The five-year returns have been massive for PharmAust (ASX:PAA) shareholders despite underlying losses increasing

It hasn't been the best quarter for PharmAust Limited (ASX:PAA) shareholders, since the share price has fallen 30% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 468%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

Since it's been a strong week for PharmAust shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for PharmAust

Because PharmAust made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years PharmAust saw its revenue shrink by 3.2% per year. This is in stark contrast to the strong share price growth of 42%, compound, per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. I think it's fair to say there is probably a fair bit of excitement in the price.

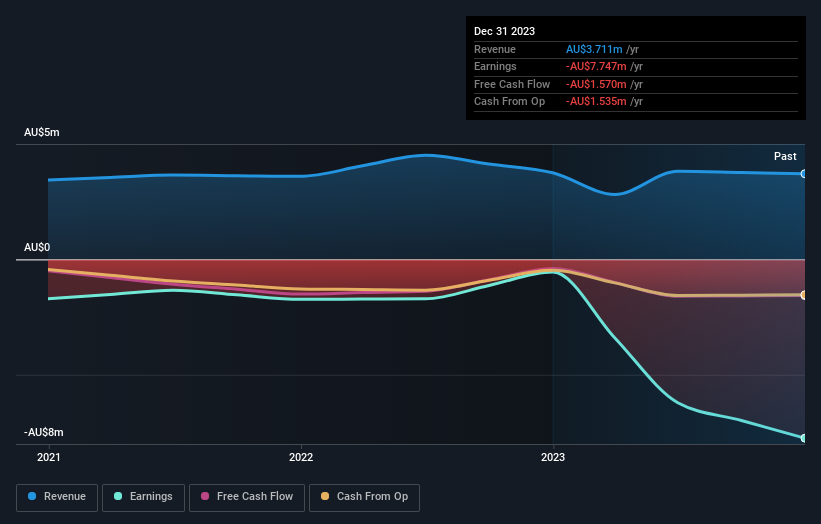

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that PharmAust shareholders have received a total shareholder return of 173% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 42% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for PharmAust (1 is significant!) that you should be aware of before investing here.

We will like PharmAust better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Neurizon Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NUZ

Neurizon Therapeutics

A clinical stage biotechnology company, develops therapeutics for neurodegenerative diseases in Switzerland, Australia, the United States, and internationally.

Moderate with adequate balance sheet.

Market Insights

Community Narratives