Investors in Invex Therapeutics (ASX:IXC) from three years ago are still down 53%, even after 12% gain this past week

It's nice to see the Invex Therapeutics Ltd (ASX:IXC) share price up 12% in a week. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 88% in that time. So it is really good to see an improvement. Perhaps the company has turned over a new leaf. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Invex Therapeutics

With just AU$1,212,256 worth of revenue in twelve months, we don't think the market considers Invex Therapeutics to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Invex Therapeutics can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Invex Therapeutics investors have already had a taste of the bitterness stocks like this can leave in the mouth.

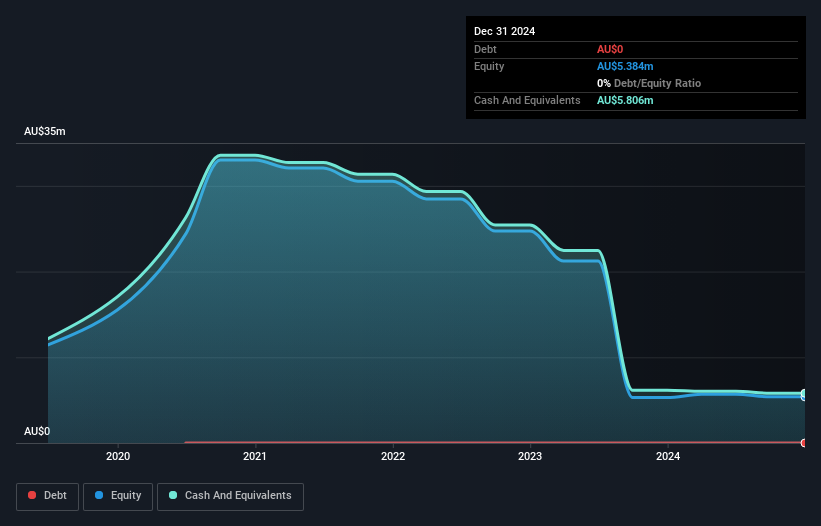

When it last reported its balance sheet in December 2024, Invex Therapeutics could boast a strong position, with cash in excess of all liabilities of AU$5.3m. That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 23% per year, over 3 years , it seems like the market might have been over-excited previously. You can see in the image below, how Invex Therapeutics' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Invex Therapeutics' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Invex Therapeutics hasn't been paying dividends, but its TSR of -53% exceeds its share price return of -88%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Invex Therapeutics shareholders are down 25% for the year, but the market itself is up 4.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Invex Therapeutics is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IXC

Invex Therapeutics

A biopharmaceutical company, engages in the research and development of treatments for neurological conditions in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives