Despite shrinking by AU$55m in the past week, AVITA Medical (ASX:AVH) shareholders are still up 226% over 5 years

The AVITA Medical, Inc. (ASX:AVH) share price has had a bad week, falling 10%. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 226% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 43% decline over the last three years: that's a long time to wait for profits.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

View our latest analysis for AVITA Medical

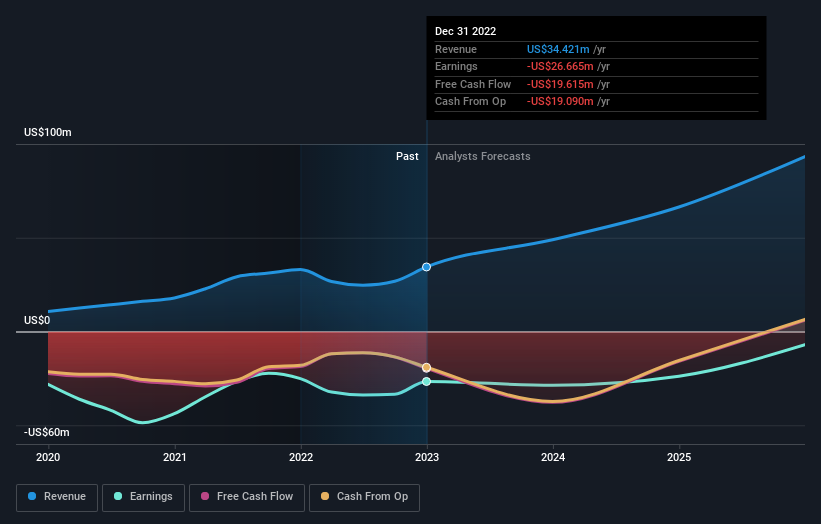

Because AVITA Medical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, AVITA Medical can boast revenue growth at a rate of 48% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 27% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes AVITA Medical worth investigating - it may have its best days ahead.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that AVITA Medical shareholders have received a total shareholder return of 84% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 27% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand AVITA Medical better, we need to consider many other factors. For instance, we've identified 1 warning sign for AVITA Medical that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AVH

AVITA Medical

Operates as a therapeutic acute wound care company in the United States, Japan, the European Union, Australia, and the United Kingdom.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives