CSL (ASX:CSL) Gains Approval for Updated COVID-19 Vaccine in Japan, Boosting Strategic Alliances

CSL (ASX:CSL) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a 25% increase in net profit after tax and innovative product launches, juxtaposed against near-term market growth difficulties and inflationary pressures. In the discussion that follows, we will delve into CSL's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of CSL.

Strengths: Core Advantages Driving Sustained Success For CSL

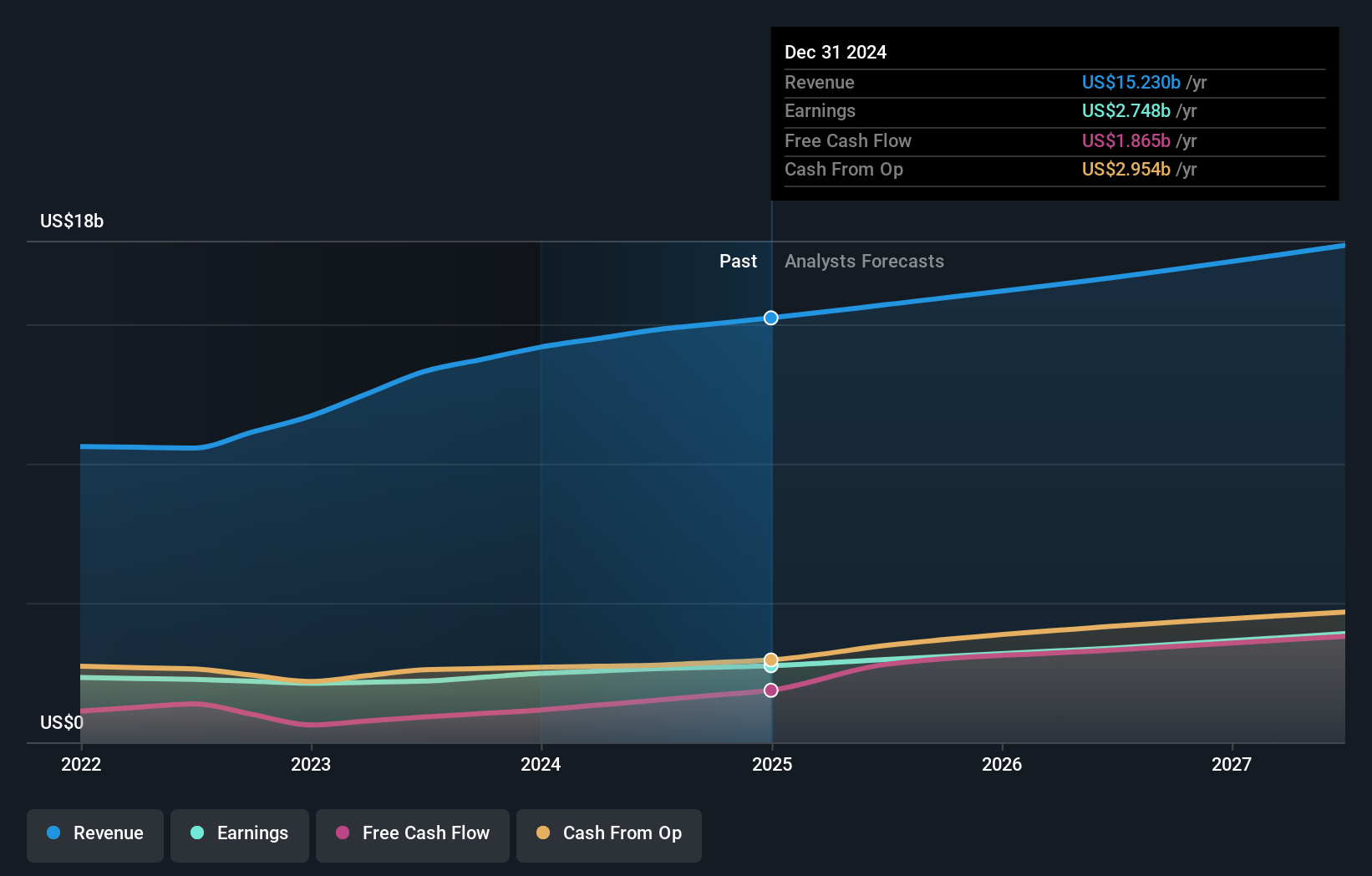

CSL demonstrates robust financial health, highlighted by a 25% increase in net profit after tax to $2.6 billion, as reported by CEO Paul McKenzie in the latest earnings call. This growth is complemented by an 11% rise in revenue to $14.8 billion, showcasing the company's strong market positioning. The innovative product pipeline, a core focus as emphasized by McKenzie, underpins CSL's strategic goals and market leadership. Furthermore, the company has achieved a 120 basis point improvement in gross margin, reinforcing its commitment to operational efficiency. Trading at 14.3% below its estimated fair value of A$345.31, CSL appears undervalued, suggesting potential for market appreciation.

Weaknesses: Critical Issues Affecting CSL's Performance and Areas For Growth

Despite its strengths, CSL faces challenges in market growth, as CFO Joy Linton noted, with both businesses experiencing near-term difficulties. The company's Price-To-Earnings Ratio (36.7x) is higher than the Global Biotechs industry average (26.9x), indicating it may be overvalued compared to industry peers. Additionally, the impact of generic competition on Ferinject and the need to maintain healthy operating margins amidst these pressures are notable concerns. While CSL's earnings are forecast to grow at 12.8% per year, this growth is not considered significant, highlighting the need for strategic initiatives to enhance profitability.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CSL has several strategic opportunities to enhance its market position. The expansion of its geographic footprint with the EU launches of HEMGENIX and TAVNEOS, as well as the Ferinject launch in China, presents significant growth potential. Additionally, the upcoming regulatory approval for garadacimab could introduce a new revenue stream. Leveraging contract manufacturing organizations for fill/finish capabilities can optimize operational efficiency. The company's digital transformation efforts, focusing on center efficiencies, further position CSL to capitalize on emerging market opportunities. Learn more about how these opportunities could impact CSL's future growth by reviewing our analysis of CSL's Future Performance.

Threats: Key Risks and Challenges That Could Impact CSL's Success

CSL faces several external threats that could impact its growth. Increased competition in the HAE space, as mentioned by McKenzie, poses a risk to maintaining its patient base. Economic factors, such as timing differences in trade receivables, could affect financial stability, as highlighted by Linton. Regulatory challenges, including the need to upgrade facilities to comply with new regulations, add to the operational risks. These factors, combined with CSL's high level of debt, underscore the importance of strategic risk management to safeguard its market position.

Conclusion

CSL's strong financial health, marked by significant increases in net profit and revenue, underscores its solid market positioning and operational efficiency, suggesting a promising outlook for sustained growth. However, the company must address challenges such as high Price-To-Earnings Ratio and generic competition, which could impact profitability. Strategic opportunities, including geographic expansion and new product launches, offer pathways to enhance market presence and revenue streams. Despite external threats and operational risks, CSL's current share price trading below its estimated fair value indicates potential for market appreciation, reflecting investor confidence in its future performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:CSL

CSL

Researches, develops, manufactures, markets, and distributes biopharmaceutical and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives