Stock Analysis

ASX Growth Companies With High Insider Ownership To Watch In June 2024

Reviewed by Simply Wall St

As the ASX200 shows signs of a positive shift, buoyed by favorable movements in international markets and anticipation around the RBA's interest rate decision, investors are keenly watching for opportunities. In this environment, growth companies with high insider ownership on the ASX stand out as potentially strong candidates due to their aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 30.1% |

| Gratifii (ASX:GTI) | 17% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 85.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Growth Rating: ★★★★★★

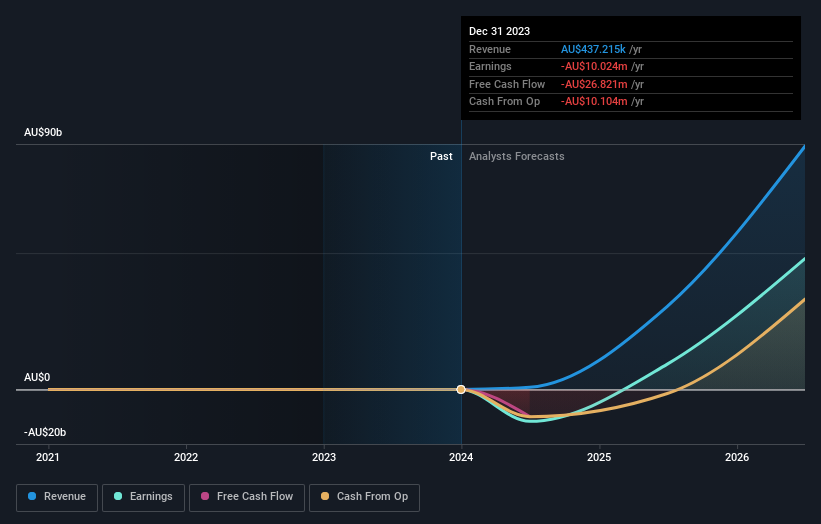

Overview: Botanix Pharmaceuticals Limited, based in Australia, focuses on the research and development of dermatology and antimicrobial products, with a market capitalization of approximately A$519.80 million.

Operations: The company generates revenue primarily from its research and development activities in the dermatology and antimicrobial sectors, totaling A$0.44 million.

Insider Ownership: 11.4%

Revenue Growth Forecast: 120.4% p.a.

Botanix Pharmaceuticals, with less than A$1m in revenue, is poised for significant growth. The company's earnings are expected to surge by 120.89% annually, outpacing the Australian market's average. Despite a recent dilution of shareholders, Botanix maintains high insider ownership and is forecasted to achieve a robust return on equity of 43.9% in three years. However, its financial runway is under one year, highlighting potential short-term funding challenges as it approaches the commercial launch of SofdraÔ.

- Unlock comprehensive insights into our analysis of Botanix Pharmaceuticals stock in this growth report.

- The analysis detailed in our Botanix Pharmaceuticals valuation report hints at an inflated share price compared to its estimated value.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

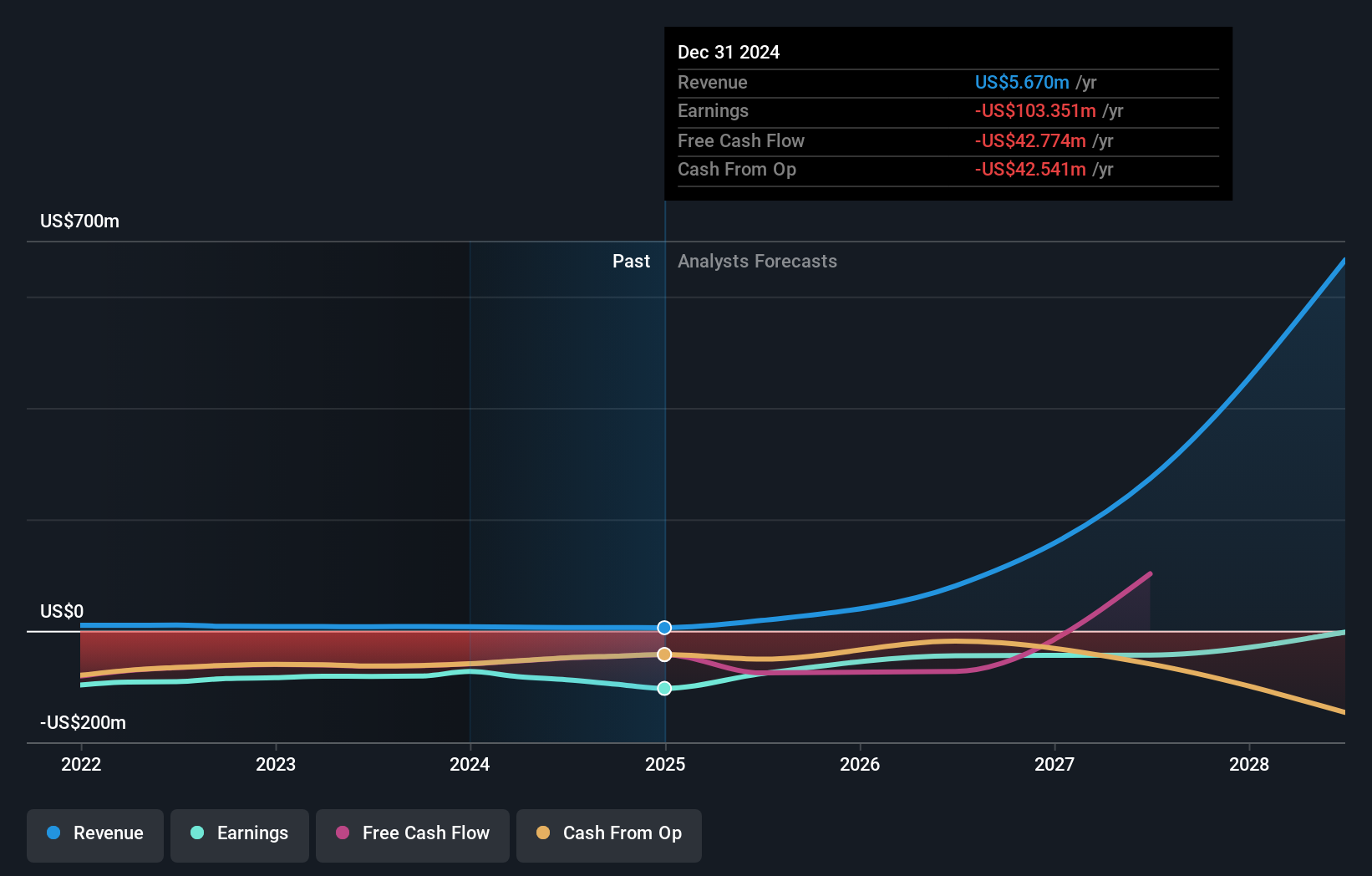

Overview: Mesoblast Limited is a biotechnology company focused on developing regenerative medicine products, operating in Australia, the United States, Singapore, and Switzerland, with a market capitalization of approximately A$1.24 billion.

Operations: The company generates revenue primarily from its adult stem cell technology platform, totaling A$7.47 million.

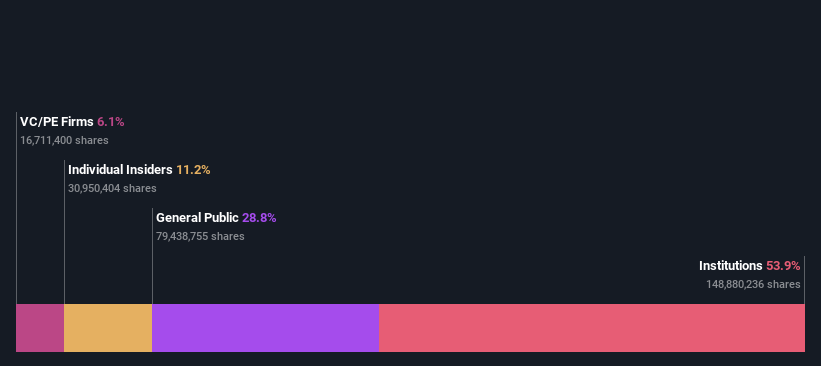

Insider Ownership: 22.2%

Revenue Growth Forecast: 55.3% p.a.

Mesoblast, amidst management shifts and significant funding activities, demonstrates robust growth potential with expected annual revenue increases of 55.3%. Recent leadership changes, including the appointment of Jane Bell as non-executive Chair, align with strategic goals. Although earnings have only grown by 0.4% annually over the past five years, forecasts suggest a sharp rise in profitability within three years. Insider transactions remain positive with more buying than selling recently, underscoring confidence from those closest to the company's operations.

- Navigate through the intricacies of Mesoblast with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Mesoblast implies its share price may be lower than expected.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited, operating both in Australia and internationally, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers, with a market capitalization of approximately A$1.34 billion.

Operations: The company generates revenue primarily through its software and programming segment, amounting to A$171.70 million.

Insider Ownership: 11.3%

Revenue Growth Forecast: 19.7% p.a.

SiteMinder, a leader in hotel management software, recently partnered with Cloudbeds, enhancing its revenue platform and distribution capabilities globally. Although its stock is trading at 45.4% below its estimated fair value, SDR's revenue growth is projected at 19.7% annually, outpacing the Australian market average of 5.4%. Expected to turn profitable within three years with an anticipated high Return on Equity of 24.9%, SiteMinder shows promising growth potential despite lacking substantial insider transactions recently.

- Click to explore a detailed breakdown of our findings in SiteMinder's earnings growth report.

- Our valuation report unveils the possibility SiteMinder's shares may be trading at a premium.

Seize The Opportunity

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing ASX Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Mesoblast is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

High growth potential and good value.