- Australia

- /

- Healthtech

- /

- ASX:AYA

Top Three High Growth Tech Stocks in Australia

Reviewed by Simply Wall St

As the Australian market remains relatively stable with the ASX ending slightly in the red midweek, investors are keeping a keen eye on sectors showing resilience and potential for growth, particularly within the tech space. In this environment, identifying high growth tech stocks requires attention to companies that not only navigate current economic conditions effectively but also demonstrate innovation and adaptability amidst broader market sentiment.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 11.53% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| Pro Medicus | 19.44% | 20.97% | ★★★★★☆ |

| Immutep | 104.12% | 46.46% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 49.60% | 61.45% | ★★★★★☆ |

| Wrkr | 53.03% | 122.27% | ★★★★★★ |

| PYC Therapeutics | 10.34% | 39.40% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.95% | 57.30% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting and diagnosing coronary artery disease in Australia, with a market capitalization of A$395.22 million.

Operations: Artrya Limited focuses on the development and commercialization of AI-driven CCTA image analysis technology, generating revenue of A$0.03 million from this segment.

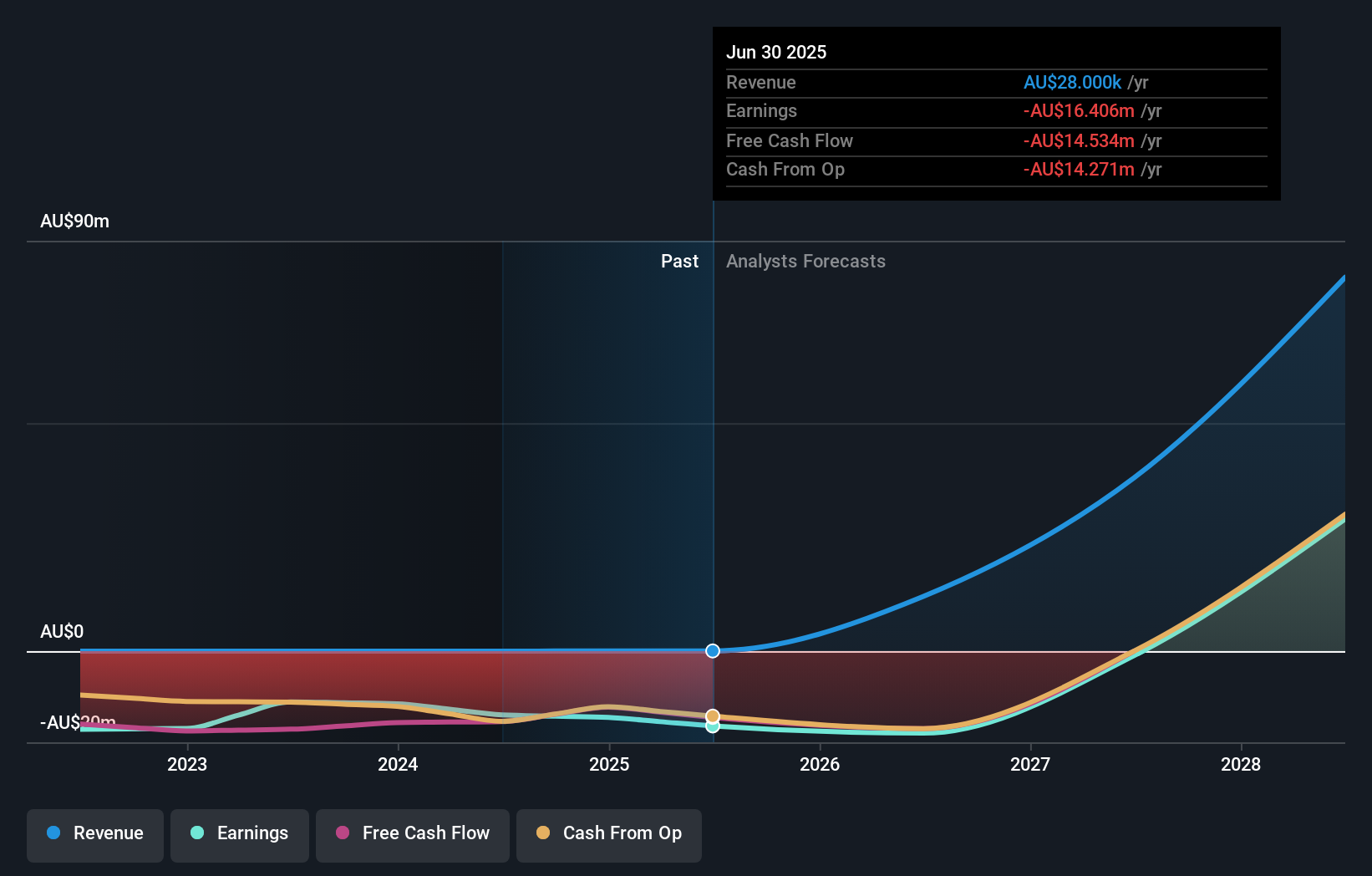

Artrya, an emerging player in the Australian tech landscape, recently bolstered its market position with a successful follow-on equity offering raising AUD 80 million. This strategic move follows its significant regulatory milestone—receiving FDA 510(k) clearance for its Salix® Coronary Plaque module, which predicts high-risk heart conditions using AI. This approval could revolutionize patient diagnostics in the U.S., potentially increasing Artrya's revenue streams significantly. Despite a challenging financial year with a net loss of AUD 16.41 million and minimal sales of AUD 28K, the company's innovative approach and recent FDA clearance set a promising stage for future growth, aligning with an expected annual revenue surge of 49.6%.

- Unlock comprehensive insights into our analysis of Artrya stock in this health report.

Review our historical performance report to gain insights into Artrya's's past performance.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across multiple regions including Australia, Europe, the United States, and Switzerland with a market cap of A$605.99 million.

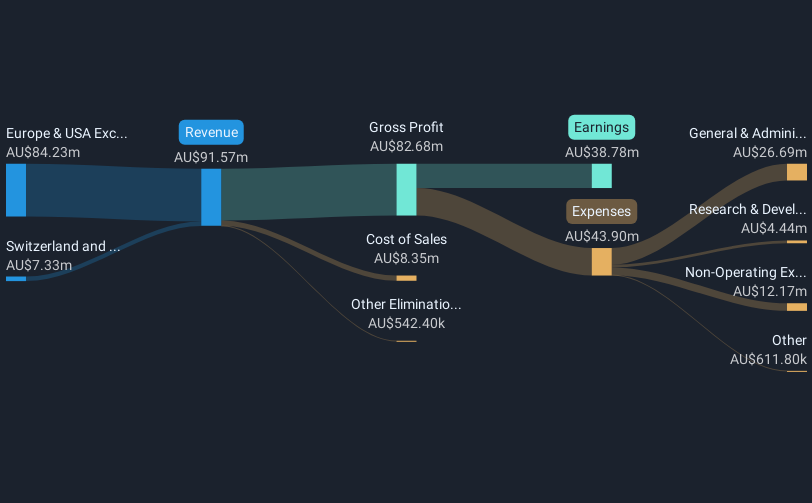

Operations: Clinuvel Pharmaceuticals generates revenue primarily from its biopharmaceutical sector, amounting to A$95.02 million. The company operates across various regions, focusing on innovative treatments for complex health conditions.

Clinuvel Pharmaceuticals, under the renewed leadership of CEO Dr. Philippe Wolgen, is poised for robust growth with a notable 22% annual revenue increase and an earnings surge of 26.2%. Despite a slow pace in share buybacks, the firm's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in the biotech industry. With earnings quality considered high and a forecasted return on equity of 18.9%, Clinuvel stands out not just for its financial health but also for its strategic focus on operational excellence and market expansion.

- Get an in-depth perspective on Clinuvel Pharmaceuticals' performance by reading our health report here.

Gain insights into Clinuvel Pharmaceuticals' past trends and performance with our Past report.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the global automotive industry with a market cap of A$635.80 million.

Operations: Infomedia generates revenue primarily from its publishing segment, which includes the development and supply of electronic parts catalogues and related software solutions for the automotive industry, amounting to A$146.51 million.

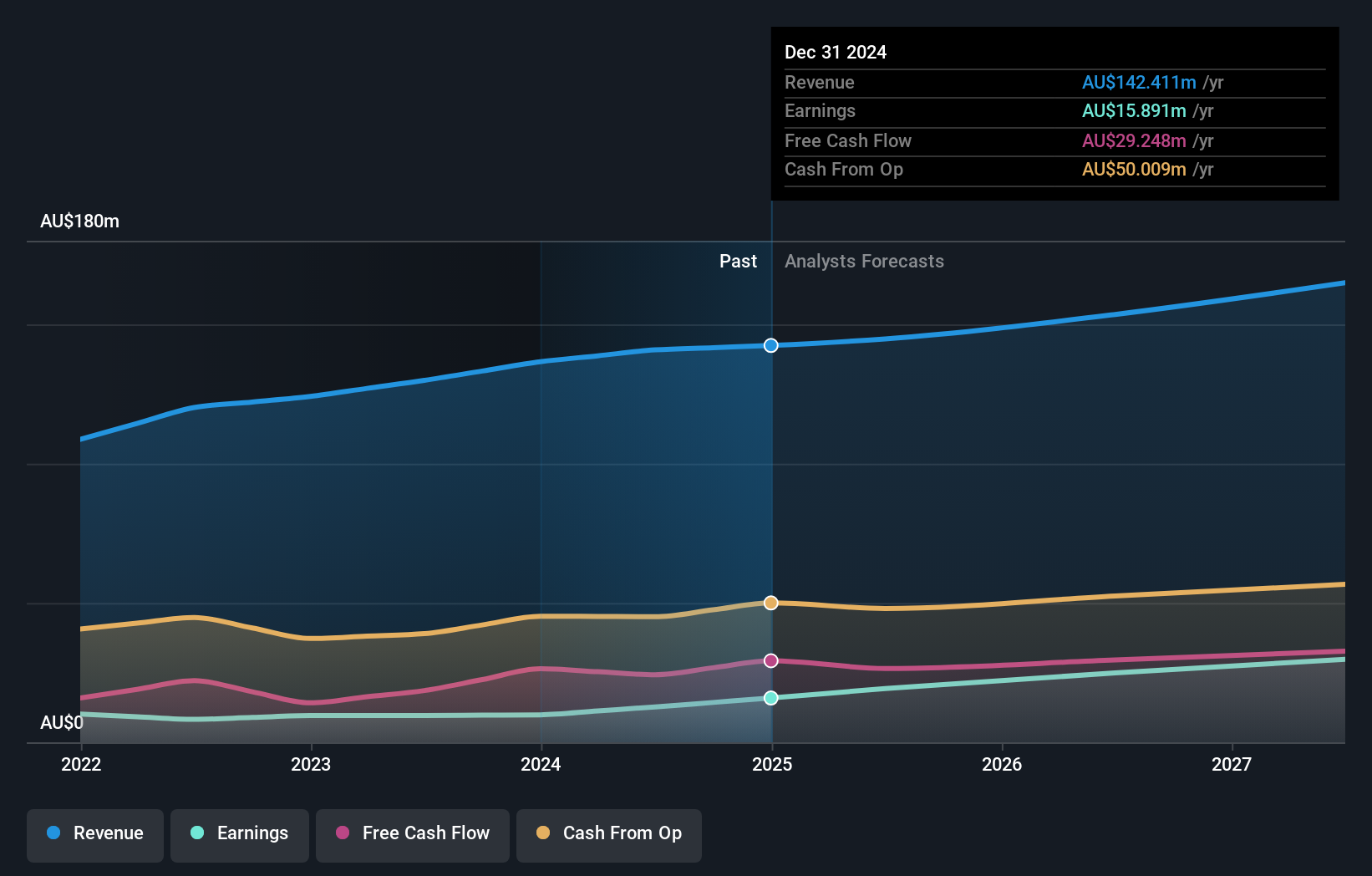

Infomedia, a key player in Australia's tech landscape, showcases robust growth with its earnings surging by 31.6% over the past year, outpacing the software industry average of 30.4%. This performance is underpinned by strategic R&D investments which have positioned the company well for future innovation. Notably, Infomedia has announced a revenue guidance for 2026 projecting sales between AUD 152 million to AUD 159 million, reflecting confidence in continued growth. Additionally, despite minimal share repurchases this year, the firm's strong earnings quality and an anticipated return on equity of 21.7% highlight its financial health and operational efficiency in a competitive market.

- Click to explore a detailed breakdown of our findings in Infomedia's health report.

Explore historical data to track Infomedia's performance over time in our Past section.

Seize The Opportunity

- Reveal the 22 hidden gems among our ASX High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AYA

Artrya

A medical technology company, engages in the development and commercialization of artificial intelligence platform that detects, diagnoses, and address coronary artery disease in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives