The Australian market has shown a steady rise, gaining 7.2% over the past year with earnings projected to grow by 11% annually. In such conditions, identifying stocks with solid financials can be key to finding opportunities for growth and value. While the term "penny stock" may seem outdated, these smaller or newer companies can still offer significant potential when they are financially robust, presenting investors with unique opportunities for discovering quality investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.49 | A$140.43M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.815 | A$50.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$412.55M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.50 | A$258.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$38.83M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.76 | A$363.06M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.30 | A$1.41B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited provides debt resolution services and develops digital engagement platforms in Australia and New Zealand, with a market cap of A$110.41 million.

Operations: The company's revenue is derived from two main segments: Collections, which generated A$37.87 million, and Legal Services, contributing A$9.08 million.

Market Cap: A$110.41M

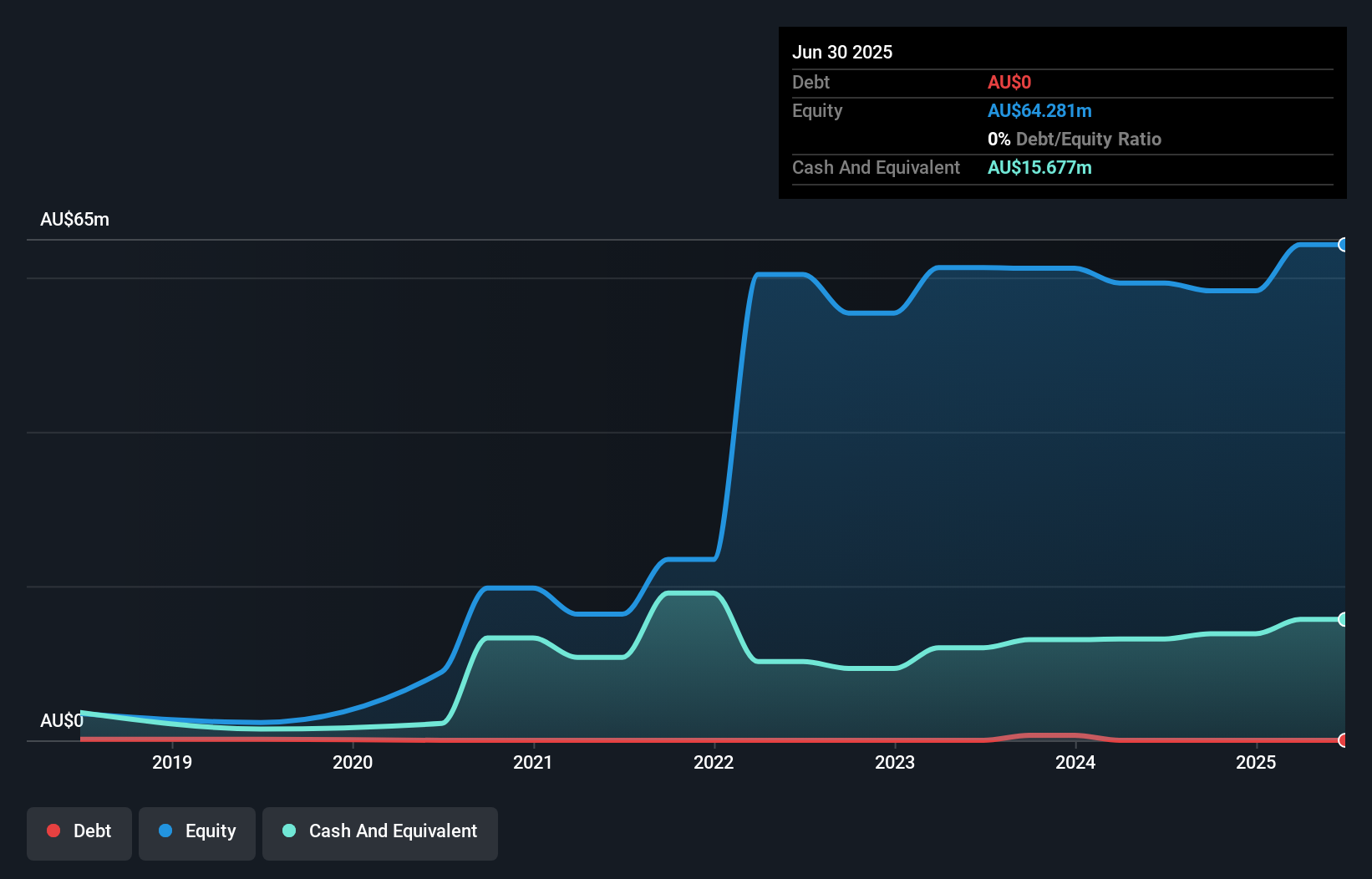

Credit Clear Limited has demonstrated substantial growth, reporting A$46.92 million in sales for the year ended June 2025, with a net income of A$3.55 million, marking its transition to profitability. The company is debt-free and maintains strong financial health with short-term assets exceeding both short and long-term liabilities. Despite trading at a significant discount to its estimated fair value, it offers good relative value compared to peers. With experienced management and board members, Credit Clear anticipates revenue between A$50 million and A$52 million for fiscal year 2026, driven by recent client onboarding investments and a focus on operating leverage.

- Click to explore a detailed breakdown of our findings in Credit Clear's financial health report.

- Explore Credit Clear's analyst forecasts in our growth report.

Medical Developments International (ASX:MVP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Medical Developments International Limited manufactures and distributes emergency medical solutions across Australia, Asia, Europe, the United States, and internationally with a market cap of A$78.86 million.

Operations: The company generates revenue from two main segments: Pain Management, contributing A$26.19 million, and Respiratory, with A$12.87 million.

Market Cap: A$78.86M

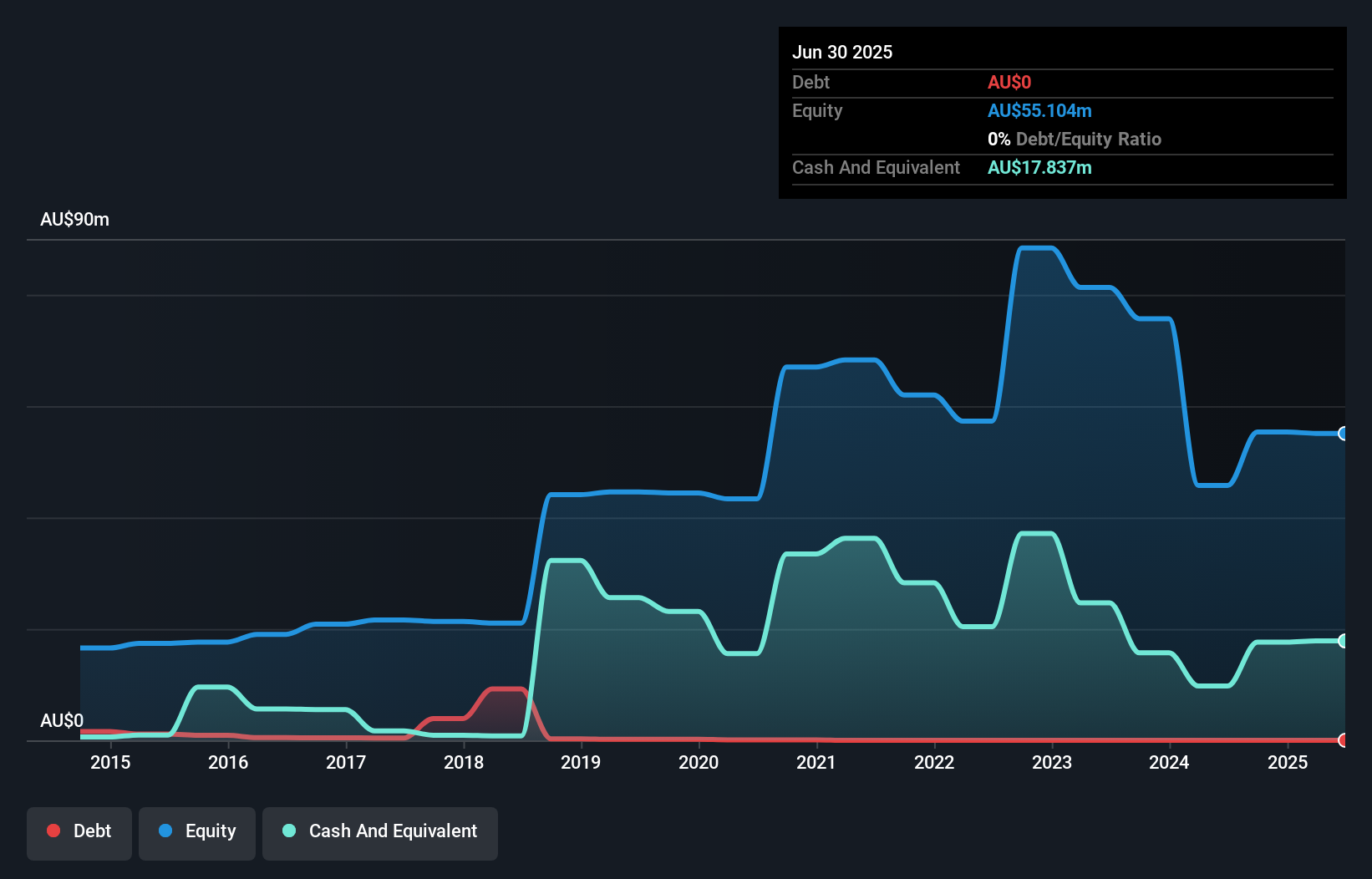

Medical Developments International Limited has transitioned to profitability, reporting A$39.06 million in sales for the year ended June 2025 and a net income of A$0.094 million, reversing a previous net loss. The company is debt-free, with short-term assets of A$35.5 million comfortably covering both short-term and long-term liabilities totaling A$11.3 million. Despite trading at a significant discount to its estimated fair value, it offers good relative value within the industry. The management team and board are experienced, contributing to stable operations as earnings are forecasted to grow significantly in the coming years.

- Jump into the full analysis health report here for a deeper understanding of Medical Developments International.

- Learn about Medical Developments International's future growth trajectory here.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

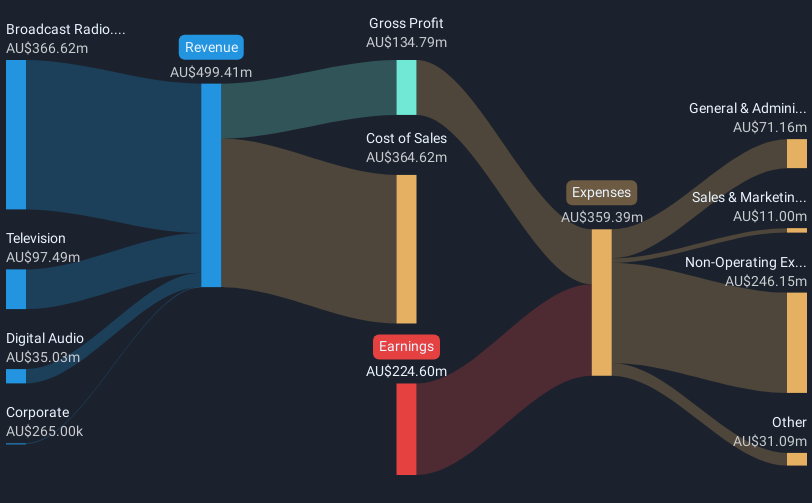

Overview: Southern Cross Media Group Limited, with a market cap of A$194.32 million, creates audio content for distribution across broadcast and digital networks in Australia.

Operations: The company's revenue is derived from two main segments: Broadcast Radio, contributing A$376.76 million, and Digital Audio, generating A$45.11 million.

Market Cap: A$194.32M

Southern Cross Media Group Limited has shown a turnaround, achieving profitability with A$421.87 million in sales and a net income of A$9.19 million for the year ending June 2025, reversing a significant previous loss. Despite its satisfactory net debt to equity ratio of 31.8%, short-term assets do not cover long-term liabilities, indicating potential financial strain. The company's digital audio segment is expected to maintain double-digit growth rates, contributing positively to future revenue forecasts between A$435 million and A$440 million for fiscal 2026. However, interest payments remain poorly covered by EBIT at just 1.5 times coverage.

- Take a closer look at Southern Cross Media Group's potential here in our financial health report.

- Assess Southern Cross Media Group's future earnings estimates with our detailed growth reports.

Make It Happen

- Jump into our full catalog of 427 ASX Penny Stocks here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXL

Southern Cross Media Group

Southern Cross Media Group Limited, together with its subsidiaries, creates audio content for distribution on broadcast and digital networks in Australia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives