Over the last 7 days, the Australian market has remained flat, yet it is up 20% over the past year with earnings forecasted to grow by 12% annually. In this context of steady growth, identifying high growth tech stocks requires a focus on innovation and strong potential for future earnings expansion.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 21.54% | 38.44% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.73% | 60.64% | ★★★★★☆ |

Click here to see the full list of 65 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

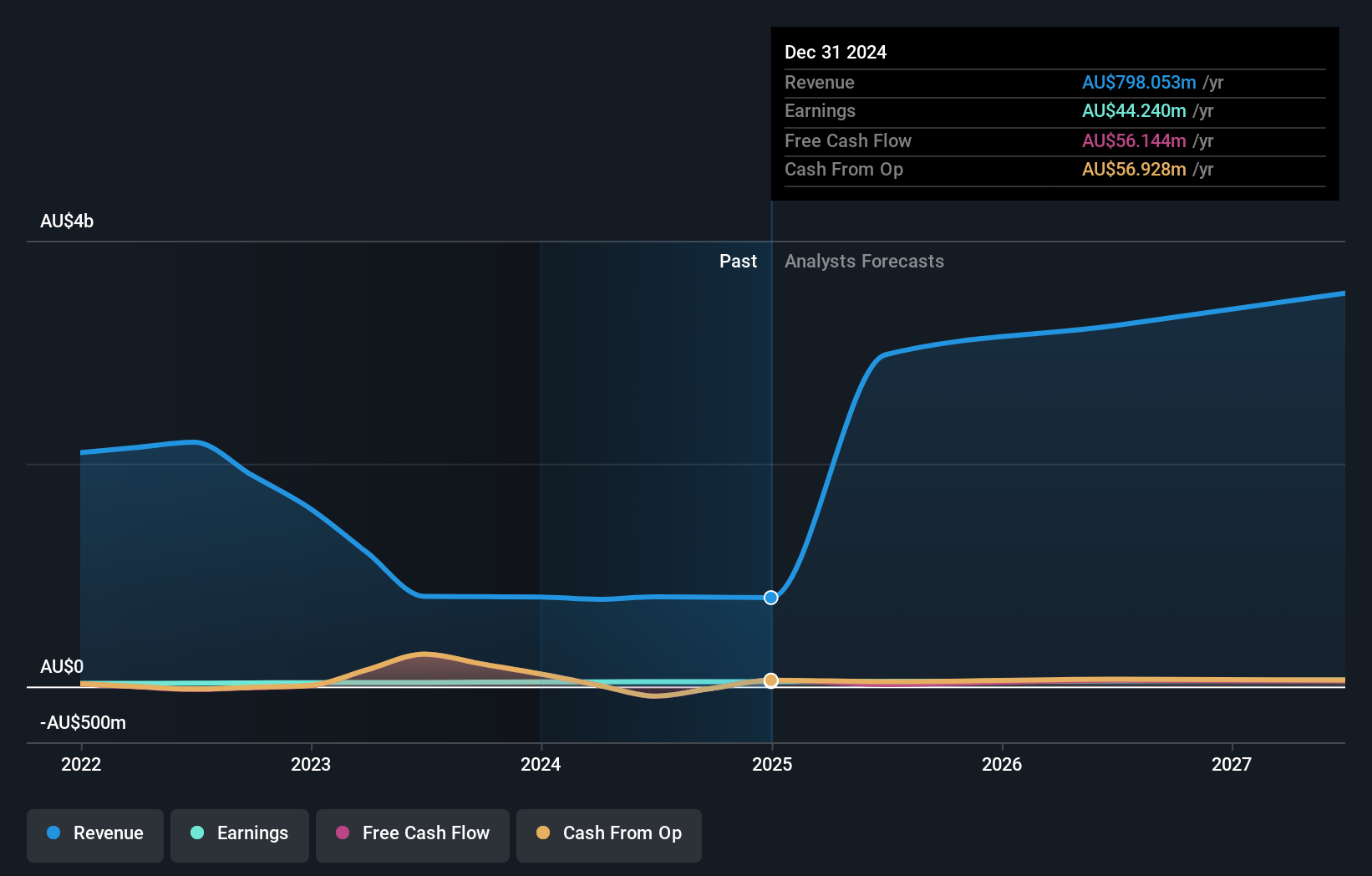

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited provides IT solutions and services across Australia, Fiji, and the Pacific Islands with a market cap of A$1.12 billion.

Operations: The company operates as a value-added IT reseller and solutions provider, generating revenue of A$805.75 million. The business focuses on delivering comprehensive IT solutions across its regions of operation.

Data#3 Limited, a contender in Australia's tech sector, is navigating through a dynamic market with a notable revenue forecast growth of 33.2% per year, outpacing the national average of 5.5%. This growth trajectory is complemented by an earnings increase of 17% over the past year and an anticipated annual profit rise of 10.9%. However, it trails the broader Australian market's expected profit growth rate of 12.2%. The company recently announced significant changes including auditor transitions to PwC and board adjustments with Ms. Leanne Muller’s retirement, signaling strategic shifts that could influence future operations and investor confidence. These developments occur alongside consistent dividend payouts, with the latest being AUD 0.129 per share, underscoring its commitment to shareholder returns amidst evolving corporate governance.

- Click here to discover the nuances of Data#3 with our detailed analytical health report.

Assess Data#3's past performance with our detailed historical performance reports.

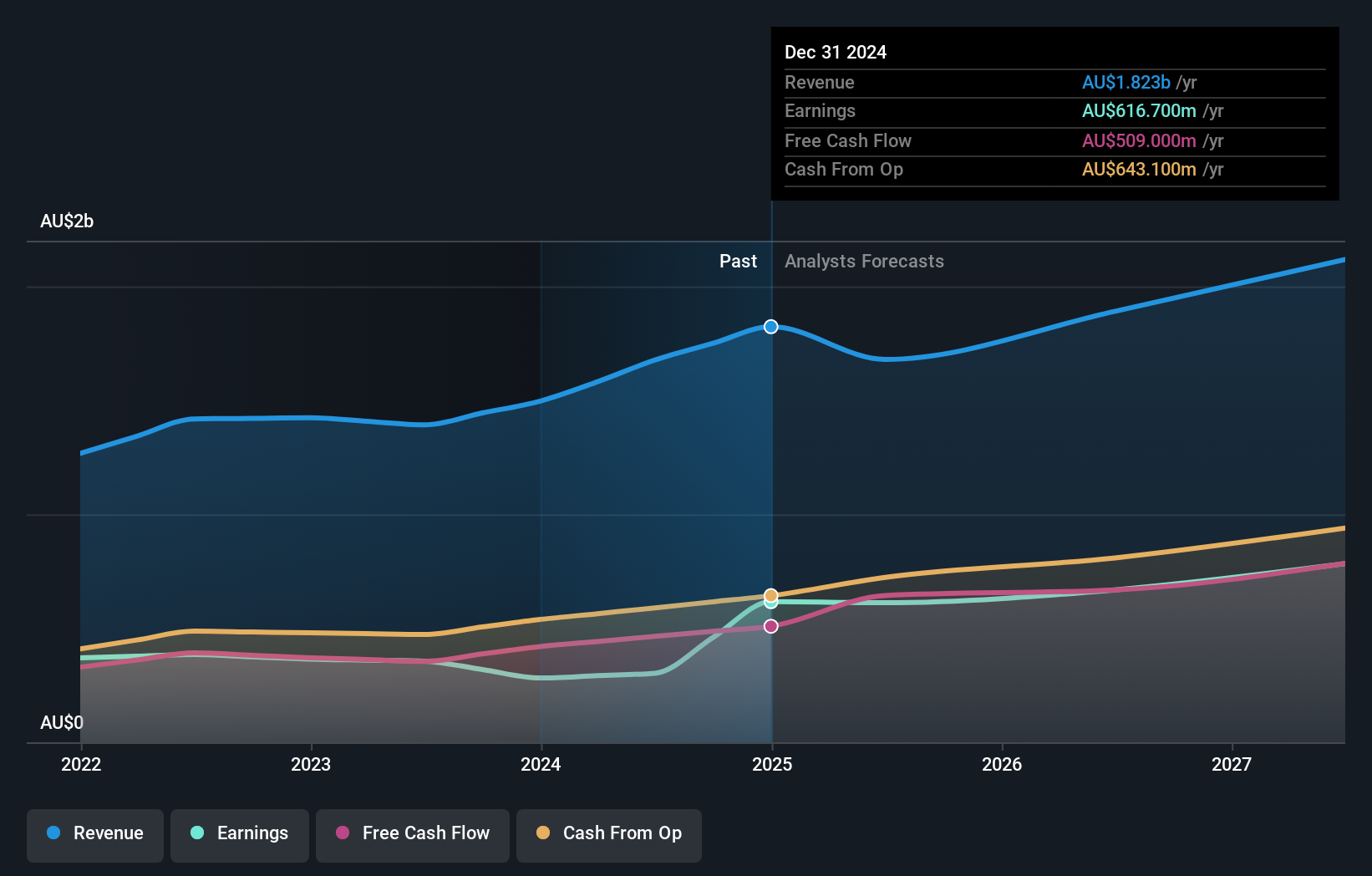

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates as an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of A$30.31 billion.

Operations: The company generates revenue primarily from its property and online advertising segment in Australia, which accounts for A$1.25 billion, followed by financial services in Australia at A$320.60 million and operations in India contributing A$103.10 million. Its business model focuses on leveraging digital platforms to provide advertising solutions for real estate markets across various countries, with a significant portion of income derived from the Australian market.

REA Group, navigating the competitive landscape of Australia's tech sector, has demonstrated a robust growth trajectory with its revenue forecast to increase by 6.6% annually. This outpaces the broader Australian market's average of 5.5%. Despite a challenging year marked by a 15% decline in earnings, the company is poised for recovery with an expected earnings growth of 16.8% per year. Significant investments in R&D have bolstered its technological capabilities and innovation potential, ensuring it remains at the forefront of digital real estate solutions. Moreover, REA Group's recent decision to increase dividends by 23%, reflecting confidence in its financial health and commitment to shareholder returns, underscores its resilience and adaptability in a rapidly evolving industry landscape.

- Take a closer look at REA Group's potential here in our health report.

Explore historical data to track REA Group's performance over time in our Past section.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market capitalization of approximately A$9.10 billion.

Operations: SEEK generates revenue primarily from its employment marketplace services, with significant contributions from the ANZ region at A$840.10 million and Asia at A$244 million.

SEEK, amidst the dynamic tech sector in Australia, is navigating through a challenging phase with a net loss of AUD 100.9 million this year, contrasting sharply with last year's net income of AUD 1.045 billion. Despite these hurdles, SEEK's revenue growth remains promising at 8% per year, outpacing the Australian market average of 5.5%. The company's commitment to innovation is evident from its R&D expenses which have been strategically increased to foster future profitability and market competitiveness. This approach is critical as SEEK aims to transition from current unprofitability towards a projected profit within the next three years, anticipated to surpass average market growth significantly by 37.4%.

Turning Ideas Into Actions

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 62 more companies for you to explore.Click here to unveil our expertly curated list of 65 ASX High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Very undervalued with outstanding track record.