Getting In Cheap On Neuren Pharmaceuticals Limited (ASX:NEU) Is Unlikely

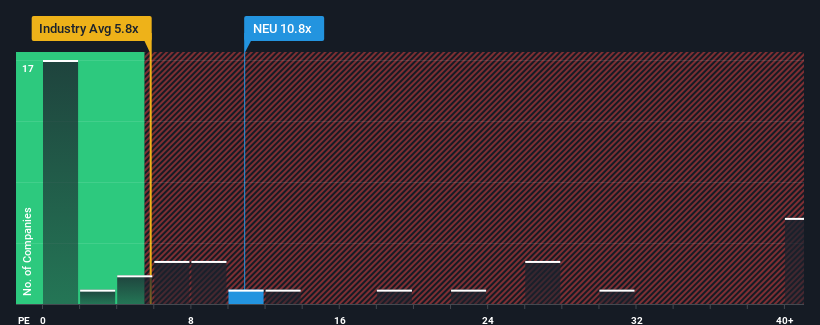

You may think that with a price-to-sales (or "P/S") ratio of 10.8x Neuren Pharmaceuticals Limited (ASX:NEU) is a stock to avoid completely, seeing as almost half of all the Pharmaceuticals companies in Australia have P/S ratios under 5.8x and even P/S lower than 1.3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Neuren Pharmaceuticals

What Does Neuren Pharmaceuticals' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Neuren Pharmaceuticals has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Neuren Pharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Neuren Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 15% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Neuren Pharmaceuticals' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Neuren Pharmaceuticals' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Neuren Pharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Neuren Pharmaceuticals with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Neuren Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Neuren Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NEU

Neuren Pharmaceuticals

A biopharmaceutical company, develops drugs for the treatment of neurological disorders.

Flawless balance sheet and undervalued.