Medical Developments International Limited (ASX:MVP) Soars 28% But It's A Story Of Risk Vs Reward

Medical Developments International Limited (ASX:MVP) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

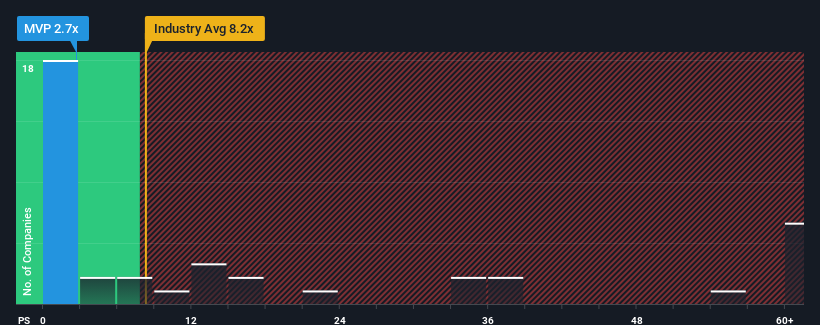

Although its price has surged higher, Medical Developments International may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.7x, since almost half of all companies in the Pharmaceuticals industry in Australia have P/S ratios greater than 8.2x and even P/S higher than 34x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Medical Developments International

How Has Medical Developments International Performed Recently?

With revenue growth that's inferior to most other companies of late, Medical Developments International has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Medical Developments International.Is There Any Revenue Growth Forecasted For Medical Developments International?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Medical Developments International's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The strong recent performance means it was also able to grow revenue by 43% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 29% per year as estimated by the lone analyst watching the company. That's shaping up to be similar to the 28% each year growth forecast for the broader industry.

In light of this, it's peculiar that Medical Developments International's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shares in Medical Developments International have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Medical Developments International currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Medical Developments International (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Medical Developments International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MVP

Medical Developments International

Manufactures and distributes emergency medical solutions in Australia, Europe, the United States, and internationally.

Undervalued with excellent balance sheet.