The Australian stock market recently demonstrated resilience, with the ASX climbing above the 7,800 points level despite mixed performances in global markets. In such a landscape, investors often seek out smaller or newer companies that can offer unique growth opportunities. Although "penny stocks" may sound like an outdated term, these stocks represent potential value investments; when backed by strong financials and fundamentals, they can provide significant upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.10 | A$154.99M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.58 | A$74.53M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.35 | A$362.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.19 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.795 | A$603.41M | ✅ 4 ⚠️ 3 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$1.10 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.47 | A$1.13B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.3825 | A$44.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 982 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dimerix Limited is a biopharmaceutical company based in Australia that focuses on developing and commercializing pharmaceutical products to address unmet medical needs, with a market cap of A$237.68 million.

Operations: Dimerix generates revenue primarily from its biotechnology segment, amounting to A$0.74 million.

Market Cap: A$237.68M

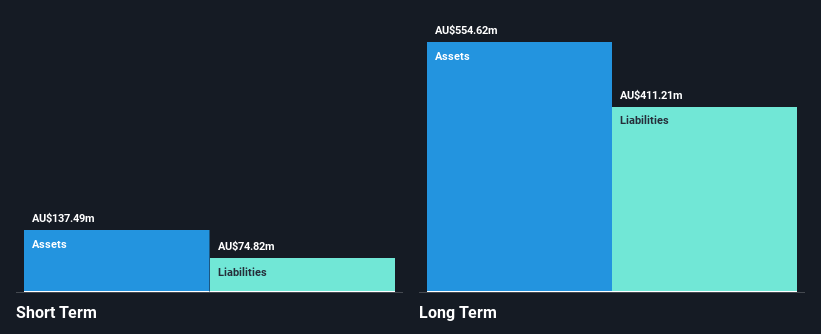

Dimerix Limited, with a market cap of A$237.68 million, is pre-revenue, generating only A$0.74 million in revenue from its biotechnology segment. The company reported a net loss of A$12.91 million for the half-year ending December 2024, an increase from the prior year. Despite being debt-free and having experienced management and board members, Dimerix faces challenges with less than a year of cash runway if current cash flow trends persist. Its addition to the S&P/ASX All Ordinaries Index reflects some market recognition despite its financial hurdles and high volatility stability over the past year.

- Click here to discover the nuances of Dimerix with our detailed analytical financial health report.

- Understand Dimerix's track record by examining our performance history report.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sovereign Metals Limited, with a market cap of A$425.91 million, is involved in the exploration and development of mineral resource projects in Malawi.

Operations: Sovereign Metals Limited has not reported any revenue segments.

Market Cap: A$425.91M

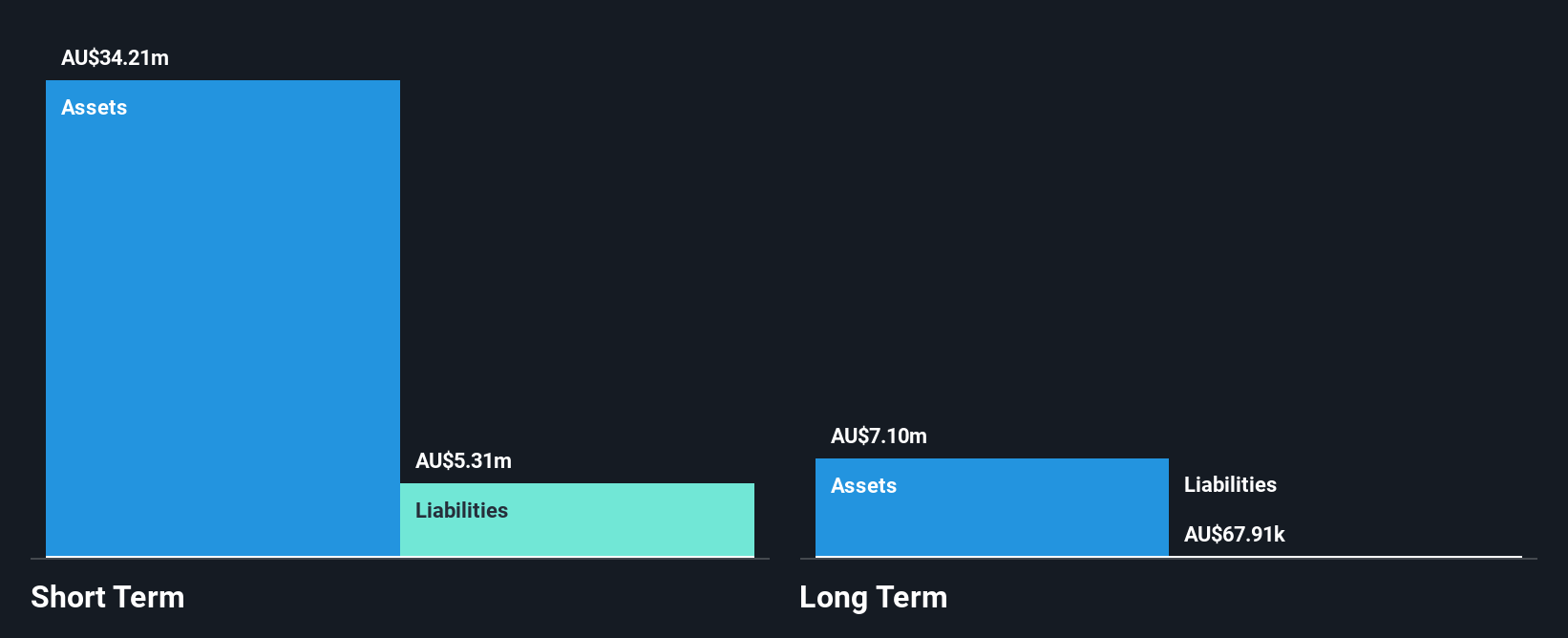

Sovereign Metals Limited, with a market cap of A$425.91 million, is pre-revenue and focuses on its Kasiya Rutile Graphite Project in Malawi. The company recently completed a A$40 million equity offering to support ongoing development efforts. Despite being debt-free and having sufficient cash runway for over a year, Sovereign's management team lacks extensive experience with an average tenure of 1.5 years. The board is more seasoned with an average tenure of 6.9 years. Recent geotechnical drilling at Kasiya aims to enhance the project's feasibility study due later this year, potentially bolstering future prospects in the graphite market.

- Dive into the specifics of Sovereign Metals here with our thorough balance sheet health report.

- Assess Sovereign Metals' future earnings estimates with our detailed growth reports.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, with a market cap of A$165.53 million, creates audio content for distribution across broadcast and digital networks in Australia.

Operations: The company generates revenue through its Digital Audio segment, contributing A$41.57 million, and its Broadcast Radio segment, bringing in A$370.70 million.

Market Cap: A$165.53M

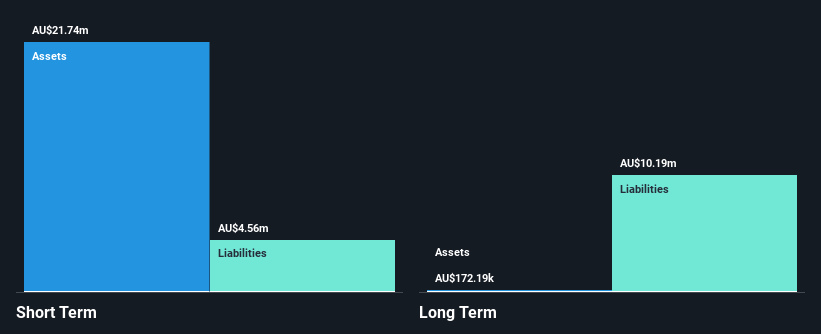

Southern Cross Media Group, with a market cap of A$165.53 million, faces challenges despite generating significant revenue from its Digital Audio and Broadcast Radio segments. Recent events include its removal from the S&P/ASX All Ordinaries Index and a decision to halt dividends to focus on debt reduction. The company remains unprofitable with negative return on equity but has managed to reduce its debt-to-equity ratio over five years. While short-term liabilities are covered by assets, long-term liabilities remain uncovered. Leadership changes aim to strengthen financial oversight as earnings are forecasted to grow significantly in the coming years.

- Click to explore a detailed breakdown of our findings in Southern Cross Media Group's financial health report.

- Understand Southern Cross Media Group's earnings outlook by examining our growth report.

Seize The Opportunity

- Dive into all 982 of the ASX Penny Stocks we have identified here.

- Want To Explore Some Alternatives? We've found 28 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DXB

Dimerix

A biopharmaceutical company, develops and commercializes pharmaceutical products for unmet medical needs in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026