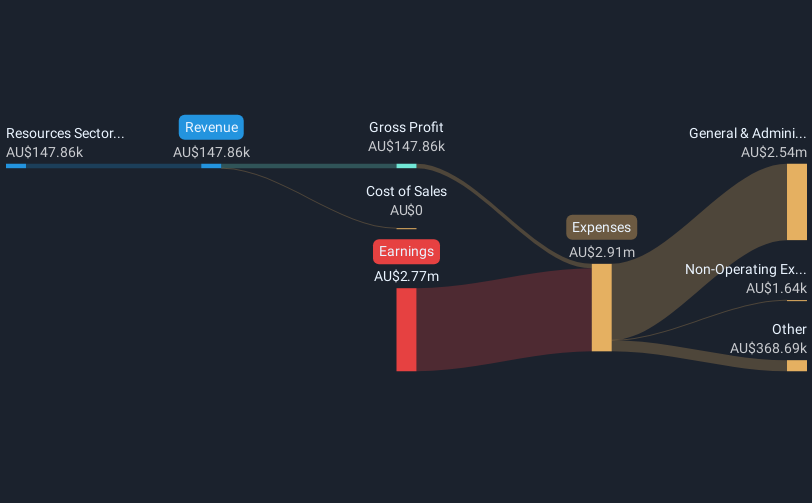

Operations: The company generates revenue from its Resources Sector, amounting to A$0.15 million.

Market Cap: A$12.75M

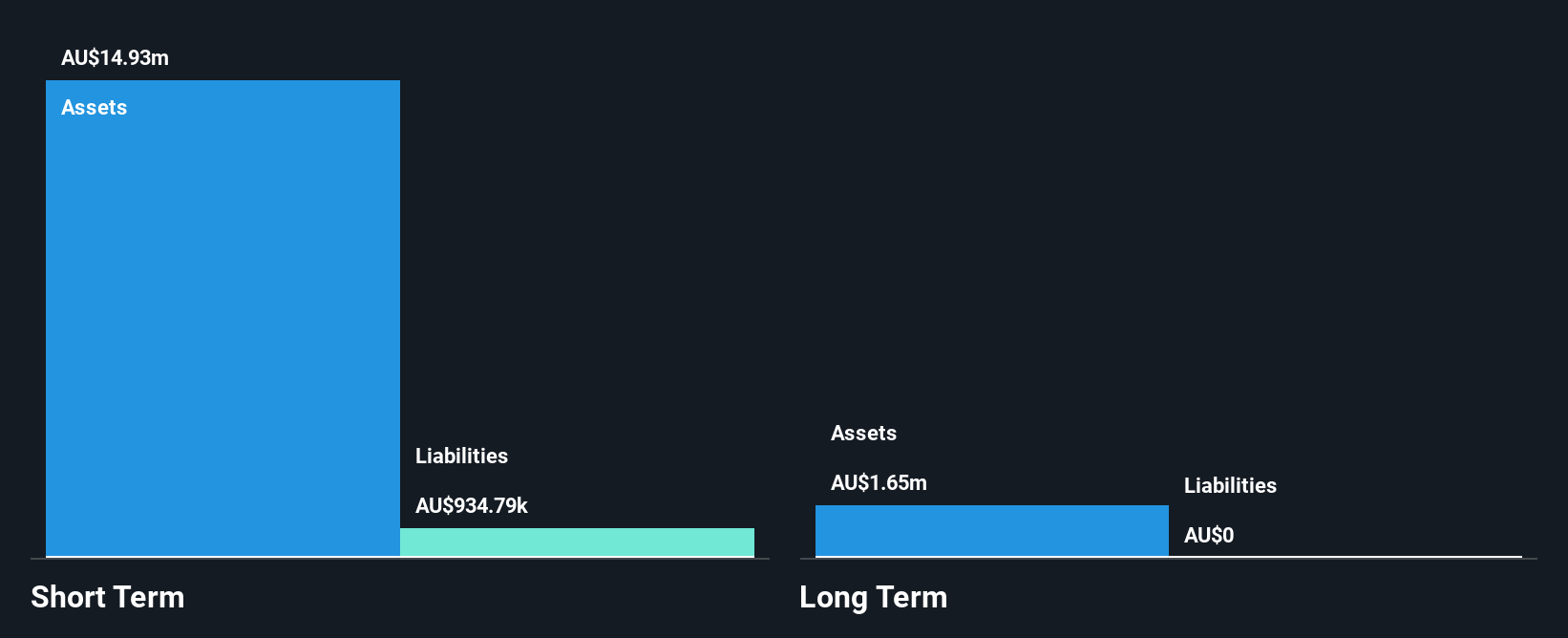

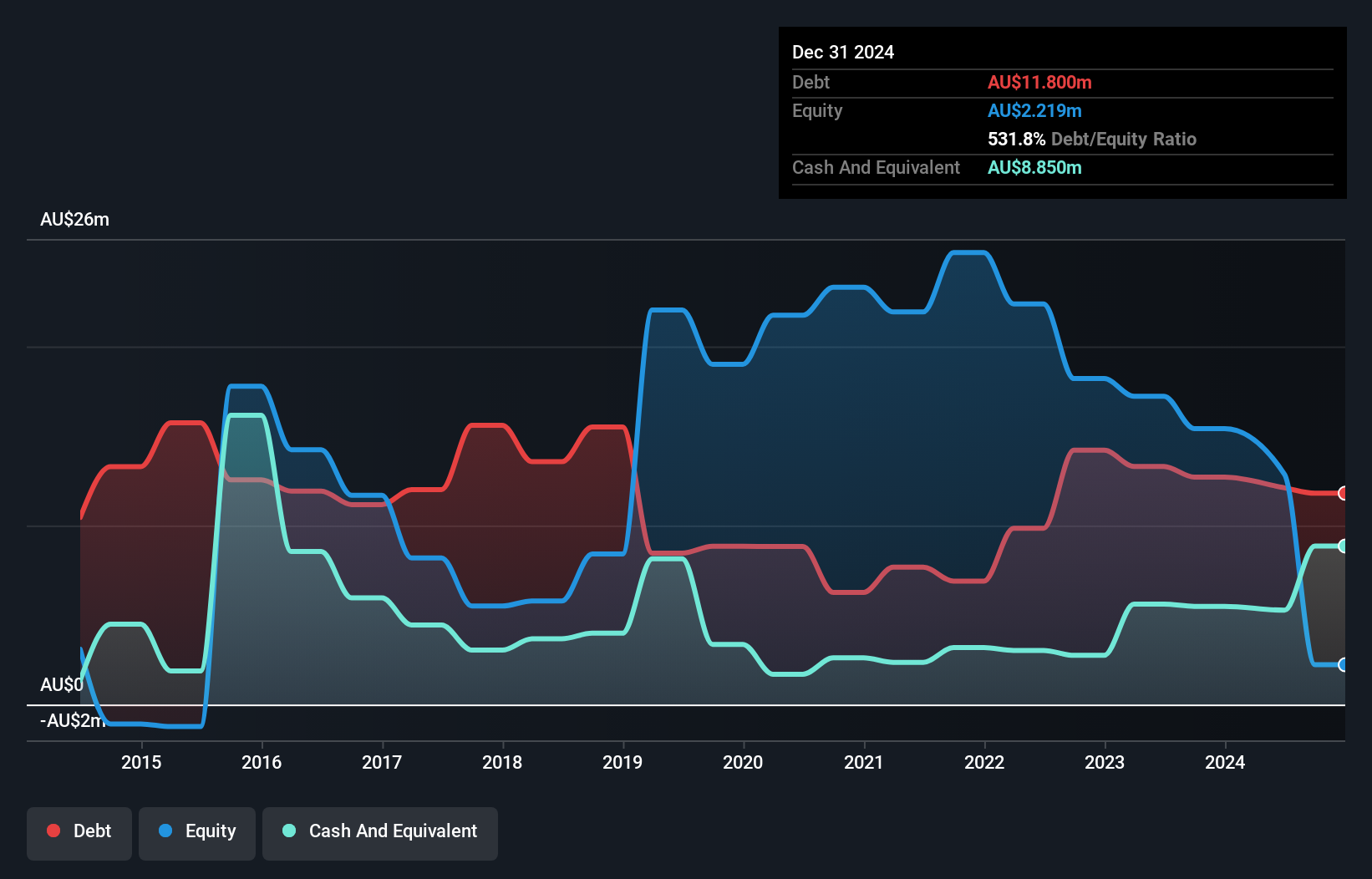

Viking Mines, with a market cap of A$12.75 million, is pre-revenue and currently unprofitable, reporting a net loss of A$2.77 million for the year ended June 30, 2024. Despite this, the company maintains financial resilience with no debt and sufficient cash runway exceeding three years due to positive free cash flow growth. However, shareholders have faced dilution over the past year as shares outstanding increased by 3.6%. The company's short-term assets comfortably cover both its short- and long-term liabilities, but its share price has been highly volatile recently.

- Jump into the full analysis health report here for a deeper understanding of Viking Mines.

- Learn about Viking Mines' historical performance here.

Make It Happen

- Click here to access our complete index of 1,037 ASX Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PTX

Prescient Therapeutics

A clinical stage oncology company, develops drugs for the treatment of various cancers in Australia.

Excellent balance sheet low.