Returns On Capital At Southern Cross Media Group (ASX:SXL) Paint A Concerning Picture

What underlying fundamental trends can indicate that a company might be in decline? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after glancing at the trends within Southern Cross Media Group (ASX:SXL), we weren't too hopeful.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Southern Cross Media Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.052 = AU$51m ÷ (AU$1.1b - AU$83m) (Based on the trailing twelve months to June 2022).

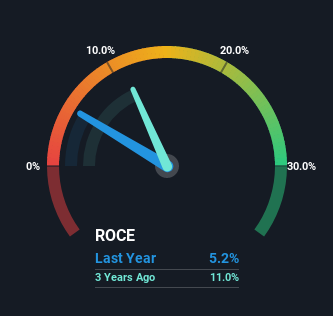

Therefore, Southern Cross Media Group has an ROCE of 5.2%. Even though it's in line with the industry average of 4.8%, it's still a low return by itself.

See our latest analysis for Southern Cross Media Group

Above you can see how the current ROCE for Southern Cross Media Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Southern Cross Media Group here for free.

So How Is Southern Cross Media Group's ROCE Trending?

The trend of returns that Southern Cross Media Group is generating are raising some concerns. Unfortunately, returns have declined substantially over the last five years to the 5.2% we see today. On top of that, the business is utilizing 33% less capital within its operations. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

In Conclusion...

In summary, it's unfortunate that Southern Cross Media Group is shrinking its capital base and also generating lower returns. This could explain why the stock has sunk a total of 85% in the last five years. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

On a separate note, we've found 1 warning sign for Southern Cross Media Group you'll probably want to know about.

While Southern Cross Media Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SXL

Southern Cross Media Group

Southern Cross Media Group Limited, together with its subsidiaries, creates audio content for distribution on broadcast and digital networks in Australia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026