Codan Leads Three Undervalued Small Caps With Insider Actions In Australia

Reviewed by Simply Wall St

In recent trading sessions, the Australian market has shown mixed signals with the ASX200 marginally up by 0.1%. Notably, the IT sector outperformed, gaining 0.9%, while materials faced a downturn, nearly losing 1%. In such a fluctuating environment, identifying undervalued small-cap stocks like Codan that show potential for growth becomes crucial for investors looking for opportunities amidst broader market movements.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.3x | 2.6x | 41.40% | ★★★★★★ |

| Nick Scali | 14.1x | 2.6x | 42.26% | ★★★★★☆ |

| Healius | NA | 0.6x | 45.22% | ★★★★★☆ |

| Codan | 29.1x | 4.3x | 20.83% | ★★★★☆☆ |

| Eagers Automotive | 9.7x | 0.3x | 29.51% | ★★★★☆☆ |

| Elders | 20.2x | 0.4x | 47.39% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.7x | 19.50% | ★★★★☆☆ |

| RAM Essential Services Property Fund | NA | 5.8x | 39.21% | ★★★★☆☆ |

| Dicker Data | 21.2x | 0.8x | -0.10% | ★★★☆☆☆ |

| Coventry Group | 295.6x | 0.4x | -32.12% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

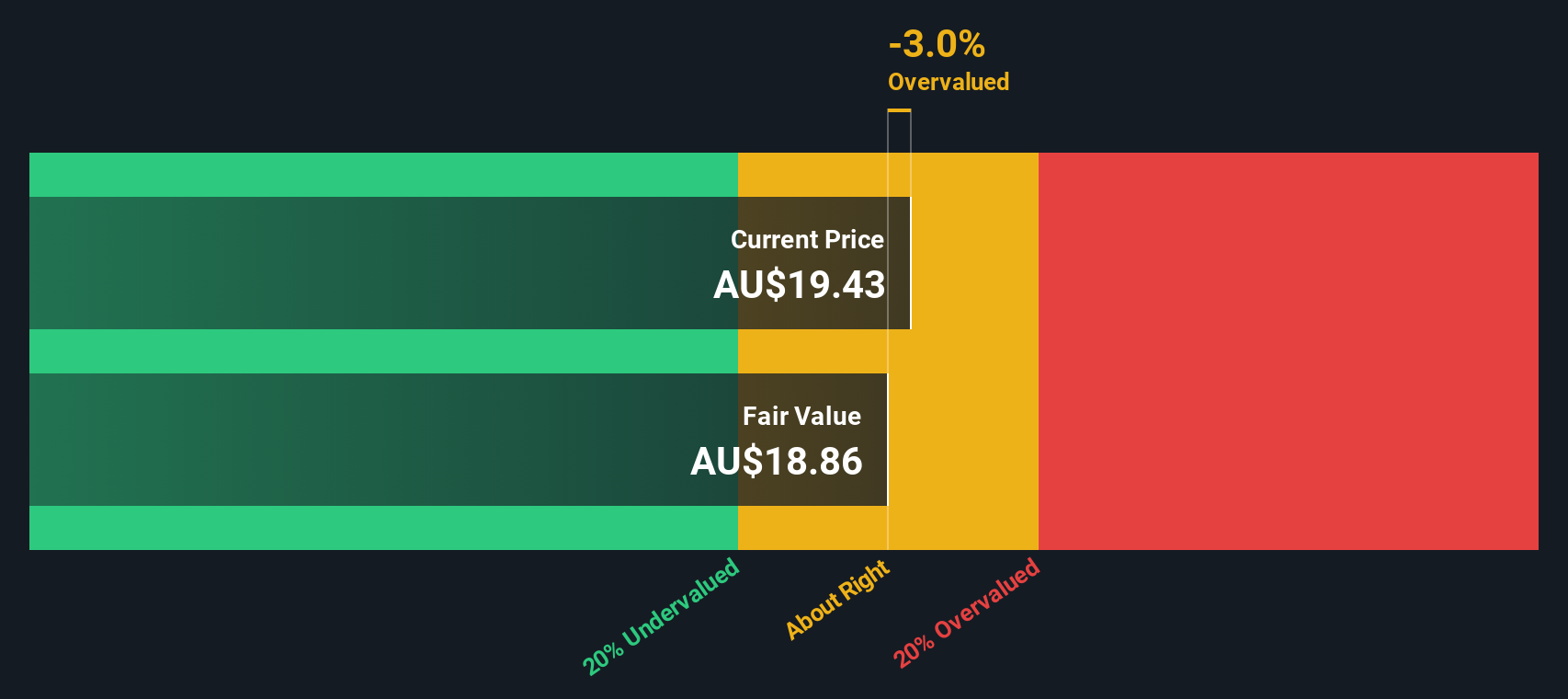

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of approximately A$1.07 billion.

Operations: The company generates revenue primarily from Communications and Metal Detection, contributing A$291.50 million and A$212.20 million respectively. Gross profit margin has shown a notable increase, rising from 59.60% in September 2013 to 54.42% by December 2024, reflecting changes in cost of goods sold and operational efficiencies over time.

PE: 29.1x

Recently, insider confidence in Codan has been underscored by their share purchases, signaling strong belief in the company's prospects. With earnings expected to grow by 16% annually, this highlights its potential despite reliance on higher-risk funding sources. This Australian firm, often overlooked due to its smaller market presence, offers intriguing growth possibilities rooted in solid insider buying activities and financial forecasts. Such dynamics suggest that Codan might be poised for noteworthy advancements in its sector.

- Dive into the specifics of Codan here with our thorough valuation report.

Gain insights into Codan's past trends and performance with our Past report.

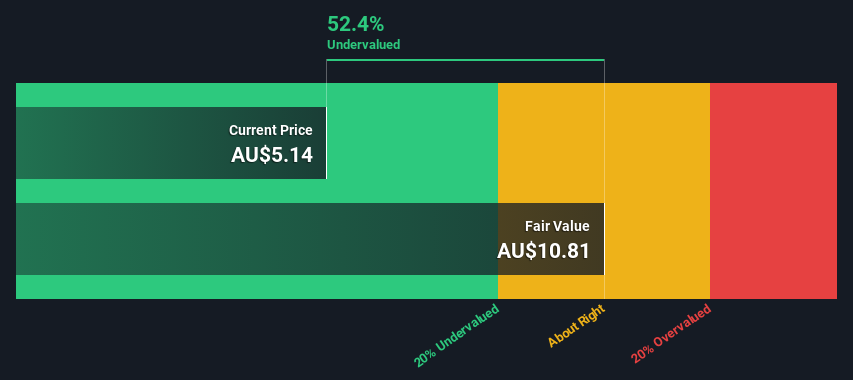

Clarity Pharmaceuticals (ASX:CU6)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clarity Pharmaceuticals is a company focused on the development of radiopharmaceuticals.

Operations: Radiopharmaceutical Development generates A$9.49 million in revenue, consistently achieving a gross profit margin of 100%. The company experiences substantial operating losses, with net income margins worsening over time to -3.22% by the end of 2024 due to escalating R&D expenses, which reached A$36.37 million.

PE: -55.3x

Clarity Pharmaceuticals, despite being unprofitable with no near-term projections for profitability, recently bolstered its financial position through a follow-on equity offering of A$20.33 million. This move, coupled with their active presence at major medical conferences, demonstrates a strategic push to enhance visibility and credibility in the biopharmaceutical sector. Insider confidence is evident as they recently purchased shares, signaling belief in long-term value despite current financial metrics and reliance on high-risk external funding. These elements collectively suggest potential for future growth as the company continues to engage actively in industry events and secure capital.

- Click here to discover the nuances of Clarity Pharmaceuticals with our detailed analytical valuation report.

Evaluate Clarity Pharmaceuticals' historical performance by accessing our past performance report.

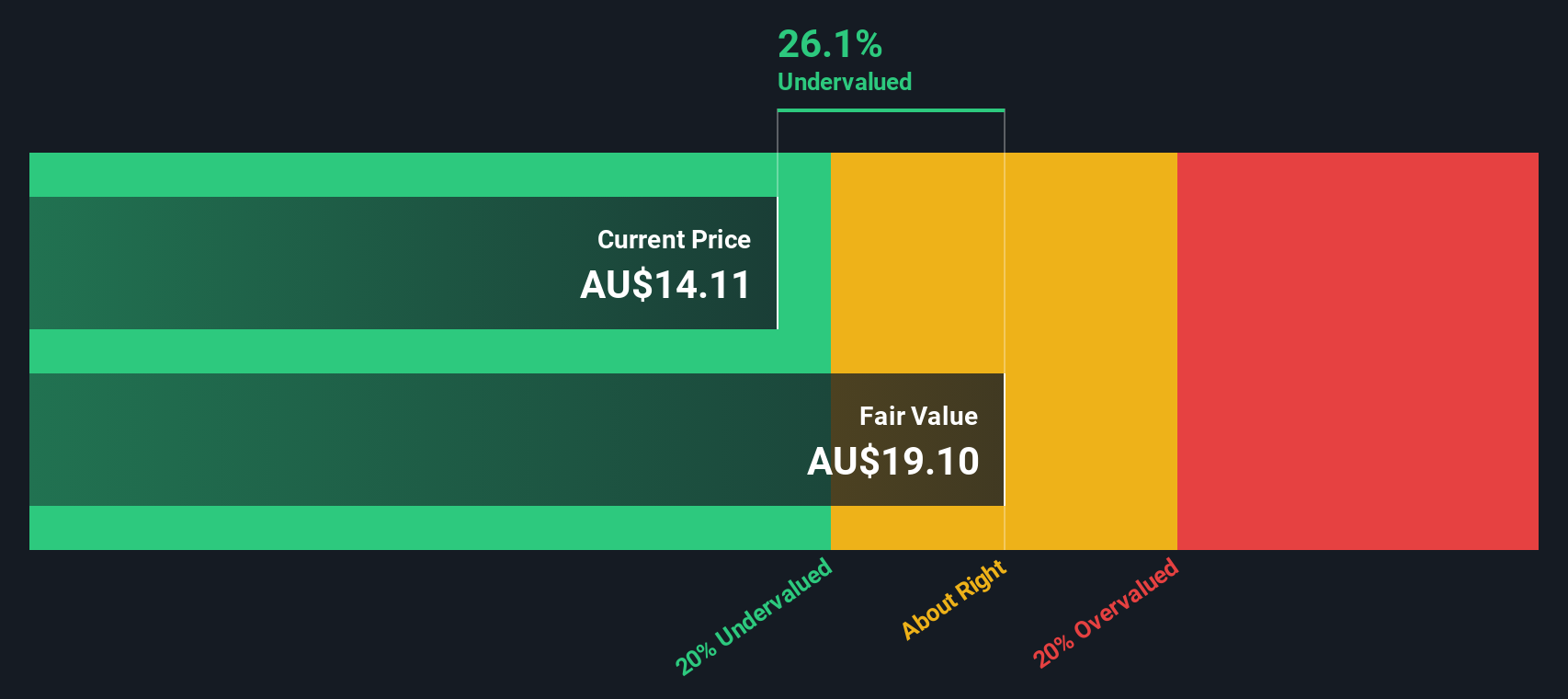

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★★

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit of A$205.19 million after deducting costs of goods sold at A$26.75 million. This segment achieved a gross profit margin of 88.47%.

PE: 17.3x

Neuren Pharmaceuticals, a lesser-known entity in the Australian market, recently showcased promising Phase 2 clinical trial results for NNZ-2591, targeting Pitt Hopkins syndrome—a condition with no approved treatments. This significant development was highlighted during their presentation at the Bell Potter Emerging Leaders Conference. Demonstrating both safety and efficacy, NNZ-2591's progress could position Neuren as an appealing prospect in the biopharmaceutical sector. Moreover, insider confidence is reflected through recent share purchases by executives, underscoring a strong belief in the company’s future trajectory.

- Unlock comprehensive insights into our analysis of Neuren Pharmaceuticals stock in this valuation report.

Understand Neuren Pharmaceuticals' track record by examining our Past report.

Where To Now?

- Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 29 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CU6

Clarity Pharmaceuticals

A clinical stage radiopharmaceutical company, engages in research and development and clinical stage radiopharmaceuticals products in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives