If EPS Growth Is Important To You, Cronos Australia (ASX:CAU) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Cronos Australia (ASX:CAU). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Cronos Australia with the means to add long-term value to shareholders.

Check out our latest analysis for Cronos Australia

Cronos Australia's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Cronos Australia to have grown EPS from AU$0.0035 to AU$0.011 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

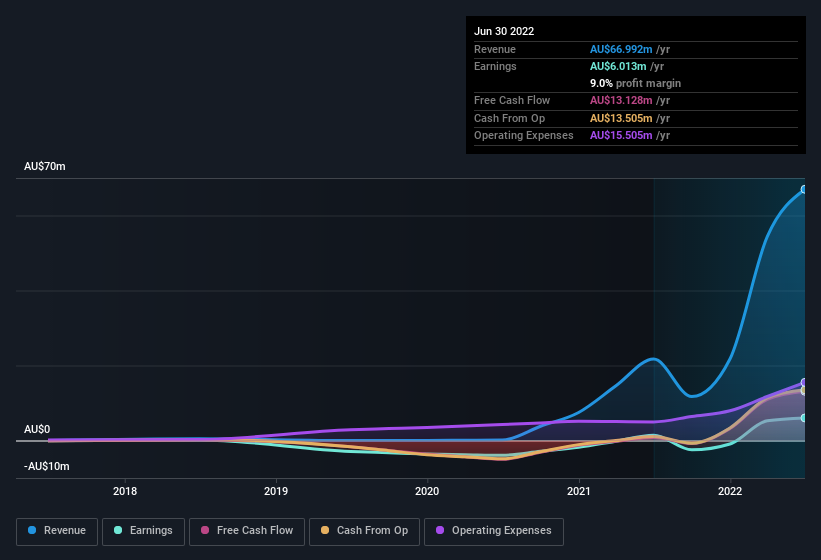

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Cronos Australia shareholders is that EBIT margins have grown from 7.8% to 15% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Cronos Australia isn't a huge company, given its market capitalisation of AU$305m. That makes it extra important to check on its balance sheet strength.

Are Cronos Australia Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in Cronos Australia in the previous 12 months. So it's definitely nice that company insider Shane Tanner bought AU$49k worth of shares at an average price of around AU$0.35. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Cronos Australia insiders own more than a third of the company. In fact, they own 55% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have AU$168m invested in the business, at the current share price. That's nothing to sneeze at!

Should You Add Cronos Australia To Your Watchlist?

Cronos Australia's earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Cronos Australia deserves timely attention. Even so, be aware that Cronos Australia is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Keen growth investors love to see insider buying. Thankfully, Cronos Australia isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VIT

Vitura Health

Engages in the sale and distribution of medicinal cannabis products in Australia.

Adequate balance sheet low.

Market Insights

Community Narratives