Australian shares are showing signs of consolidation after a recent bullish surge, with the ASX 200 futures indicating a slight decline. Amid such market dynamics, investors often seek opportunities in lesser-known areas like penny stocks, which can still offer growth potential despite their niche status. These smaller or newer companies may present surprising value and stability, making them worth exploring for those interested in diversifying their portfolios.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.48 | A$116.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.795 | A$49.5M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.84 | A$437.26M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.20 | A$236.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Count (ASX:CUP) | A$1.04 | A$173.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.77 | A$367.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.28 | A$1.4B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dimerix Limited is a biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs in Australia, with a market cap of A$327.10 million.

Operations: The company generates revenue of A$5.59 million from the development of occupational drug testing devices and new therapeutic agents.

Market Cap: A$327.1M

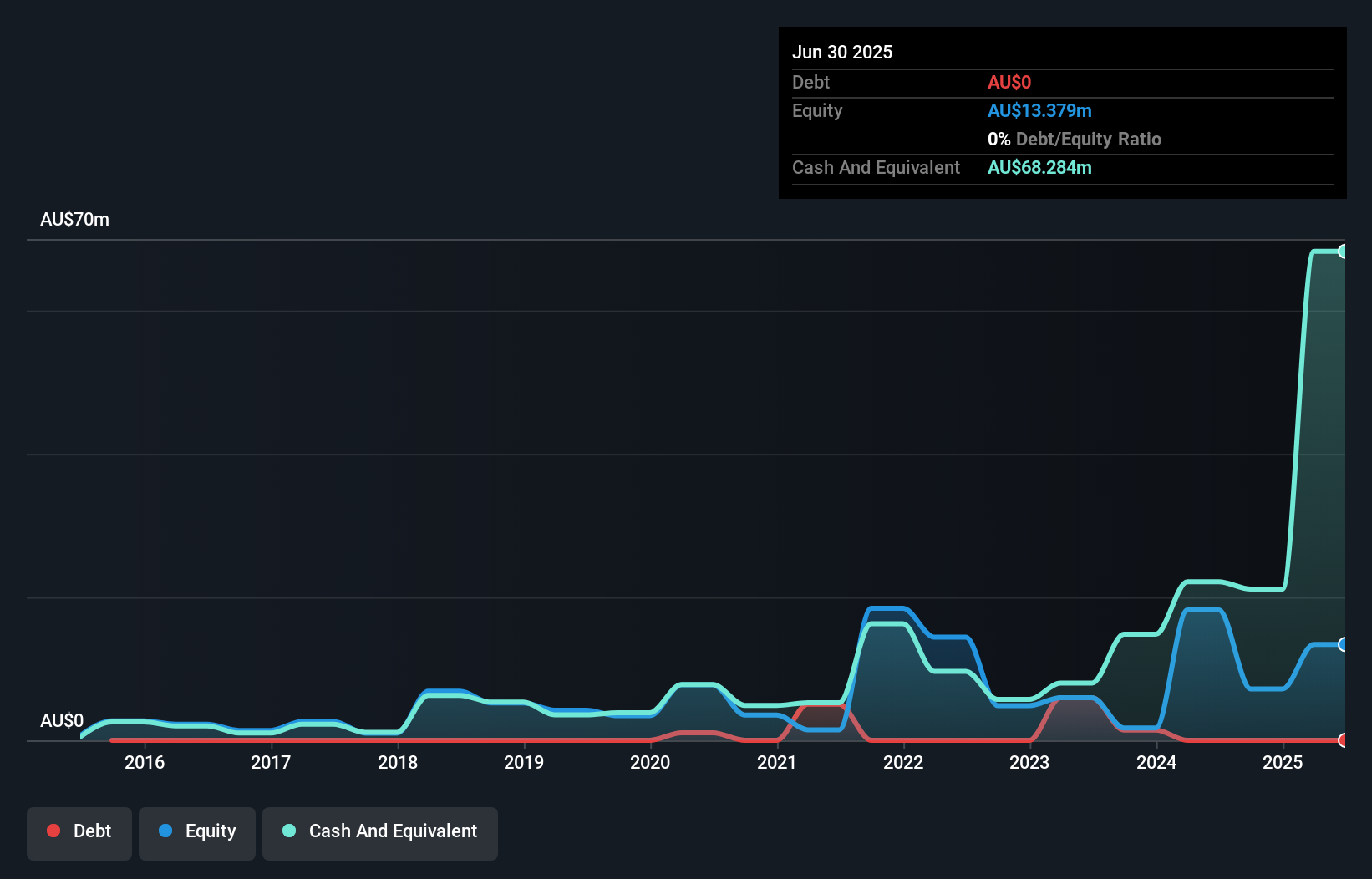

Dimerix Limited, a biopharmaceutical company, operates with a market cap of A$327.10 million and reported revenue of A$5.59 million for the year ending June 2025, marking significant growth from the previous year's A$0.41 million. Despite being unprofitable with a net loss of A$13.25 million, Dimerix benefits from having no debt and sufficient cash runway for over three years due to positive free cash flow growth. The management team is experienced with an average tenure of 4.4 years, and its board has an average tenure of eight years, providing stability in leadership amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Dimerix's financial health report.

- Assess Dimerix's previous results with our detailed historical performance reports.

HMC Capital (ASX:HMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HMC Capital Limited, along with its subsidiaries, owns and manages real estate-focused funds in Australia and has a market capitalization of approximately A$1.39 billion.

Operations: HMC Capital generates revenue through its diverse segments, including Digital (A$84.1 million), Real Estate (A$79.8 million), Private Credit (A$42 million), and Private Equity (A$28.3 million).

Market Cap: A$1.39B

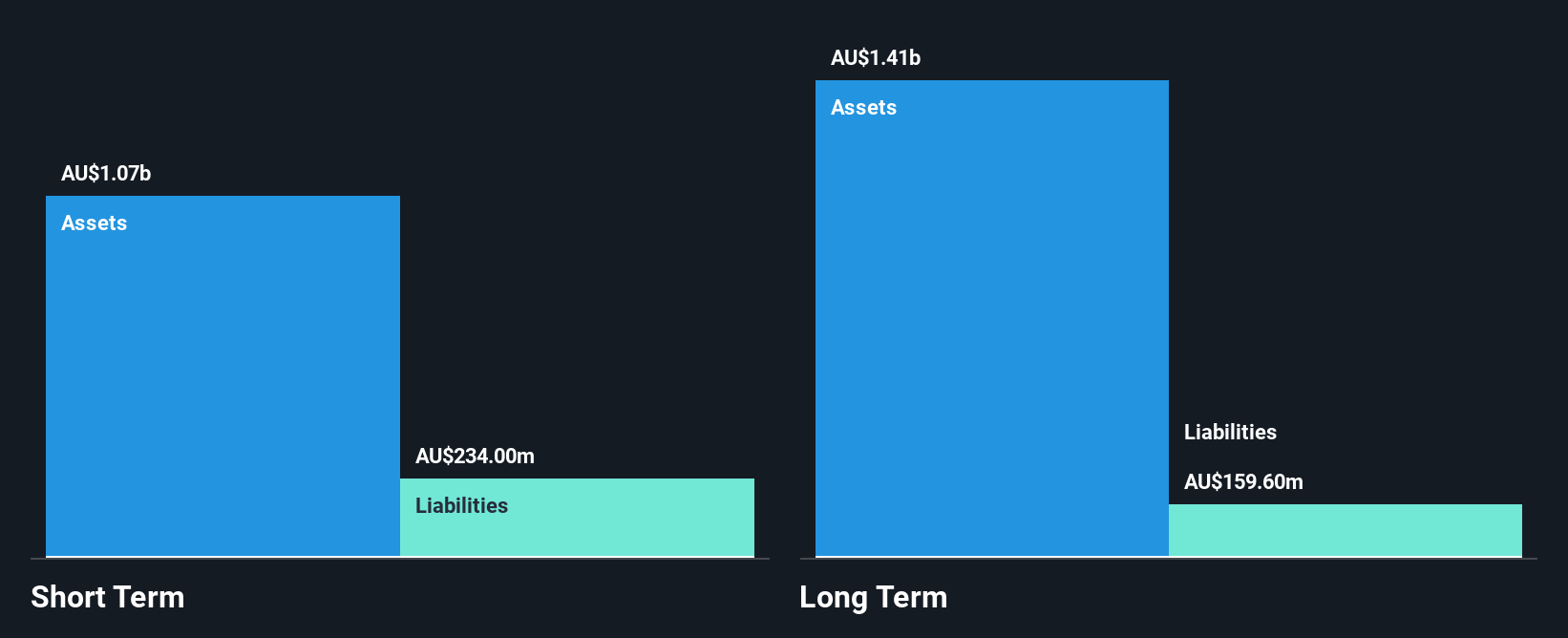

HMC Capital, with a market cap of A$1.39 billion, has demonstrated robust financial performance, reporting A$234.2 million in sales for the year ending June 2025, up from A$93.2 million the previous year. The company's earnings grew by 123.2%, surpassing industry averages and highlighting strong operational efficiency despite a large one-off loss impacting recent results. HMC's debt is well-managed with more cash than total debt and operating cash flow covering 24% of its debt obligations. However, its dividend yield of 3.57% remains unsupported by free cash flows, posing potential risks for income-focused investors amidst ongoing strategic evaluations in its energy transition portfolio.

- Click here to discover the nuances of HMC Capital with our detailed analytical financial health report.

- Review our growth performance report to gain insights into HMC Capital's future.

SomnoMed (ASX:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SomnoMed Limited, along with its subsidiaries, manufactures and sells devices for the oral treatment of sleep-related disorders across the Asia Pacific region, North America, and Europe, with a market cap of A$188.73 million.

Operations: The company generates A$111.49 million in revenue from its production and sale of products designed to treat sleep disordered breathing.

Market Cap: A$188.73M

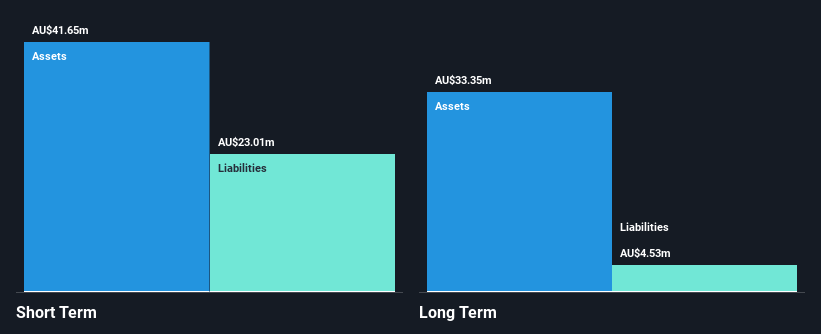

SomnoMed Limited, with a market cap of A$188.73 million, reported a net loss of A$3.46 million for the fiscal year ending June 2025, though this loss was significantly lower than the previous year's A$12.24 million. The company anticipates revenue between A$119 million and A$126 million for fiscal 2026, indicating potential growth in its operations focused on sleep disorder treatments. Despite being unprofitable, SomnoMed's short-term assets exceed both its long-term and short-term liabilities, and it has reduced its debt to equity ratio substantially over five years while maintaining a sufficient cash runway exceeding three years.

- Unlock comprehensive insights into our analysis of SomnoMed stock in this financial health report.

- Gain insights into SomnoMed's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Navigate through the entire inventory of 424 ASX Penny Stocks here.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DXB

Dimerix

A biopharmaceutical company, develops and commercializes pharmaceutical products for unmet medical needs in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success