Clinuvel Pharmaceuticals (ASX:CUV) Shareholders Have Enjoyed A Whopping 648% Share Price Gain

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. For example, the Clinuvel Pharmaceuticals Limited (ASX:CUV) share price is up a whopping 648% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. The last week saw the share price soften some 2.0%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Clinuvel Pharmaceuticals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

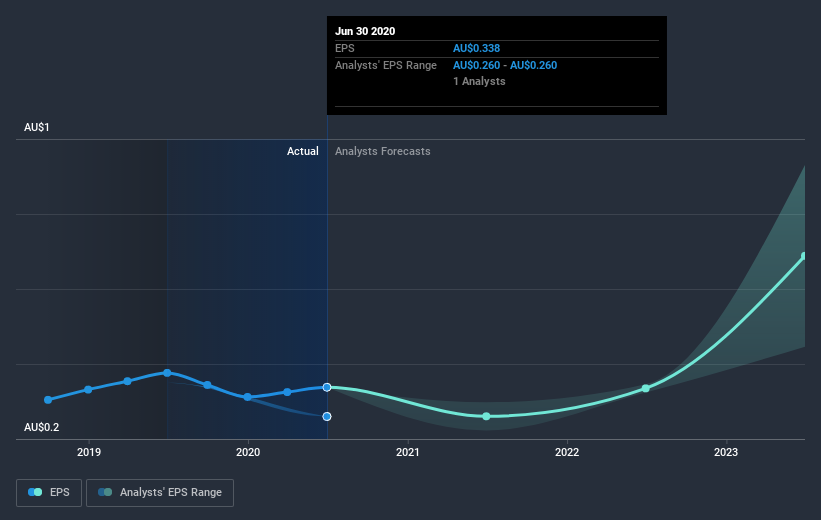

During the five years of share price growth, Clinuvel Pharmaceuticals moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Clinuvel Pharmaceuticals share price is up 158% in the last three years. In the same period, EPS is up 31% per year. That makes the EPS growth rather close to the annualized share price gain of 37% over the same period. So one might argue that investor sentiment towards the stock hss not changed much over time. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Clinuvel Pharmaceuticals has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Clinuvel Pharmaceuticals' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Clinuvel Pharmaceuticals' TSR for the last 5 years was 651%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Clinuvel Pharmaceuticals shareholders are down 18% for the year (even including dividends), but the market itself is up 0.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 50%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Clinuvel Pharmaceuticals better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Clinuvel Pharmaceuticals .

But note: Clinuvel Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Clinuvel Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives