Did You Participate In Any Of Paradigm Biopharmaceuticals' (ASX:PAR) Incredible 811% Return?

Paradigm Biopharmaceuticals Limited (ASX:PAR) shareholders have seen the share price descend 15% over the month. But over three years the performance has been really wonderful. In fact, the share price has taken off in that time, up 789%. So the recent fall doesn't do much to dampen our respect for the business. Only time will tell if there is still too much optimism currently reflected in the share price.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Paradigm Biopharmaceuticals

With just AU$3,647,847 worth of revenue in twelve months, we don't think the market considers Paradigm Biopharmaceuticals to have proven its business plan. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Paradigm Biopharmaceuticals has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Paradigm Biopharmaceuticals investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

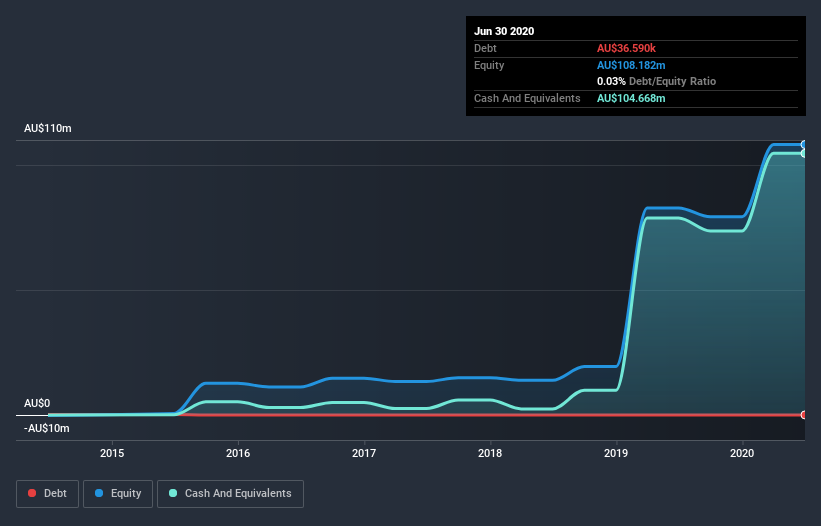

Paradigm Biopharmaceuticals has plenty of cash in the bank, with cash in excess of all liabilities sitting at AU$100m, when it last reported (June 2020). This gives management the flexibility to drive business growth, without worrying too much about cash reserves. And given that the share price has shot up 32% per year, over 3 years , it's fair to say investors are liking management's vision for the future. You can see in the image below, how Paradigm Biopharmaceuticals' cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. However you can take a look at whether insiders have been buying up shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Paradigm Biopharmaceuticals' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Paradigm Biopharmaceuticals hasn't been paying dividends, but its TSR of 811% exceeds its share price return of 789%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Paradigm Biopharmaceuticals had a tough year, with a total loss of 13%, against a market gain of about 3.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 51% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Paradigm Biopharmaceuticals you should be aware of.

Of course Paradigm Biopharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Paradigm Biopharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PAR

Paradigm Biopharmaceuticals

Engages in the research and development of therapeutic products for human use in Australia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026