Immutep (ASX:IMM) shareholder returns have been , earning 29% in 3 years

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, Immutep Limited (ASX:IMM) shareholders have seen the share price rise 27% over three years, well in excess of the market return (10%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 14% , including dividends .

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Immutep

With just AU$3,505,722 worth of revenue in twelve months, we don't think the market considers Immutep to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Immutep comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

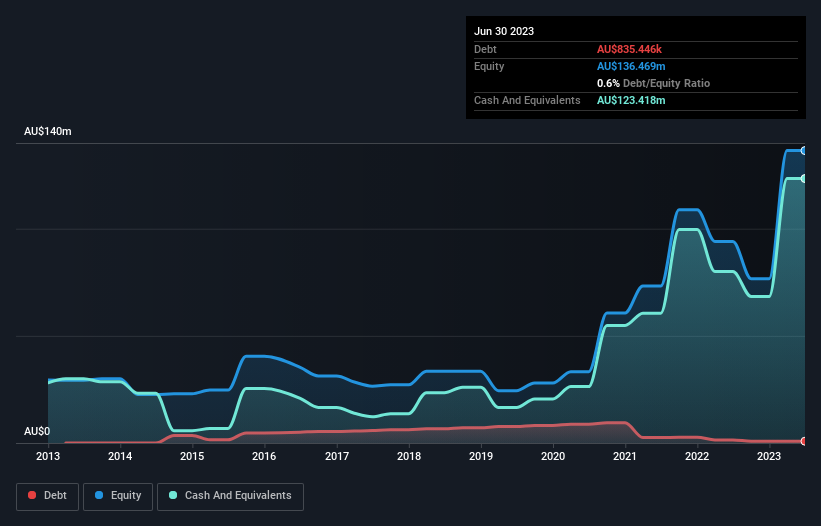

Immutep has plenty of cash in the bank, with cash in excess of all liabilities sitting at AU$112m, when it last reported (June 2023). This gives management the flexibility to drive business growth, without worrying too much about cash reserves. And with the share price up 142% per year, over 3 years , the market is focussed on that blue sky potential. You can click on the image below to see (in greater detail) how Immutep's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We're pleased to report that Immutep shareholders have received a total shareholder return of 14% over one year. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Immutep better, we need to consider many other factors. For example, we've discovered 2 warning signs for Immutep that you should be aware of before investing here.

Of course Immutep may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IMM

Immutep

A biotechnology company, engages in developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives